Australians headed to the polls for the Federal Election two Saturdays ago.

The result was a historical victory on two levels. The Australian Labor Party achieved its biggest win since Bob Hawke swept Malcolm Fraser out in 1983. The party even strengthened its position after its first term. This is something that has never happened in Australian electoral history.

A stronger incumbent government typically means stability. Uncertainty remains about Australia’s future from an economic and social perspective. Have a deeper look into the key policies of this government. I doubt it’ll bring social cohesion and economic prosperity.

What are my concerns for Australia after this election, for the next three years and likely beyond?

How the younger generation made their dissatisfaction loud and clear

Australians used to vote for a government that sought the following:

Act in the interest of its people,

Build the country’s prosperity, and

Focus on bringing Australians together.

However, the rise of social justice has turned elections into an ‘us vs them’ campaign.

This election highlighted it particularly.

Let me go back to the three topics that effectively divided the younger and older voters – housing affordability, climate change, and taxes on investments and inheritance.

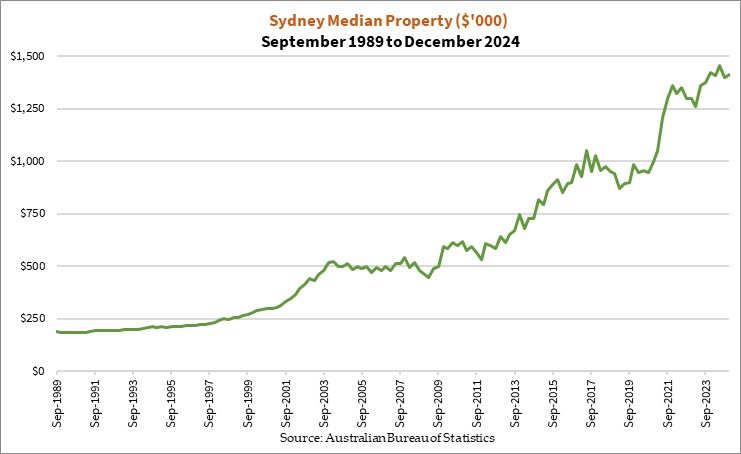

Australia’s prosperity has undeniably grown over the last 3 decades. We saw booms in mining, property and the banking sectors. Our immense wealth in minerals and land delivered bonanza gains to those who owned or invested in them, aided by falling interest rates.

But who owned the overwhelming proportion of these assets?

Those aged 50 or older. Those aged 35 or younger who entered the workforce after the subprime crisis watched the real estate market fly out of their reach like a stray balloon at the Easter Show:

| |

The disenfranchised younger generation is now at a point where their votes matter. And it is upending the traditional balance of power. What surprises me though is their belief that the Labor Party, and the Greens, will help them catch up.

That is why they support curbing corporations, and removing tax incentives to investors.

The Australian Labor Party has touted the idea of improving housing affordability by directly influencing house prices since 2016. Their most popular policy was to abolish negative gearing. The Albanese government even floated this before the election. The party is now looking to introduce a tax on unrealised gains, inheritance, and removing the capital gains discount.

All these seek to level the scores, not just the playing field. Doing so could skew investment behaviour by penalising long-term investments and wealth accumulation over short-term speculation. This could lead to unintended consequences.

Many in the younger generation advocate a shift to green energy and eliminating fossil fuels. Climate change resonates strongly with them. Part of this stems from the perception that the status quo is responsible, so any change is better than no change.

We have tried this out in the last three years. The result? Rising utility bills.

On the issue of corporations, the younger generation seems more receptive to bigger government. They perceive corporations and businesses to be problematic to society. When they want a solution, they lean towards a government solution.

Those are the economic issues. The government also seeks to bring back ‘The Voice’ and pass it in Parliament, despite the resounding vote against it in 2023.

What is the implication of this? Yes, you guessed it, wealth redistribution! Giving more representation to the Aborigines and Torres Strait Islanders in positions of power will lead to the inevitable transfer of economic benefits to them.

A fair go by redistributing wealth

What I surmise is this election was the younger generation signalling to the older generation that it was time to pay up.

Australia didn’t vote for greater productivity going forward, but a ‘take from Peter to pay Paul’.

The younger generation perceives this as how they can get a fair go, rightly or wrongly.

I hope I’m wrong about where our country is heading. I want to relish your emails in the coming years, calling me out for my failed predictions.

To be wrong in this case would mean a happy ending!

P.S. You may be wondering about the elephant, or ‘Orange Man Bad’, in the room and why I didn’t mention him. Our mainstream media has paraded themselves about how the election here is a repudiation of President Trump and the MAGA movement.

They were wrong.

The Coalition party hardly inspired any MAGA supporters in Australia with their message and energy. Those who don’t like President Trump have many more reasons to not vote for the Coalition party anyway. The attempts by the Coalition party to try to draw in more moderate voters and bring back its disenfranchised conservative base caused it to bleed votes from both.

But if we must give the mainstream media their smug satisfaction, let them have it!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments