I had the pleasure of interviewing Louis Christopher (founder of SQM Research) this week, just prior to the release of his annual ‘Boom and Bust Housing Report’ for 2023 (which was recorded exclusively for Cycles, Trends & Forecasts subscribers).

I make a point of reaching out to Louis every so often to catch up on what he’s seeing in the markets.

In recent years — at least — he’s been more accurate forecasting short-term (by ‘short term’ I mean annual) percentage movements in the property market than any other data agency in Australia.

This includes Domain, CoreLogic, Australian Property Monitors, the Real Estate Institute of Australia (REIA), and most notably, the major banks!

Louis has a reputation for telling it like it is — and that often means going against opinions of the crowd.

And this year’s forecast is no different.

Every data agency is predicting a continued market downturn.

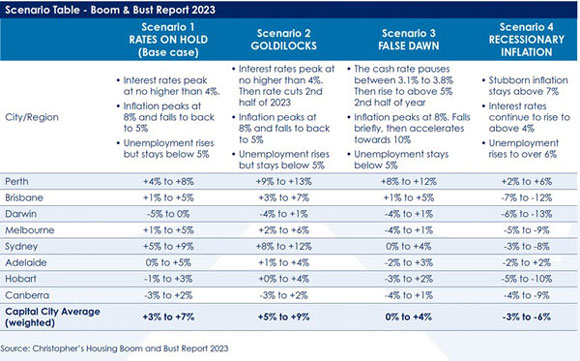

However, in tune with our cycle analysis over at Cycles, Trends & Forecasts, where we expect markets to peak into 2026, Louis is bucking the trend and forecasting a modest recovery in 2023 of between 3–7% nationally, led by Sydney and Perth’s housing markets.

Here’s the breakdown:

|

|

| Source: Louis Christopher |

He admitted to me that he expected to get some flak via social media for the 2023 forecast.

The mood of the crowd is very much in bear territory.

Take the major banks, for example.

They’re still forecasting a 20–30% peak-to-trough decline nationally, through 2022–23.

It may bring some comfort to know that they have an appalling record for accuracy when it comes to forecasting movements in real estate prices.

The analysis tends to rest on a one-eyed view of simply looking at changes to the cash rate as the only driver to price movements in the land market.

Worse still, their forecasts change like Melbourne’s weather!

They’re adjusted every few months depending on if it looks like it’s going to rain or shine.

As Louis said to me during our chat:

‘I just wish the mainstream media would hold them to account for all the changes in the forecasts that they do!

‘We (SQM Research) put ours at the end of the year for the year ahead.

‘We generally don’t like doing revisions — we just generally admit we got it wrong if we do get it wrong and that’s the way to roll…

‘I think putting out revisions all the time, and not even stating that it’s a revision isn’t a forecast…when you put out a forecast only 90 days earlier…you know…I don’t like it, I think it lacks accountability…’

Indeed.

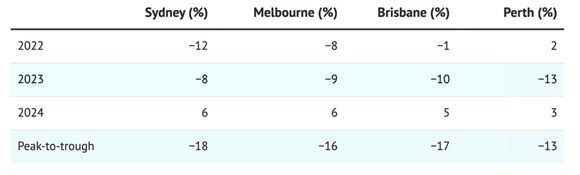

Take ANZ.

It has just revised its forecast of a peak-to-trough decline in Australian house prices to 18% — with a recovery not expected until 2024.

Nationally, they expect a 11% drop in 2023 (after a 7% fall this year).

Here’s its breakdown:

|

|

| Source: ANZ |

The thing is, a few months ago (in August), the forecast was for a 20% fall.

It’s changed continually throughout the year.

At the end of 2021, they were predicting values to continue rising by 6% through 2022!

In fact, Louis was also the only one — to my memory — that called for a peak in property prices in early 2022 before a reversal mid-year.

That forecast played out as suggested, so it gives good reason to take note regarding what he sees ahead for 2023.

Perhaps the most surprising aspect of Louis’s analysis is the call for a recovery of Sydney’s property market by 6–8%.

Louis gives good reasons for it, however:

- There’s going to be an increase in underlying demand for accommodation, whether rental accommodation or owner occupier accommodation through 2023, driven primarily by an increase in overseas arrivals (the first port of call is typically Sydney and Melbourne).

- Workers are returning to the office, which means that an increase of residents that have been living regionally are coming back to the city, placing more pressure on demand. It’s already started, and likely to continue through 2023.

- The switch from stamp duty to land tax for first home buyers is another driver. First home buyers can now access the market without having to save a substantial amount for the tax.This is likely to produce a price wave across the lower price segments of the market with increased demand.It will eventually translate to the more expensive segments as those benefitting from more demand in the lower ranges when selling will have more to spend when upgrading.Let’s wait and see if other states follow suit…

- Finally, Louis takes into account Sydney’s exposure to the Asian economy, despite it looking like the US could fall into recession. This should buffer any impact for Australia, which remains the ‘Lucky Country’ geographically.

On the ground, things are not as bad as the mainstream media is painting.

Clearance rates have been improving since mid-year.

There’s a lot of huff and puff over their accuracy each week (especially if you’re monitoring the conversations on Twitter when the data is released).

However, there’s no getting away from the fact that they’re a leading indicator of percentage changes to median house prices.

SQM’s analysis of clearance rates is undoubtably the most accurate and, therefore, the most conservative measure out of all the data agencies (typically recording clearance rates in the 40–50% range).

And yet, even SQM’s recording a 60% clearance rate for Sydney’s Eastern Suburbs, indicating demand is outpacing available supply.

It’s not limited to the eastern burbs either.

A friend searching for a home in Sydney’s inner west said to me in an email recently:

‘You might be interested in what’s happening here…there’s nothing wrong at all with the market, at least in the Inner West, despite the usual BS from the media/RBA/Economist etc.’

He purchased shortly following and admitted that he had to go higher than he wanted due to competition.

Melbourne’s market has equally improved in recent weeks.

The big discounting that we saw earlier in the year has ceased, and the market is tracking along fairly consistently.

Conditions are still good for negotiation, but there’s been an increase in turnover and competition in the sub-$1 million market.

If that continues into next year, I’d expect to see a change of trend and prices start to turn into positive territory by Q2 2023.

The ‘Boom and Bust Housing Report’ has a range of different scenarios that could play out through 2023.

As Louis said to me, ‘uncertainty is the order of the day’.

Global fractions continuing to affect supply changes, wars, potential runaway inflation, and record-high debt-to-GDP levels.

His analysis doesn’t come without caveats.

Still, if you’re going to listen to any market forecast for the year ahead, I’d recommend steering clear of this week’s sensationalist headlines pumped out by the mainstream media of dramatic price falls:

|

|

| Source: The Sydney Morning Herald |

Check out Louis’s ‘Boom and Bust Housing Report’ instead!

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments