Last week I wrote about the Riverina State, a concept that seeks to improve the representation of rural New South Wales and Victorian voters.

That wasn’t the only major takeaway from the conference.

Another was building a connection with the Australian Medical Professionals Society (AMPS). This society comprises doctors, nurses and other healthcare professionals that the mainstream medical community sidelined in the last four years.

They’re currently delving into the validity of lockdowns and vaccine mandates. The Society has delivered many publications, some of which I’ve studied.

And…

I’ve started participating in analysing the data. In particular, I’m going down the trail of the ‘numbers game’ that the medical and healthcare establishment played to set the narrative and put in place certain mandates.

While the establishment owns the prevailing narrative, I believe that they’ve overplayed their hand. Not only that, their deceit is catching up with them.

I’ll talk about that today.

Most of you know I’ve penned articles in the last three years expressing my doubts and outrage at how the medical and healthcare industry betrayed the people’s trust.

My earlier articles discussed the government overreach and the excesses it committed during the global virus outbreak.

I expressed my doubts about the accuracy of the instruments, the logic behind the emergency measures and whether ulterior motives exist, such as using fear to control the population.

As time passed, I shared with you some findings from my analyses (or by others) that suggests the possibility of malfeasance by the authorities and the pharmaceutical companies.

This included the admission by a Pfizer executive to the European Union Parliament in October 2022 that it had rushed the trials and release of its mRNA experimental drug. Since the global rollout, it has received mixed response especially as adverse side effects mount.

Another is the ‘Twitter Files’ that revealed a coordinated campaign to censor dissenting opinions and suppress studies that went against their narrative. It involved the World Health Organization, government agencies, pharmaceutical companies, mainstream media outlets, social media platforms and the medical research community.

I’ve also shown you the journal articles that hid the truth in plain sight. The results in these articles either don’t match the conclusions or the authors omit points that may counter their message.

Tide turned, backlash building

The prevailing narrative is that the mRNA drugs were 100% safe and effective, masks stopped the spread, and claims of hydroxychloroquine and ivermectin being effective alternative treatments are false.

However, time has passed and this narrative is crumbling fast.

With every big lie, there comes a time of reckoning. You often will see signs of the backlash well before the crunch.

It may be public support turning into doubt. Or the authority walks back quietly on something that they once staunchly defended.

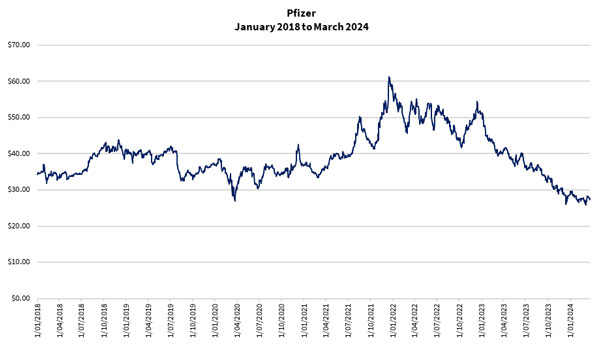

To show you what I mean, let’s look at the price of Pfizer [NYSE:PFE], the leading manufacturer of the mRNA vaccine, over the last few years:

| |

| Source: Refinitiv Eikon |

It has been in freefall since mid-2022 as the global uptake of their drugs fell.

I believe that it’ll get far worse as the company faces the music over its malpractice. But unlike the past, the government won’t give it immunity against damages that its product caused. I’ll cover that in a short while.

Another is the Food & Drug Administration (FDA). Last Friday, it lost its case in the US Fifth Circuit Court of Appeals against three doctors suing over its public messages to suppress ivermectin as an effective treatment against the Wuhan virus and its myriad ‘variants’.

Remember this?

| |

| Source: X (@US_FDA) |

Some of my relatives, friends and I (all humans and not livestock, mind you) used ivermectin when we fell sick back then. None of us experienced any harm, most of us experienced a quick recovery.

This ad along with other public messages will soon disappear…but not to be forgotten.

This leads me to the next point.

The Emergency Use Authorisation…the

devil’s in the details

So, why the big deal over the mRNA drug, the medical industry and the alternative treatments?

A battle is looming in the not-so-distant future. It’ll be between the growing number of people harmed by the drug against the authorities and manufacturers who forced it on them while hiding crucial facts about its risks.

The conditions stated in the Emergency Use Authorisation (EUA) will eventually determine who wins.

For those unfamiliar, in November 2020, the US government granted the manufacturers a fast-track process to develop and roll out these drugs under the EUA.

You can read the details of the conditions in the FDA website.

Normally such drugs would need to undergo years of testing and review before its release to the market.

But governments wanted to allay people’s concerns during this outbreak. With directives from the WHO, many were made to believe that vaccines would do the job.

The EUA would facilitate a fast release of these drugs into the market, provided that no alternative treatments are available and the drug manufacturers passed the criteria set by the FDA.

On the first point, you can see the peculiar case of how the FDA weighed in on ivermectin, along with hydroxychloroquine and various vitamins.

For several years this message stuck, but now it has faced a humiliating defeat and retraction.

The second point is more concerning. In early-2022, the FDA had to release to the public the data submitted by the vaccine manufacturers.

The spotlight is now shining on Pfizer, although other manufacturers aren’t off the hook.

Omitting crucial data to tilt the game

A recently published paper identified several data inconsistencies by studies testing the efficacy of the mRNA drugs. You can find the paper here.

Key issues included shortening the trial period, miscategorising observations, and evidence of cherry-picking data to deliver a desired outcome.

Earlier this month, Michels et al published a paper in the International Journal of Vaccine Theory, Practice, and Research that highlighted the inconsistencies with the Pfizer trial data could’ve changed the outcome of the FDA approval to release its product to market.

I conducted some statistical tests on the data found in the paper to confirm the findings.

Firstly, the data sent to Pfizer claimed that of the 6 participants who died in the trials leading up to the submission date for EUA approval, 2 received the mRNA drug and 4 received the placebo.

However, Pfizer subsequently released an interim report in March 2021 that showed 11 participants died during that period. 6 received the drug and 5 received the placebo.

The results showed the drug didn’t deliver a significant effect if you consider the 11 participants who died.

Moreover, by withholding 5 observations, Pfizer tipped the result in favour of its claim that its drug was effective.

As I write this article, the analysis continues. The authors of this paper will no doubt release more findings as time passes.

Now, I can’t conclude from my analysis and the findings thus far that this proves Pfizer intentionally put profits ahead of helping people.

But it all becomes more suspicious when you consider the concerted effort to censor dissenting opinions and threats to deregister medical practitioners for not standing in line.

I’ll leave you to be the judge.

Take steps to protect yourself…think gold!

Before I end this article, I want to leave you with this thought.

Public trust has plummeted across the board. Many things we used to take for granted we can’t anymore.

That’s why you should protect yourself and those closest to you.

For me, I take my refuge in gold. It’s something that the authorities seek to disparage. That’s why I like it even more.

Over the past decade, I’ve studied the gold market in great depth and that’s helped me deliver solid returns.

You can find out more about my work in my precious metals investment newsletter, The Australian Gold Report.

You’ll find unique metrics and perspectives in this service that don’t exist anywhere else. That’s because I developed them through years of experience and analysis.

With gold breaking into new all-time highs, this is a great time to jump on board.

So, consider signing up now and make a difference to your future!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments