In today’s Money Morning…the Goldilocks moment…think about this for a second…use this to your advantage…and more…

If you’d spent the last 57 years tipping the Melbourne Demons to win the flag, you just had your moment of redemption.

I’m sure the win was made all the sweeter by the long wait.

And I was thinking about it on Sunday night; there must a be a few long-suffering Dees fans out there who were just starting primary school the last time Melbourne won it.

Now, they’re not far off retirement!

So a big congrats, especially to you guys.

While such fairy tale wins are the stuff of sporting legends, you can’t afford to wait that long with investing.

There’s a sweet spot you can look for to help you time your moves into the biggest ideas.

Let me explain more…

The Goldilocks moment

Think about this for a second…

The Dees were $26 to take the flag at the start of the year.

So assuming you’d punted on them every year since 1965, you’re still down about 55% on your money, despite Saturday’s win.

If you’re having a dabble in sports betting, this is just the cost of a bit of fun.

But when you’re investing, this is obviously a terrible outcome.

It turns your moment of glory into a bittersweet victory.

Now, I’m not saying there’s anything wrong with taking a long-term position in an investment idea or thesis.

Indeed, the more you can get your head out of the here and now, the bigger your investing advantage.

But there is a sweet spot.

I call it the Goldilocks moment.

In my experience, looking ahead between one and two years is the ideal place to start looking for hidden exponential investment opportunities.

As a small-time investor, that’s your big advantage.

You see, big funds benchmark themselves against the index. Which means they’re very focused on quarterly returns and how they compare to their peers.

They can’t take too much risk because if they perform poorly over a couple of quarters, money can start to flow out to other funds.

They take a percentage fee on the amount of funds they have under management, so this hits their own hip pocket.

This fact of life means they’re pretty short term in their thinking.

You and I aren’t accountable to this pressure to a degree.

But like I said, there is a sweet spot.

Look too far ahead and you could end up with the same outcome as our hypothetical Dees punter.

You’re eventually ‘right’, but you don’t make any money out of it.

I’ll admit, though, that investing so far out can come with some big risks too. I mean, a lot can change, especially if you’re investing in a fast-moving trend.

Here’s one thing that can make life easier…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Use this to your advantage

Wired magazine just put out an article called ‘The Exponential Age will transform economics forever’.

It’s a great read and it summarises a lot of what Lachlann Tierney and I have been saying for many years now in our Exponential Stock Investor service.

That is, the idea that change happens in today’s world faster than most people can fathom.

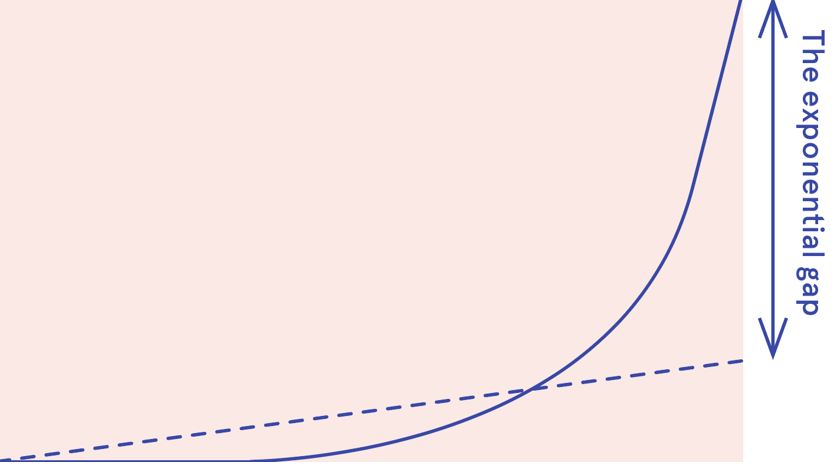

And it results in an ‘exponential gap’ between what people think will happen and what actually will.

This chart explains it:

|

|

| Source: Wired |

Now, if you think about what we said at the start and our ideal time frame, you may have had a light-bulb moment.

It’s this…

If you can identify which trends are going to go exponential in the next few years, you can invest in those areas before the broader market knows what’s hit it.

But without a PhD in various technical fields — big changes frequently come from cutting-edge science — knowing how far we are from adoption can itself be hard to work out.

I mean is quantum computing around the corner, or is it still a decade away?

And people have been investing in graphene stocks for over a decade now and we’re still waiting on the breakthrough use case.

So what if there was a cheat?

A way to invest just as the market was first starting to price in these transformational moments?

That would mean you mightn’t need to wait as long. And if you’ve latched onto the right trend, it could be the start of something big.

Well, I think there is one such ‘cheat’.

Like all investment tools, it’s not perfect.

But in my experience, it certainly gives you a real edge in picking the ideal times to invest in fast-moving trends.

I call it the ‘First Law of the Markets’ and I’ve just released a video guide on how it works.

So if you’re keen to give your small-cap investing a bit of extra oomph, you can go here and find out more.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.