In 1973, Jim Rogers and George Soros founded the Quantum Fund.

According to Wikipedia:

‘…from 1973 to 1980, the [Quantum Fund] portfolio gained 4,200% while the S&P advanced about 47%.’

In April 2007 (around the time Ben Bernanke was assuring us subprime would be contained), Jim Rogers was again in the news.

As reported by Reuters:

| |

| Source: Reuters |

To quote from the article (emphasis added):

‘“I am short home builders and Fannie Mae FNM.N,” Rogers, who co-founded the Quantum Fund with hedge fund industry legend George Soros, said at the Reuters Hedge Funds and Private Equity Summit on Tuesday.

‘“They will go down a lot more. You just don’t clean out a speculative bubble in six months,” added Rogers, who now invests only his own money. Rogers’ calls, particularly his views on commodities, still resonate with other investors. He said he was short American Home Mortgage Investment Corp AHM.N and other mortgage companies as well.’

Today’s investors would be wise to heed the lesson of 2007…the busting of speculative bubbles take time and inflict serious losses.

In an interview with Kitco News on 21 July 2022, Jim Rogers — who has been around markets for more than 50 years — didn’t mince words when it comes to what he thinks is in our future (emphasis added):

‘Jim Rogers [aged 79], Chairman of Rogers Holdings and Co-Founder [with George Soros] of the Quantum Fund, is forecasting “the worst” bear market in his lifetime.

‘Rogers said that he expects the coming bear market to be the worst in his lifetime, based on the “staggering debt” levels in the United States.’

Hyperbolic?

Well, if you believe in ‘yin and yang’ or ‘every action having an equal and opposite reaction’, then the symmetry of the best bull market in history being followed by the worst bear market is not unrealistic.

Jim Rogers is 79 years young, and the experience gained from 50 years in markets is invaluable.

The older and greyer…the better

The business of investing is one of the few that (over the full rotation of the cycle) doesn’t discriminate against the older worker.

In fact, when it comes to long-term wealth creation, the older and greyer the better.

In every cycle there are fads and fraudsters that capture the hearts, minds, and money of novice, impatient, and greedy investors.

However, when the cycle rotates from up to down, the pretenders always get found out.

The fads and fraudsters come in different guises:

- Nifty 50s in 1970.

- Entrepreneurs in 1987.

- Japanese developers in 1990.

- Dotcoms in 2000.

- Subprime lenders in 2008.

- Loss making IPOs. Cryptos. Meme stocks. NFTs in 2021.

They all have the same swagger, use the same language, and attract the same crowd.

If you’ve been there and done that long enough, you can spot the pattern.

Recently, I reread the transcript of an interview Howard Marks had with Hugo Scott-Gall (from Goldman Sachs) in 2013.

Warren Buffett’s ringing endorsement of Howard Marks gives you a good insight into his investment expertise:

‘When I see memos from Howard Marks in my mail, they’re the first thing I open and read. I always learn something, and that goes double for his book.’

If you would like to join Warren Buffett in receiving memos from Howard Marks, please go here.

A lot’s happened in the nine years since the interview; however, the advice of Howard Marks is timeless…and, in the current investing climate, highly relevant…

‘In hot times, the few who do remember the past are dismissed as relics of the old, lacking the ability to imagine the new. But it invariably turns out that there’s nothing new in terms of investor behavior. Mark Twain said that “history does not repeat itself but it does rhyme,” and what rhymes are the important themes.”’

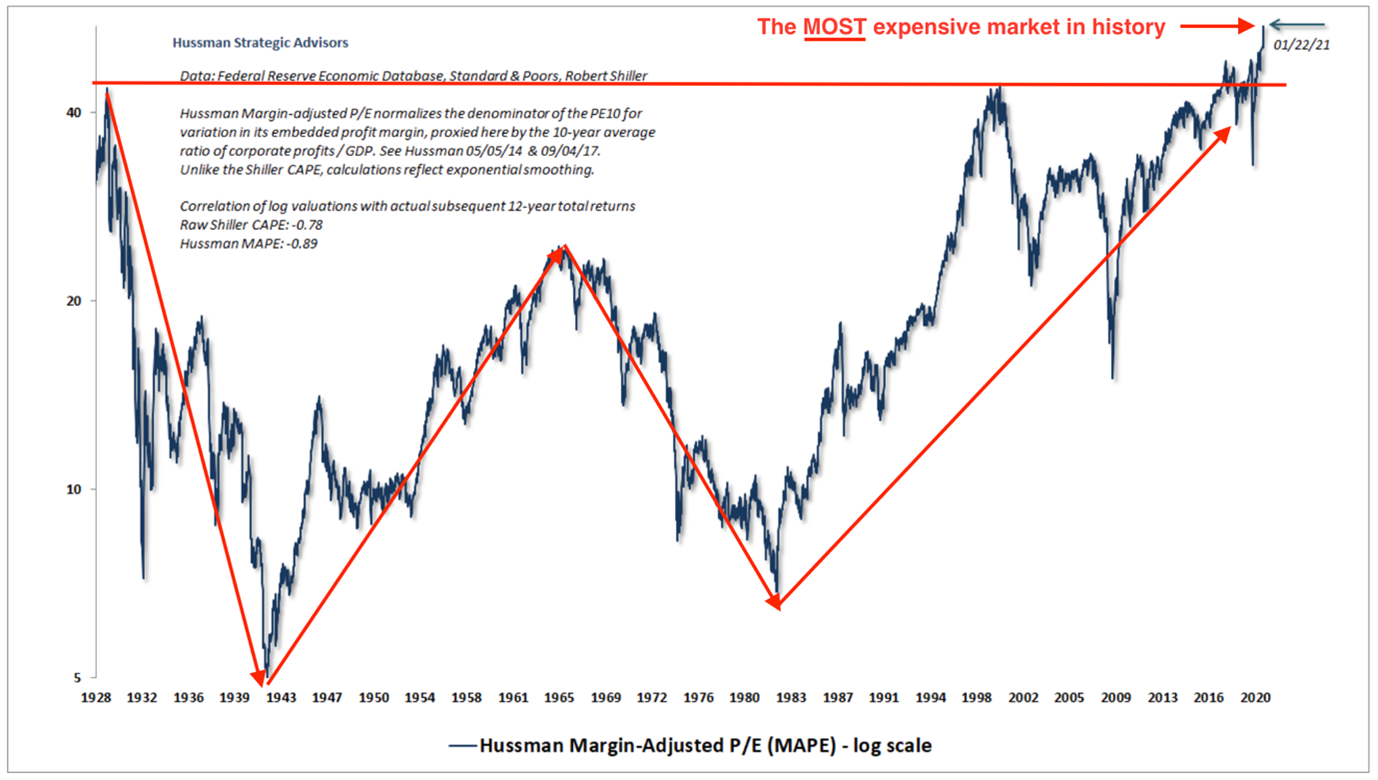

John Hussman’s (another who has a track record in keeping his head while others lose theirs) margin adjusted PE (MAPE) valuation chart illustrates the US market’s rhyming pattern.

Over- to under- to over- to under- to overvalued:

| |

| Source: Hussman Strategic Advisors |

Each rise and fall are unique in duration and extent…but the repetition is evident.

And, within each long-term trend, there are shorter-term verses of the same ‘over-to-under’ rhyme.

The most recent long-term trend began in the early 1980s.

It’s taken the US market well beyond anything previously experienced…both in duration and the extent of gains. In spite of the recent wobbles on Wall Street, the conviction in this 40-year trend being a permanent fixture remains strong.

Confidence in the Fed’s ability to consign this century-old ‘ebb and flow’ pattern to the history books has not yet been shaken.

This pattern is NOT unique to US shares…it applies to ALL markets.

Every single overvalued market in history (be it shares, property, precious metals, tulips, ostriches, et al.) has suffered the same fate…a collapse in value.

What was once overvalued eventually becomes undervalued.

There has never been an exception to this pattern…not once.

Perhaps, what is still the MOST expensive share market in history, is going to be the first to defy centuries of repetitive human behaviour.

Are you punting your future on a change in human nature?

Do you really want to punt your capital on the notion of fear and panic being erased from our emotional DNA?

When Howard Marks was asked ‘How can we understand investor psychology and use it to make investment decisions?’…

Hereplied (emphasis added):

‘It’s the swings of psychology that get people into the biggest trouble, especially since investors’ emotions invariably swing in the wrong direction at the wrong time. When things are going well people become greedy and enthusiastic, and when times are troubled, people become fearful and reticent. That’s just the wrong thing to do. It’s important to control fear and greed.’

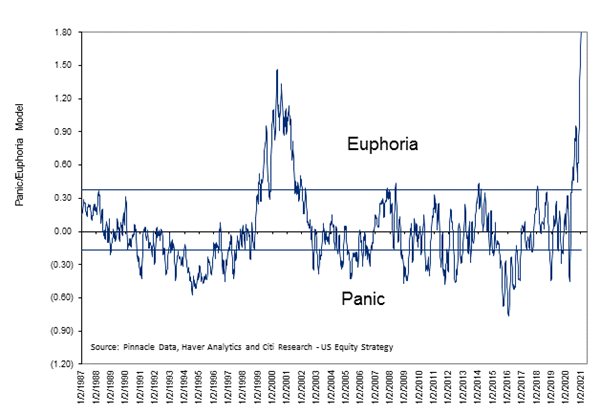

At the height of the speculative boom in 2021, the Citi Panic/Euphoria Index (based on a number of market inputs) provided an insight into where investor emotions were at…Euphoria has swung to a level exceeding prior market highs in 1987, 2000, and 2007:

| |

| Source: Sentiment Trader |

FOMO (fear of missing out) was compelling investors to act…buy anything, buy something…just get in and be part of the action.

Here’s another priceless piece of advice from Howard Marks (emphasis added):

‘Another mistake that people often make is to compare themselves with others who are making more money than they are. They mistakenly conclude they should emulate the others’ actions after they’ve worked. This is the source of the herd behavior that so often gets them into trouble. We’re all human and so we’re subject to these influences, but we mustn’t succumb. This is why the best investors are quite cold-blooded in their professional activities.’

Investor envy is a powerful emotional trigger.

Stories of people making easy money in a short space of time are hard to resist…for the novice and professional investor alike.

What I’ve learnt from my years in this business is this: lamenting what could’ve/should’ve/would’ve been is a waste of emotional energy.

Regrets…get used to them

Regrets are part and parcel of investing.

Get used to it.

Whatever you wish had happened in the boom times, didn’t.

Move on.

Different choices were made for reasons that made sense at that time.

Also, until events play out and the cycle turns a full rotation, it’s too early to start joining dots and drawing comparisons.

Chasing yesterday’s winner — the one that made the money — is often a fool’s errand.

Whatever the money-making ‘it’ was, has already gone up.

If there is any upside left, it’s doubtful it’ll be anything like the original gain…and, in my experience, unless cashed out, it tends to be fleeting.

I witnessed this behavioural pattern at the peaks in 1987, 1999, and 2007.

Clients wanting what happened yesterday to be their tomorrow.

Sorry, that moment has passed.

Each and every time, this short-lived euphoria was snuffed out by permanent losses.

Decisions were made on emotion…and no amount of logic could persuade people otherwise.

And finally, there’s this gem from Howard Marks:

‘Prudence is particularly dismissed when risky investments have paid off for a span of years. John Kenneth Galbraith wrote that the outstanding characteristics of financial markets are shortness of memory and ignorance of history.’

So true.

People forget and/or get suckered into believing ‘this time is different’.

The only thing different about this time was the duration and extent of the ‘upside’ in this cycle. It has been one for the history books…and so too will the all-too predictable bust.

The wisdom of Howard Marks hopefully serves as a reminder of how sound advice never goes out of fashion…unlike fads and frauds.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia