One of Australia’s leading healthcare, pathology, diagnostic imaging, and hospital companies, Healius [ASX:HLS] has posted the receipt of an off-market takeover bid from Australian Clinical Labs [ASX:ACL].

Healius’s board wishes its shareholders to sit tight until it has evaluated the bidder’s statements and taken due consideration.

HLS shares were down nearly 2% following the bidder’s announcement. Shares were worth $2.78 after sliding more than 4% in the month and 36.5% in the past full year.

ACL had also plummeted more than 3% earlier today, trading around $3.60 and having flopped 29% in the year, despite taking a 21% boost in the month:

www.TradingView.com

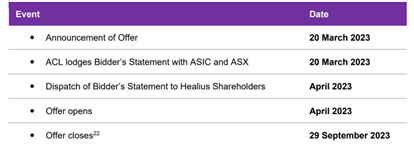

ACL’s play for Healius

Australian Clinical Labs intends to make an off-market takeover for Healius by acquiring all fully paid ordinary shares on issue.

ACL intends to swap 0.74 ACL shares for every 1 HLS share, representing a nil-premium merger based on the VWAP (volume-weighted average price) of both companies’ shares on the ASX, 28 February through to 17 March.

If Healius agrees to the terms of the offer, it will mean both HLS and ACL shareholders will hold around 68% and 32% of shares, respectively.

ACL stated that if Healius shareholders accept the offer, it will bring both companies together in a way that benefits them both, as the two companies are expected to be worth significantly more together than as separate entities.

Other benefits for HLS shareholders were outlined, including a diversified earnings base, material synergy potential of around $95 million, and derisking to operational turnaround with an experienced management team.

ACL also argued significant value creation of 90% above the Healius’s share price, better patient and doctor outcomes, better ESG benefits, security in a successful track record of integration on ACL’s part, and the possibility of CGT scrip-for-scrip rollover relief if HLS shareholders are to accept.

In order for the offer to become a success, ACL expects:

- A 90% minimum acceptance condition

- ACCC clearance for the proposed merger

- Foreign Investment Board approval

- Shareholder approval

- Healius’s financial performance in FY23 EBIT, debt positions contracts and condition being reasonable

Michael Alscher, ACL’s Chairman, stated:

‘The merger of Healius with Australian Clinical Labs and the synergies and value creation that are expected to be unlocked is expected to create a fundamental step change in value for both shareholder groups.’

ACL CEO Melinda McGrath also commented:

‘Our vision is to create Australia’s largest pathology provider, with enhanced scale, profitability, and potential for expansion. The Proposed Merger is expected to unlock $95 million in synergies and de-risk the required operational turnaround at Healius, with the potential for an additional $95 million of Potential Operational Improvement Benefit to be achieved through improved performance at Healius. Together, this is expected to deliver stronger earnings, and has the potential to create a value uplift for the Merged Group of $2.1 billion.

‘The increased balance sheet strength achieved through the Proposed Merger will enable acceleration of investments to enhance and expand a range of patient and doctor services, including developing and bringing new tests into Australia, creating centres of clinical excellence, enhancing regional service sustainability, and investment in digital and automated solutions.’

Source: ACL

Australia’s reset and restructure…where does this leave you?

Have you been thinking about the state of the world lately?

Changes are all around us, growing by the day. And the signs that the Australian economy is not what it once was, are everywhere.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has — certainly not the mainstream media.

He says ‘no one is talking about how this could end the Australian economy’ as we know it, and it could be as soon as within the next 12 months!

But if you can learn the patterns and get yourself ready for change, this could put you ahead of the curve.

If you want to know more about the biggest geoeconomic shift of our lifetime, click here.

Regards,

Mahlia Stewart

For Money Morning