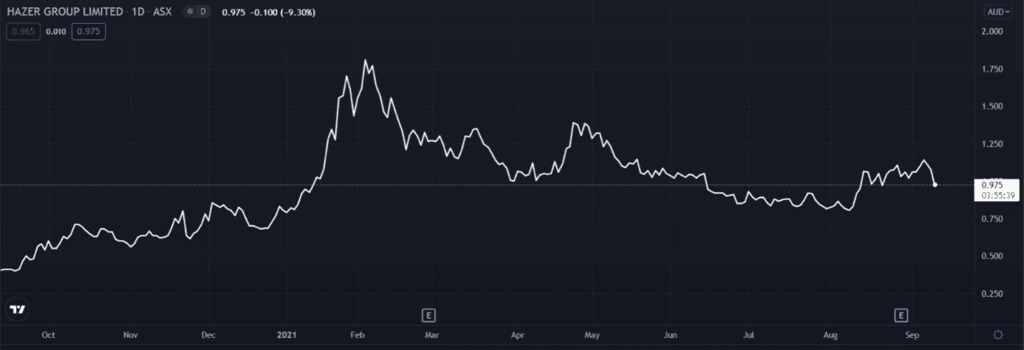

The Hazer Group Ltd [ASX:HZR] share price sinks as the hydrogen tech developer completes a $7 million placement.

Hazer will also invite eligible shareholders to participate in a share purchase plan to raise up to $7 million.

A rise in HZR’s share price did not follow the rise in capital, with the Hazer share price currently down 9.30%.

Despite today’s drop, HZR is still up 150% over the last 12 months.

Hazer’s $7 million placement

Hazer said it has received binding commitments from institutional and sophisticated investors to raise gross proceeds of $7 million.

Per the placement, HZR will issue 7,608,696 new fully paid ordinary shares at an issue price of 92 cents, raising the aforementioned $7 million, before costs.

What will Hazer use the money for?

The proceeds will ‘support and expand the business development activities to take advantage of the high global interest in technologies such as the Hazer Process.’

Part of the placement will also fund research and development regarding applications for Hazer’s graphite advanced carbon material.

HZR described the eponymous Hazer Process as a novel, low-carbon emission hydrogen and graphite production technology, originally developed at the University of Western Australia.

The company thinks this tech could deliver two high-value products while reducing carbon emissions.

Hazer’s $7 million share purchase plan

In addition to the placement, Hazer is also inviting eligible shareholders to participate in a share purchase plan.

Participation is optional and available only to registered shareholders of fully paid HZR ordinary shares.

Under the plan, eligible shareholders can buy up to $30,000 worth of shares at an issue price of 92 cents per share.

The issue price reflects a 14.42% discount on the last traded price of $1.075 and a discount of 16.52% on the average market price of the company’s shares during the five trading days immediately prior to the announcement date of the share purchase plan offer.

What’s next for the HZR share price?

Despite finishing FY21 with $24.6 million in cash, Hazer may have felt it needed more to throw at its key commercial demonstration project.

The company forked out $6.6 million in FY21 paying for the demonstration plant.

Hazer’s operating expenditure also rose 41% in FY21 to $5.6 million.

The capital raised today may offer Hazer more runway to execute its growth ambitions.

Hazer Chairman Tim Goldsmith said:

‘We are delighted to have secured the support of new institutional and sophisticated investors, as well as the ongoing support of existing shareholders.

‘We have an exciting program of activities ahead for the Company in 2021 and 2022 with the completion of the Hazer Commercial Demonstration Project (CDP) in Q1 2022.’

If you are interested in other Aussie stocks highly invested in the energy market like Hazer, then I suggest checking out this report by our energy expert James Allen.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here