Something very odd just happened in UK politics. The government bumped their head on an imaginary threshold. And it’s sending a jarring warning right through parliaments and markets around the world.

Bloomberg has the details:

‘When Prime Minister Keir Starmer and Chancellor of the Exchequer Rachel Reeves plotted Labour’s path to power in the UK, they banked on eye-catching moves to hike taxes on private equity and ultra-rich “non-dom” residents to fund key spending plans. Now, those promises are meeting reality.

‘Reeves is reviewing how to implement both pledges because of internal Treasury analysis which says the moves could end up costing the exchequer money, rather than raising upwards of £5 billion ($6.6 billion) over the parliamentary term.’

Raising taxes could bring in less revenue? Can you imagine how that’d change politics?

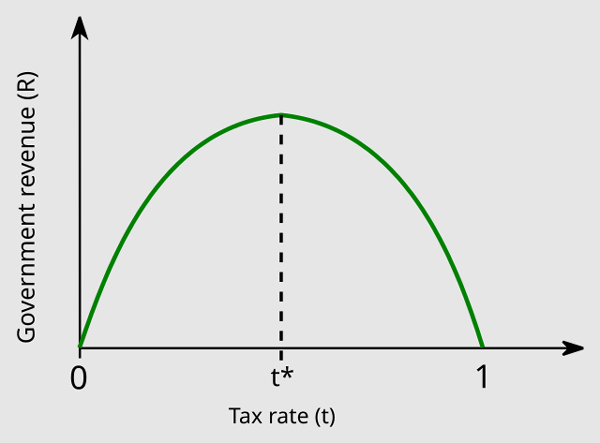

This is not a new idea, of course. Academics call it the Laffer Curve, named after the economist Arthur Laffer.

He pointed out that tax hikes from low levels of tax raise lots of additional revenue. But the more you hike taxes, the less additional revenue you get. That’s because high taxes change habits. The higher the tax, the bigger the incentive to avoid it. People emigrate, shut down their business, join the grey economy and lots more.

At some point, hiking taxes actually cuts overall revenue. The response from taxpayers shirking outweighs the revenue raised from those taxpayers who allow themselves to be bled like Medieval medical patients.

| |

| Source: Bastianowa, Wiki Commons |

But all of this was supposed to be theoretical. Something that pops up in speeches by fringe economists and their even fringier one-term political counterparts.

When the Financial Times published an article that claimed, ‘Analysis of the UK Budget suggests revenue gains from tax cuts are vanishingly rare’, nobody panicked. The UK’s Labour Party ignored it.

But suddenly the UK government is discovering it may be a very real problem.

And the rest of us might not be far behind…

Governments may be offside on

the Laffer Curve

The UK Treasury’s warnings suggest the Brits have hit the theoretical threshold. It can’t raise more money by raising taxes. So, there is only one way left to deal with the dangerous debt and deficit: cut spending.

The thing is, the UK only raises slightly more taxes as a percent of GDP than Australia. And less than many other nations.

Admittedly, the UK’s new Labour government is being unusually stupid about who it taxes. They are trying to tax the sectors of the economy most likely to do a “John Galt” – give up and go elsewhere.

Taxing private school fees just shifts students into the public sector. Removing the tax loopholes used by “non-doms” just sends the one foot they kept in the UK overseas. Private equity is notoriously fleeting.

But the broader point still stands. The question is whether this is a warning for the rest of us. What if governments around the world are hitting tax thresholds that put them offside on the Laffer Curve?

What if raising taxes doesn’t result in

more revenue anymore?

We’ve all heard endless tales about overindebted governments around the world. Some of us have been going on about it for decades…

The long-term projections are dire, to say the least. The IMF is even warning our Treasurer about long term deficits and getting spending under control. This during a surplus.

We used to presume all this amounted to higher tax rates in the future. But if you were to presume that the stone has been bled dry already, the implications get mighty interesting…

We’d have to see a radical shift in government policy in coming decades. A prolonged period of government spending cuts. Something nobody considers likely.

That has huge implications for all of us. But this newsletter isn’t about how to maximise your Centrelink benefits in an age of austerity. It’s about how markets would be hit.

So, which sectors might be on the chopping block if governments have to tighten their belts instead of asking taxpayers to carry the burden?

1. Defence

Three new defence ETFs are getting listed on the ASX. If ever there was a sign of a trade gone mainstream, this is it.

And it’s no surprise given the state of geopolitics. We can only await President Biden’s Nobel Peace Prize.

The question is whether defence companies can handle a global budget crackdown. Given the choice between guns and butter, it’d take a lot of war to convince voters to favour guns. Just ask East Germany’s mainstream politicians.

A lot of foreign aid goes to buying weapons systems from the countries doing the giving. Remember when German bailout money was used by the Greeks to buy German submarines? The point being that a budget crackdown would undermine that sort of spending too.

I think the defence sector is vulnerable to being caught offside by the Laffer Curve.

2. Infrastructure

Demographic doom implies needing less infrastructure spending. With countries like Japan, South Korea and parts of Europe to experience outright population decline, governments are going to lose the excuse that justifies any infrastructure spending: projects always pay back if you just wait for long enough.

Transfer payments that build nothing for the future will be the priority. Especially amongst voters without children.

3. Healthcare

Australia is getting a global reputation for employing a higher share of its population in the healthcare sector than its peers. This is a mystery to me. We’ve never managed to see the same GP twice, but still get asked ‘who is your GP’ each time we visit a hospital. And most of the time, we can’t even understand what the GP is saying…

You might think that as the population ages, the healthcare budget will boom. But what if this burden is shifted onto private pockets to help shoulder the burden? What if the threshold of money the government is willing to spend to keep people alive is lowered?

The morally justified argument that any amount of money should be spent to save a life could come under fire if it is outright unaffordable. Highly expensive treatments could be left off the public sector’s list.

That’s already happening in many socialised healthcare systems around the world. And I’m not sure people will pay out of pocket when they discover the size of the bill that public sector coverage masked.

Change so slow only long-term

investors will notice

That’s three sectors of the stock market which could come under pressure if government spending becomes the lever by which governments manage their debts. As opposed to raising tax rates, which they’re used to doing.

This, by the way, runs contrary to much of the advice and recommendations you’ll find in Strategic Intelligence Australia. We’re positioned for an infrastructure spending boom on the back of Net Zero and a defence budget bonanza.

But those are medium term trends. We’re no Net Zero believers or neo-cons. And today’s Fat Tail Daily is about long-term trends.

No doubt our politicians will need to learn the hard way what the UK’s just discovered. So it’ll pay investors to watch how UK politics and markets unfold in coming years. We may be some ways behind in the race over the peak of the Laffer Curve, but we’re heading in the same direction.

Regards,

|

Nick Hubble,

Editor, Strategic Intelligence Australia

Comments