Hastings Technology Metals [ASX:HAS] is rattling the can for $110 million to advance its Yangibana Rare Earths Project.

Hastings said the project ‘remains on track’ for commissioning in 2024.

HAS is set to issue about 22.7 million new fully paid ordinary shares at $4.40 per new share.

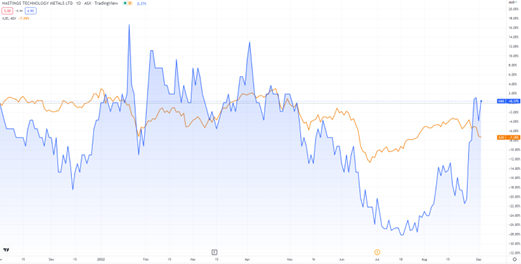

HAS shares have traded sideways year to date, up 1%.

Source: www.tradingview.com

Hastings’ placement and SPP launch

On Tuesday, Hastings announced the launch of a two-part funds raising in the form of a $100 million two-tranche placement and a $10 million share purchase plan.

The company’s two-tranche placement has been released with the intent to raise around $67 million (in tranche 1) and a further $33 million (in tranche 2), expected to contribute to an overall cash balance of $237 million.

Once completed, the placement and SPP are expected to raise a gross total of up to $110 million.

The placement consists of selling approximately 22.7 million new fully paid ordinary shares, each at an offered price of $4.40 for each new share.

That’s an 18.8% discount to the closing price of $5.42 on Friday, and a 12.3% discount to the 10-day volume weighted average price of $5.02.

The new 22.7 million shares will represent around 22.4% of Hastings-issued shares.

Hastings will be harnessing the funds for advancing its Yangibana Rare Earths Project development, due for commissioning in 2024.

HAS funding its future

The rare earths producer will still have to await shareholder approval before the placement and SPP can go completely ahead.

Approval will be sought at the next General Meeting (10 October).

Then the proceeds — along with project finance debt — will be put to action, funding the allocation of more processing equipment and initial works at HAS’s Yangibana hydrometallurgy plant at Onslow.

There is a chance the SPP won’t raise the full $10 million, as this one hasn’t been underwritten.

Hastings’ Executive Chairman Charles Lew commented on the placement and SPP:

‘Hastings is delighted to announce the underwritten Institutional Placement, which strengthens the Company’s balance sheet and places it in a strong position to finalise project financing for Yangibana as it approaches plant commissioning by 2024.

‘The Placement demonstrates support for Yangibana as a world-class project and represents an endorsement of our development strategy. Additionally, it provides further validation of market support for Hastings’ recently announced proposed strategic investment in Neo Performance Materials and longer-term aspirations of becoming a fully integrated mine-to-magnet producer.

‘We are also pleased to offer our existing eligible shareholders the opportunity to participate in this equity raising via the SPP. I would also like to take this opportunity to thank existing shareholders for their continued support and look forward to welcoming all new investors to the Hastings register.’

Are you prepared for the EV takeover?

The EV market is rapidly expanding, boosted further by government initiatives and funding programs supporting production across the globe.

But our energy expert, Selva Freigedo, thinks the global transition to EVs means the industry faces a supply crunch, which can send prices for battery materials soaring even higher in 2022 and beyond.

If you’d like to know more, I suggest checking out Selva’s battery tech metals report.

Find out more here.

Regards,

Kiryll Prakapenka,

For Money Morning