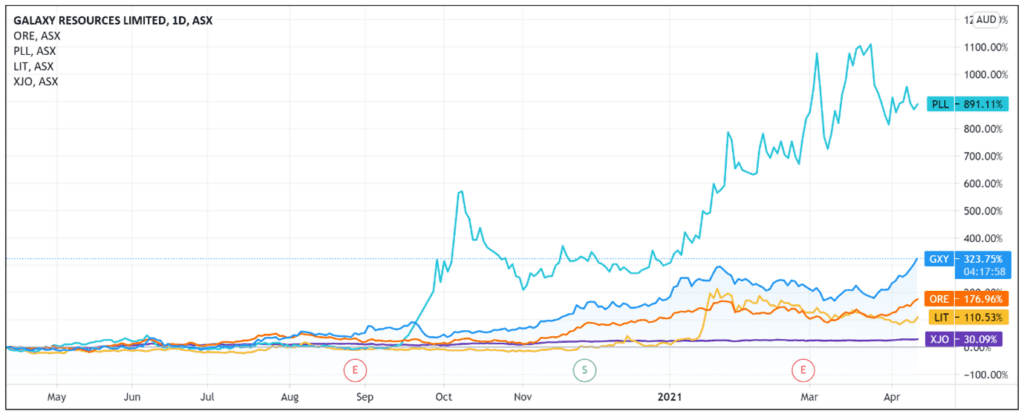

Galaxy Resources Ltd’s [ASX:GXY] share price is up 5.8% after releasing a resource and reserve update for its Sal de Vida Argentina project.

It follows a strong week for ASX lithium stocks.

Orocobre Ltd’s [ASX:ORE] share price closed 6.6% up on Tuesday following its lithium price upgrade.

Vulcan Energy Resources Ltd’s [ASX:VUL] shares closed higher yesterday and are up 10% at time of writing after the operationalisation of VUL’s direct lithium extraction plant.

And Lithium Australia NL’s [ASX:LIT] shares are currently up 13% following a positive pre-feasibility study.

Year-to-date, GXY’s share price is up 50% and up 315% over the last 12 months.

Galaxy Resources overview

Galaxy currently has three assets worldwide focused on lithium production.

Its 100% owned Mt Cattlin project in Western Australia is a mature operation producing high-grade spodumene concentrate.

GXY also owns 100% of the James Bay spodumene project strategically located in Quebec, Canada.

Galaxy expects it to achieve construction-ready status in 2021.

And finally, there is the Sal de Vida operation in the Catamarca Province, Argentina.

GXY described the Sal de Vida project as a ‘near-term producer of battery grade lithium carbonate.’

The project is situated in the lithium triangle where Chile, Argentina and Bolivia meet. Galaxy stated that this lithium triangle is currently the source of more than 40% of global lithium production.

Galaxy’s Sal de Vida project update

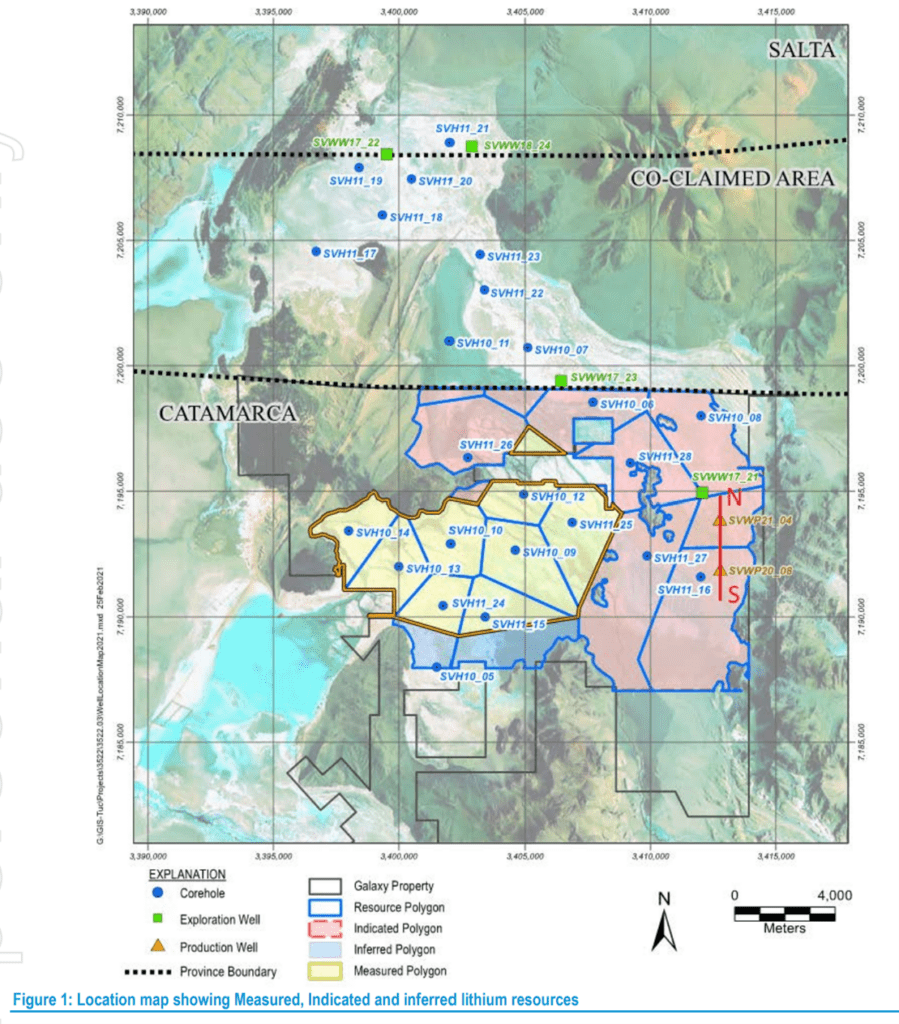

GXY announced today that assessment of hydrogeological data from the drilling of two production wells led to an increase in the company’s resources and reserves.

Accordingly, Galaxy’s revised brine resource now comes to 6.2 million tonnes of lithium carbonate equivalent (LCE).

This marks a 27% increase from the company’s prior estimate.

The revised reserve estimate now totals 1.3 million tonnes of recoverable LCE, a 13% increase from the prior estimate.

Further, the drilling recovered higher grade brine from both wells.

The average lithium concentration of the recovered brine was 933 mg/L compared to the average resource of 754 mg/L.

Galaxy noted that production drilling will continue to test the aquifer at depth with a further update expected in Q3 2021.

GXY share price outlook

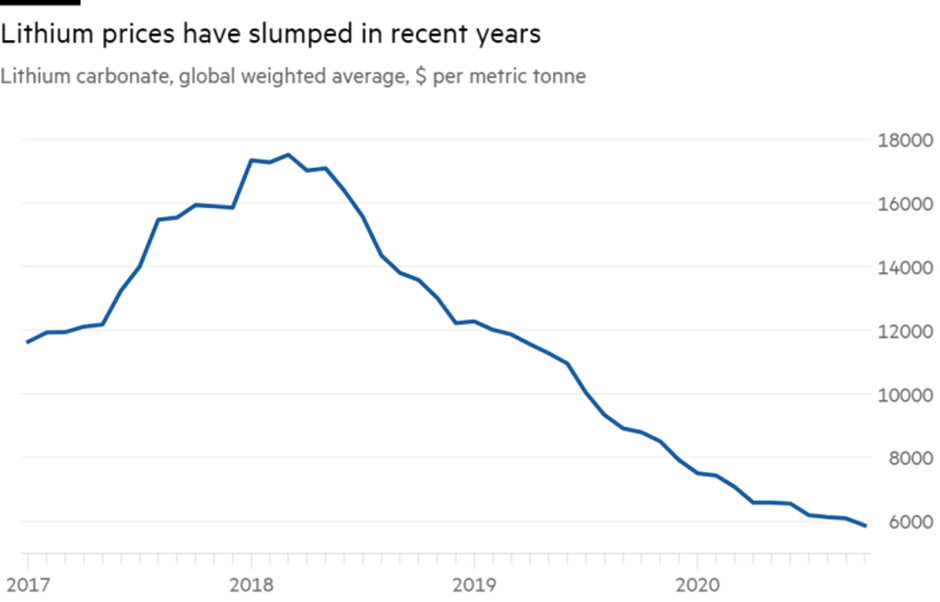

Speaking to the Financial Times, co-founder of Westbeck Capital Management Will Smith stated that there is a ‘hugely well-capitalised demand sector and the supply sector is still coming out of the trenches with a few plasters on.’

Mr Smith was referring to the drop in lithium prices from their 2018 peak.

The price slump led Pilbara Minerals Ltd’s [ASX:PLS] Chief Executive Ken Brinsden to say in December 2020:

‘The industry is not going to expand at today’s prices … Inevitably, there has to be a price increase if the industry wants to satisfy the growing demand.’

But as I have recently covered, lithium prices are rising again in 2021.

Howard Klein, founder of RK Equity, told the Financial Times that equity markets ‘are pricing in a lithium price rise and they’re going to get a price rise — inventories are depleting and there will be consolidation and more discipline.’

And in a supply squeeze, companies that can ramp up their production can benefit.

With today’s announcement that Galaxy’s revised resources and reserves are up 27% and 13% respectively, investors may think it is well positioned to capitalise on the growing demand for lithium amid shrinking supply.

If you want further analysis about the ASX lithium sector, then you can read our free report here.

Regards,

Lachlann Tierney,

For Money Morning

Comments