Geopolitical risk is on the rise for resource investors.

Changes to a country’s constitution opening the door for nationalisation, rioting, political instability, and punitive taxes are just some of the challenges faced by international mining operators.

That includes Australian-based producers ‘diversifying’ into these increasingly unstable regions.

Geopolitics is a key aspect to consider as an investor, but very few are paying attention to this important issue.

You see, mining is unique as an investment class.

With an asset (ore body) sitting somewhere between 100 and 500 metres below the surface, miners can’t pick up their business and shift it to a different state or country when conditions change.

Resource companies are stuck wherever the mineralised rocks occur…that includes regions with political uncertainty, civil unrest, or countries with a history of suddenly changing mining laws or royalty taxes.

But there’s a big problem in the industry RIGHT NOW…geopolitical instability is brewing across the globe.

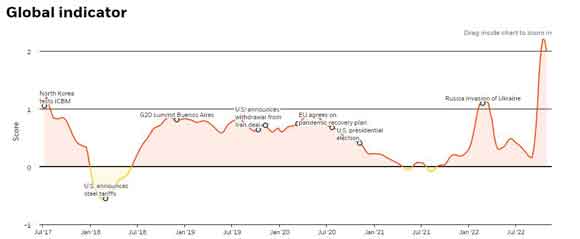

According to the major US-based fund manager BlackRock, geopolitical instability spiked sharply in 2022.

In its December 2022 report, it identified major issues stemming from war and trade tensions:

‘A new geopolitical world order is coming into view. The Ukraine war and escalating U.S.-China competition have deepened fragmentation. Our BlackRock Geopolitical Risk Indicator hit a high amid increased market attention to U.S.-China relations, emerging market risks, political upheaval in the UK and the Ukraine war.’

The international fund manager has its own model for calculating the level of risk…the global BlackRock Geopolitical Risk Indicator (BGRI).

As the chart shows below, the Indicator hit an all-time high in 2022:

| |

| Source: BlackRock Investment Institute |

Global insecurity breeds protectionism, and that’s having a major influence on metal supplies RIGHT NOW.

Just look at the recent events taking place at the Cobre mine in Panama.

Hailed as one of the best copper mines to enter production within the last 10 years, this large, relatively high-grade porphyry deposit was the flagship operation for the Canadian producer First Quantum Minerals [TSE:FM].

Development got off to a solid start…the Panamanian Government supported the company throughout its early years of production, keeping royalties relatively low at around 2% per annum.

For First Quantum, the stage was set for a strong long-term partnership…

But with analyst signalling looming supply deficits for copper, the Panamanian Government rapidly changed tact.

With the potential for higher copper prices in the years ahead, leaders were eager to secure a MUCH larger slice of the mine’s mineral rich pie…a whopping 20% of revenue, no less!

Battle lines were drawn…First Quantum refused to accept the new demands, and the government reacted with a shutdown of the Cobre operation.

But with the issue reaching a climax in December 2022, it was clear First Quantum had very few cards to play…with a hefty US$6 billion already poured into the project, the company couldn’t afford to walk away.

It was a case of accept the punitive tax or suffer the consequences of a prolonged shutdown.

The company chose the former; there was NO alternative.

The tax represented a ‘raw deal’ according to most analysts…

Importantly, it demonstrated the VERY REAL risk that international miners take when venturing into new frontiers.

But the risks are certainly not limited to Panama.

With a political crisis unfolding in Peru, riots and violent protests have forced the suspension of several major operations.

Notably, Glencore’s [LON:GLEN] enormous Antapaccay copper mine recently scaled back capacity thanks to nationwide protests that saw an attack on the facility in early 2023.

Then, just last week, one of the world’s largest copper mines, known as the Las Bambas Facility, supplying around 2% of global copper supply, was hit by the civil unrest.

According to the Chinese owner, MMG [HK:MMG], operations will be suspended with protesters cutting off road access to the mine.

Geopolitical instability will have long-lasting effects in Peru…

It forces operators to pull much-needed investment away from exploration and project development.

As the world’s second-largest copper-producing nation, these events don’t bode well for a global economy demanding a multi-fold increase in copper output to support the renewable energy transition.

But perhaps one of the biggest threats to supply sits directly south…Chile.

Ranked as the world’s most important copper producer and second-largest lithium supplier, Chile has stepped up pressure against the world’s major mining operators, including Australia’s own BHP, with a proposal for higher mining royalties.

But perhaps of greater concern for the major miners is the growing distaste toward multinationals in Chile.

Political leaders are leaning ever closer toward nationalistic idealism…

As Reuters reports, Chile has set the constitutional groundwork that could allow it to bring its massive mining operations under State control…you can read more about that here.

Unsurprisingly, it’s sparked an angry response from major mining firms, including Australia’s own BHP.

BHP certainly has a lot at stake…in partnership with Rio Tinto and Japanese based JECO Corp, it operates the world’s largest copper mine, Escondida (image below):

| |

| Source: The Australian |

The mine, an enormous porphyry deposit located in Northern Chile sitting in the Atacama Desert, provides around 6% of the world’s entire supply of copper!

It’s a HUGE cash cow for the company…but it’s also juicy, low-hanging fruit for a government looking to reap more from its copper riches.

It forces BHP and other multinationals to rethink their long-term strategy in the country.

It means a severe pullback on investment, including exploration in the world’s most important copper province…ultimately, the political landscape in Chile places even greater threats to the future supply of critical metals.

Considering that Chile and Peru alone account for around 35% of the global copper supply, it indeed paints a concerning supply problem for a critical metal set to play centre stage in this coming green energy transition.

Then there’s Mexico…

In April 2022, this Central American country declared lithium to be a strategic mineral and property of the nation.

The country has set up a State-owned company called LitioMx, which will be responsible for managing the exploration, mining, and refining of lithium throughout the national territory of Mexico.

According to the US Geological Services, Mexico has the ninth-largest identified lithium resource globally (1.7 million tonnes).

From Chile to Mexico, the South and Central American region host enormous reserves of critical metals…this vast land mass is pivotal in supplying the raw materials needed for the global economy to reach its carbon neutral goals.

But according to Canadian billionaire and CEO of Ivanhoe Mines [TSE:IVN], Robert Friedland, he believes the geopolitical conditions brewing across this region make the continent un-investible.

Nationalisation is on the rise and is set to become a major issue in future…with a much higher value being placed on raw materials; governments are looking to capture a far greater share of their resource wealth.

With rising costs of living, including food and basic household goods, there’ll be a strong political will to strip multinational mining companies of their commodity windfalls as metal prices increase.

Higher royalties, State-owned companies, or even outright nationalisation are some of the risks resource companies face as pressure mounts on critical metal supplies.

Don’t be mistaken…as a commodity investor, selecting the right location for investment is just as important as finding the right project.

But the options are dwindling…

So how do you capitalise on this global problem?

Accumulate companies holding quality assets in regions with a long history of civil and political stability.

One of those locations is Australia.

In terms of mining, Australia is indeed an enviable place to invest…access to skilled labour, industry-leading infrastructure, technological innovation, and supportive rural communities, there’s a lot of upside for majors and juniors operating on the world’s largest island.

However, in terms of the global critical metal supply chain, Australia is just a very small part of the pie.

As someone that’s looking to capitalise on the full potential of a global boom in mining stocks, you need to look beyond…

Another viable option is Canada…the country certainly shares similar attributes with Australia, including low geopolitical risk.

In fact, the Toronto Stock Exchange (TSE) is the world’s largest exchange for listed resource stocks.

According to the TSE, it holds no less than 43% of the world’s public mining companies.

But take care…unlike Australia, many Canadian miners are leveraged to operations in South and Central America.

So do your due diligence!

Until next time, have a great week.

Regards,

| |

James Cooper,

Editor, The Daily Reckoning Australia

PS: If you don’t have the time to scroll through the thousands of listed mining stocks available across Australia and Canada, I’ve already done the hard work for you.

Using my experience in the industry on the geology and financial side, I’ve uncovered what I believe to be amongst the best stocks set to capitalise on the growing urgency of critical metal supplies. Importantly, each stock is located within a prime, geopolitically stable region.

You can access all the recommendations by clicking here.

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.