Today the Kogan.com [ASX:KGN] share price was slipping nearly 2% after the electronic services retailer released a business update for January 2023.

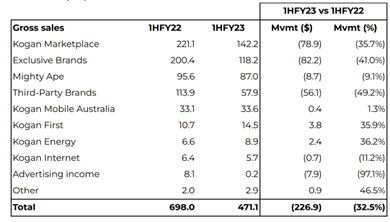

Kogan was focused on reducing its warehouse inventory — which it did by 39%. Though, this was at the detriment of gross sales for the half, having moved down by 32.5% to just $471.1 million.

Kogan complained of soft trading conditions and cycling still linked to COVID-19 lockdown orders.

The KGN share price was at $4.25 at the time of writing, trending 40.5% down over the last 52 weeks.

www.tradingview.com

Kogan’s business update: curbed inventory and dropping sales

Kogan’s focus was on its sell-through of excess inventory during the second half, revealing that it has reduced its inventory in-warehouse by 39% since the 30th of June last year (from $159.9 million to $98.3 million).

Kogan says the inventory reduction level is supportive of its growth in net cash to $74 million, particularly after having funded the Mighty Ape Tranche 3 payment of $14.2 million and repaid loans and borrowings of $25 million.

The company also revealed subdued sales activity, with gross sales of $421.1 million declining 32.5% YoY.

Gross profit of $62.9 million was also down, soft trading conditions lingering as the cycling of a period in the prior year was impacted by COVID-19 lockdown orders.

KGN said that in its focus on balancing its excess inventory, providing massive discounts for customers, but hurting gross profit and gross margin.

On the other hand, reducing its inventory meant the group was able to reduce operating costs.

Kogan grew its Kogan First subscribers to 404,512 by the end of December, 47.6% year-on-year (YoY), and Australian Kogan Mobile customers grew 4.2% YoY.

CEO of Kogan, Ruslan Kogan, commented:

‘The impacts of inflation and interest rates have begun to affect the lives of Australians and New Zealanders. We’ve been growing Kogan.com for more than 16 years now, so we’ve been through many cycles and we know that when customers are watching their costs carefully, ecommerce becomes even more important.

‘We are proud and excited to have added Brosa to the Kogan Group, expanding our share of the online furniture retail market. Along with our acquisition, we are now looking forward to welcoming, delighting and delivering great value to the 500,000 Brosa customers, as we relaunch the brand in the second half of the financial year.’

Source: KGN

Kogan looking forward

With a gross profit of $62.9 million impacted by soft topline performance and declining sales of $471.1 million, Adjusted EBITDA was down $4.4 million.

EBITDA decreased to negative $23.0 million, and adjusted EBIT was also down $12.7 million. EBIT was negative $31.3 million.

The company said that now it has cleared the bulk of its excess inventory, it can continue optimising operating costs and streamlining its business in the hope of returning to operating margins delivered before the COVID-19 pandemic.

Kogan expects gross margin improvements from January onwards while it works on operating costs through the second half of FY23.

Now working as an ‘inventory-light’ business, KGN said it would focus on achieving improve operating margins and profitability, with results aimed for 2H FY23.

Five bargain stocks for your portfolio

2022 was a year that, as it went on, was fraught with more and more challenges.

With many of the effects of the pandemic still lingering, we were handed an influx of new challenges — inflation, the war, continually rising rates…

Households and businesses alike were — and still are — feeling the pinch.

The hard yards aren’t quite over yet…

And it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning