Like I said recently, you don’t need to be a saint to invest in green projects.

Nor do you need to be a genius to see the opportunity ahead.

But where specifically to look?

Well, Europe is probably at the front of the queue.

Over there, central bankers are looking at engaging with the green bond market which totals around US$119 billion.

Take this for example, from Bloomberg:

‘The pandemic could easily have derailed Christine Lagarde’s plan to enlist the European Central Bank in the fight against climate change. Only she won’t let it. “It’s a topic that I am very keen about, which I believe has a systemic dimension,” she told journalists after the ECB’s latest monetary policy meeting on Sept. 10.

‘Lagarde made battling global warming a defining feature of her eight-years as managing director of the International Monetary Fund, warning that humanity would be “roasted, toasted, fried and grilled” if it failed to act.’

Continuing:

‘Some of Lagarde’s strongest support comes from Brussels, where European Commission President Ursula von der Leyen is shepherding the rollout of a Green Deal that envisages zeroing out Europe’s net carbon emissions by the middle of this century.’

Now regardless of whether you think Lagarde’s ‘roasted’ claim is hyperbole, it is clear that Europe is hell-bent on green initiatives.

And there are plenty of ASX companies with exposure to the European green push.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

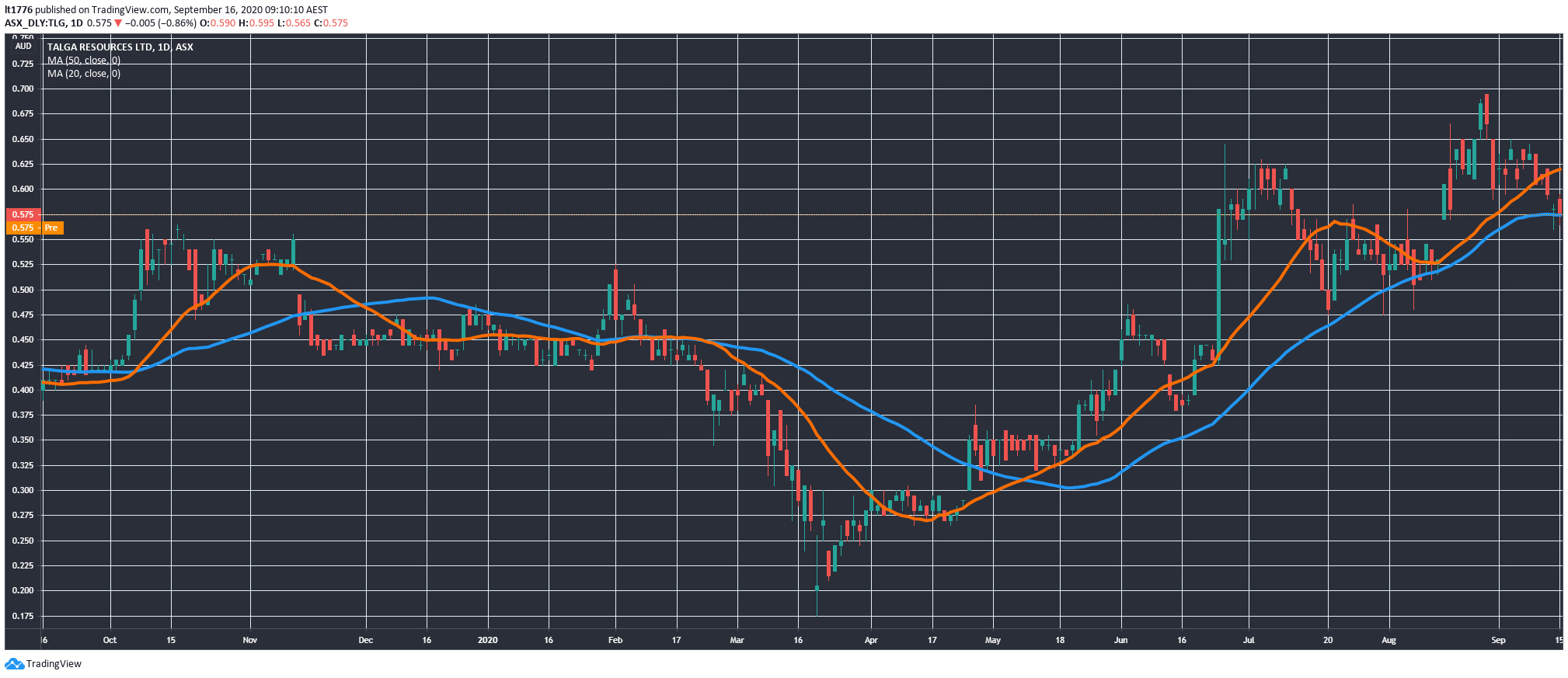

For instance, there is the graphene and battery anode company Talga Resources Ltd [ASX:TLG].

They are pushing strongly up the charts from March, which you can see below:

|

|

| Source: tradingview.com |

They have a deal with Bentley Motors in place for graphene-based engine parts, as well as significant demand for their Talnode®-C anode product.

In addition to this, they are testing a graphene-based paint on the hulls of cargo ships so it doesn’t wind up in the ocean.

A lot of lead-based paint falls off these ships harming the ocean’s water quality.

US renewables and a potential Green New Deal hinge the on election — still opportunities

Unlike Europe, US central bankers don’t plan on making climate change part of their policy settings.

Jerome Powell, the Chairman of the Federal Reserve said in January, ‘society’s overall response to climate change needs to be decided by elected officials and not by the Fed.’

And the Trump administration is keen to roll back environmental red tape (or sensible regulations depending on your views), in part by neutering the Environmental Protection Agency.

But this doesn’t mean green companies can’t succeed in the US under the current administration.

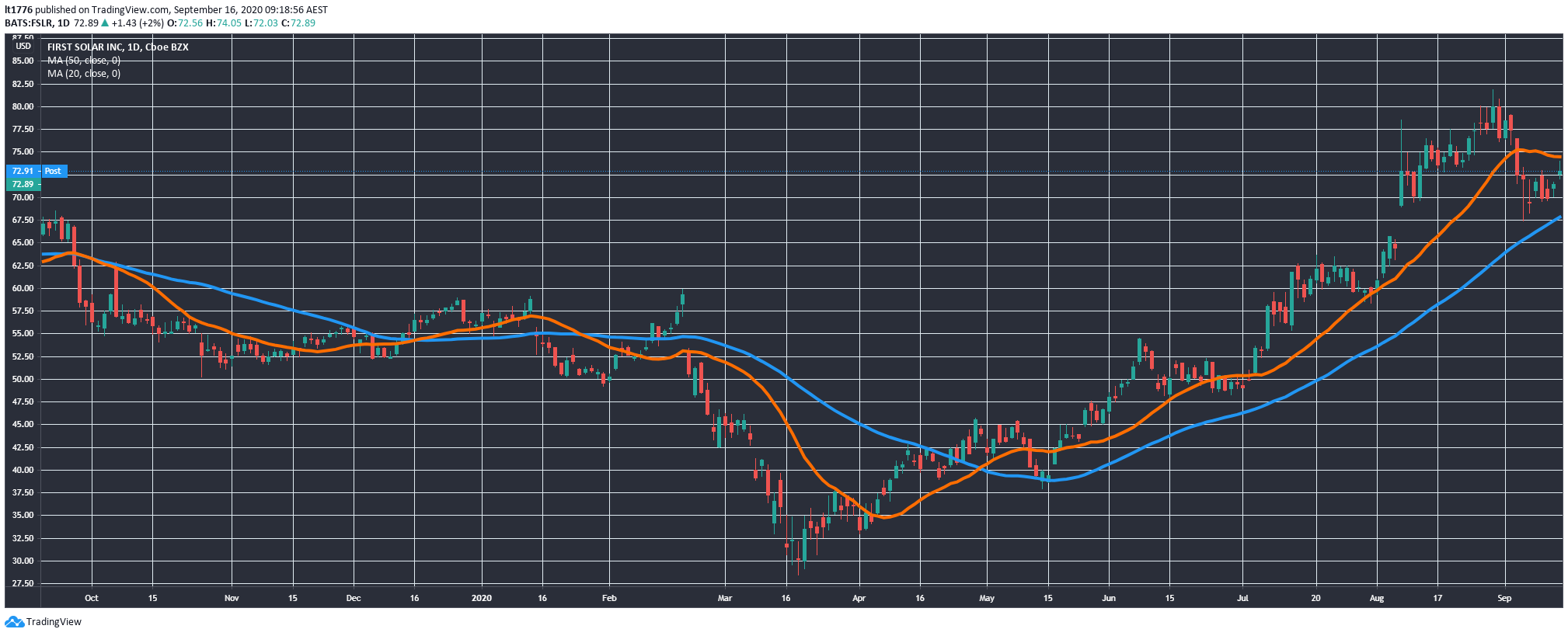

Just check out the chart for First Solar, Inc [NASDAQ:FSLR]:

|

|

| Source: tradingview.com |

They are now a US$7.7 billion company.

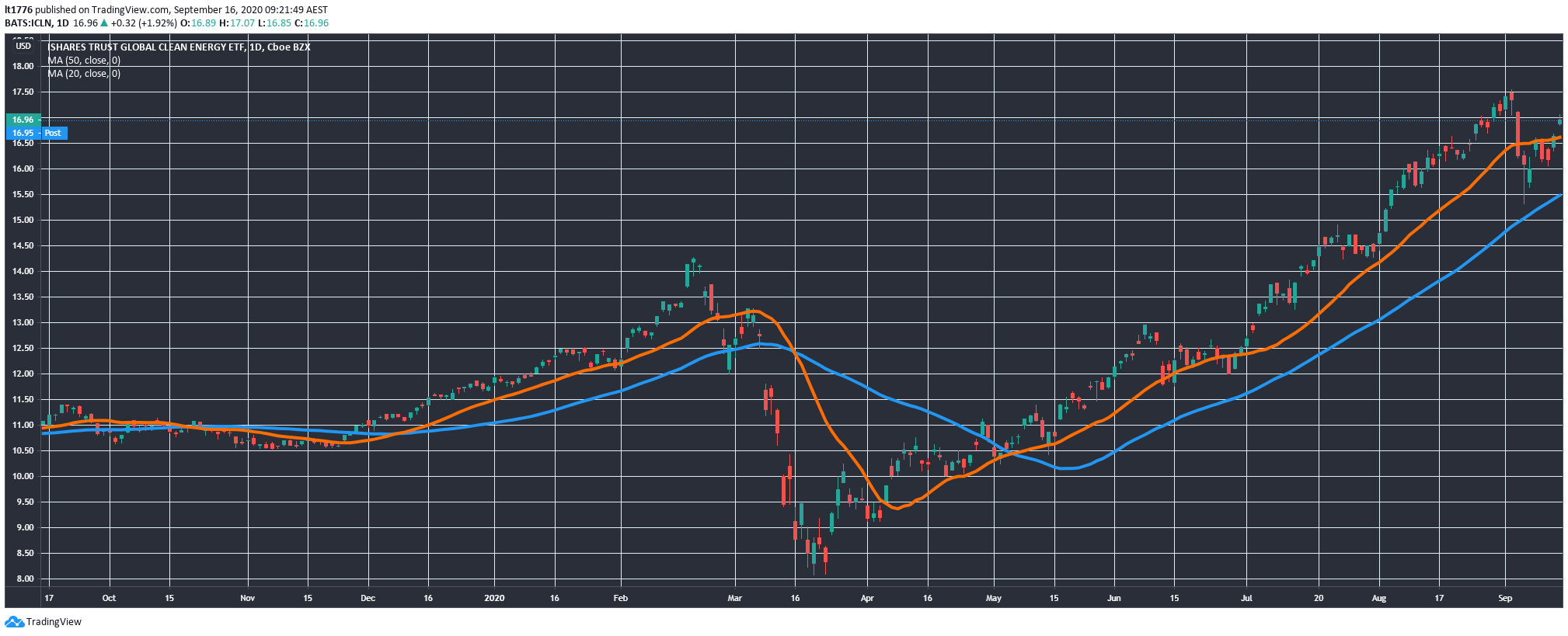

They are also the biggest weighting in the iShares Global Clean Energy ETF [ICLN], which is on a big run with a year-to-date return of over 40%:

|

|

| Source: tradingview.com |

And if Biden gets in, you could reasonably expect a surge in share price for companies and ETFs like these two.

Regardless of where you stand, from a political science perspective I think it’s clear the Democrats are pivoting to the left — particularly on environmental issues.

And that wing of their party is clamouring for a ‘Green New Deal’.

Trillions could pour into the sector should Trump fall in November.

And here’s where Australia comes into the picture.

Australian companies are largely behind the push and here’s one stock to watch

Corporate Australia is increasingly pushing for green initiatives. Perhaps more so than government.

This is reflected in BHP’s $400 million Climate Investment Program.

You may think this is a cynical attempt to massage public optics, but it’s indicative of the increased risk, reputational or otherwise, if corporate Australia isn’t seen to be doing something.

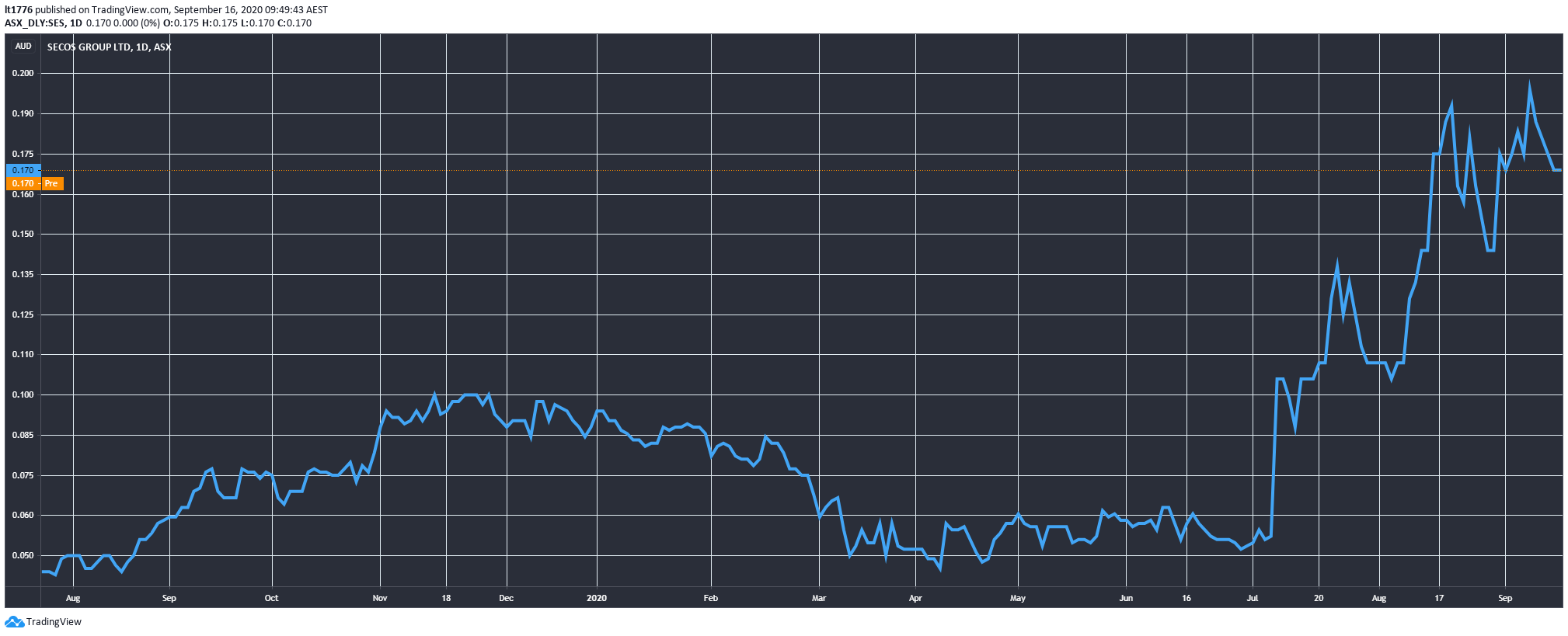

Here’s the chart for one super intriguing company that I’ve watched over the last year too.

|

|

| Source: tradinview.com |

That’s a big breakout if I’ve ever seen one.

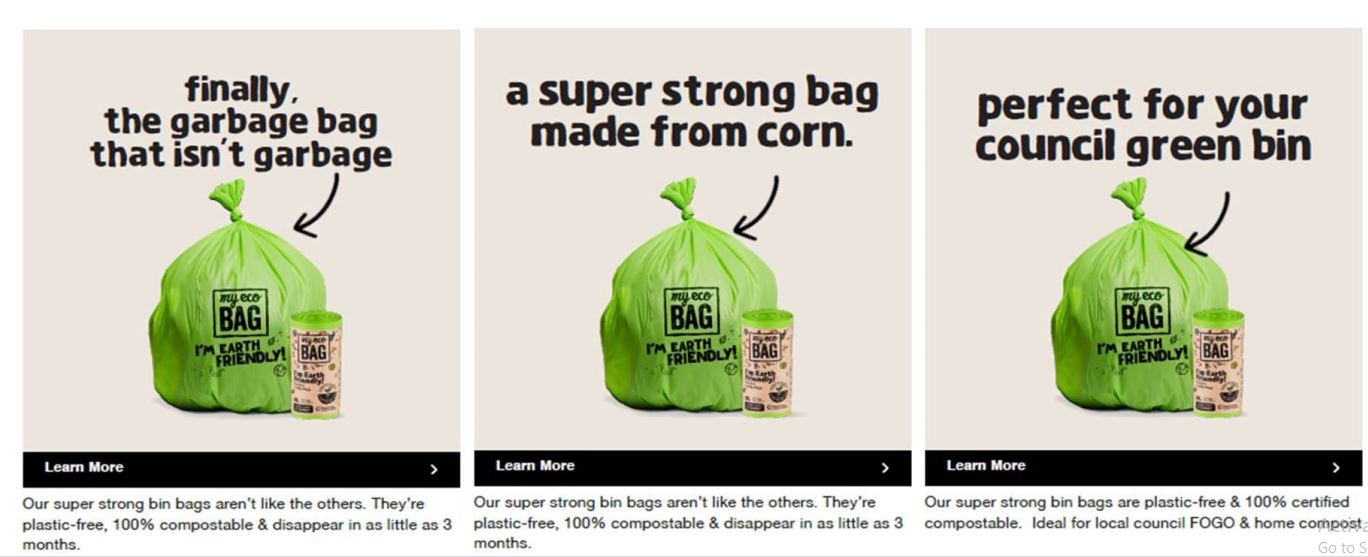

The company is called Secos Group Ltd [ASX:SES] and they do sustainable packaging.

You can see what their marketing campaign looks like as well:

|

|

| Source: Company Presentation |

I’ve used biodegradable bags before, and strength is a key feature lacking in some of the products.

So, I’ll definitely be looking out for these ones in the future.

We all know the sheer amount of waste in the packaging industry — and it’s worth a whopping US$850 billion.

I don’t expect big companies like Amcor Plc [ASX:AMC] or Orora Ltd [ASX:ORA] to fade away overnight.

But change is coming, and innovation is desperately needed.

As a result, you can expect some big green investing opportunities to present themselves in the coming months and years.

Be prepared to invest accordingly.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.