At last, some relief.

You’ve probably noticed that prices at the pump have dropped.

I’ve certainly noticed the difference with petrol prices around $1.65 a litre, down from around $2.15 earlier this year. It’s quite a drop.

‘Fill up now,’ while it’s still cheap, pressed one of the headlines I read this week.

The truth is that petrol prices can be very volatile, especially when one finds themselves in the middle of an energy crisis.

What’s interesting is that much of the price drop hasn’t come from a supply increase. Instead, what’s pushing petrol prices down is lower demand and consumption.

In the US, for example, people are driving less.

From the Washington Post:

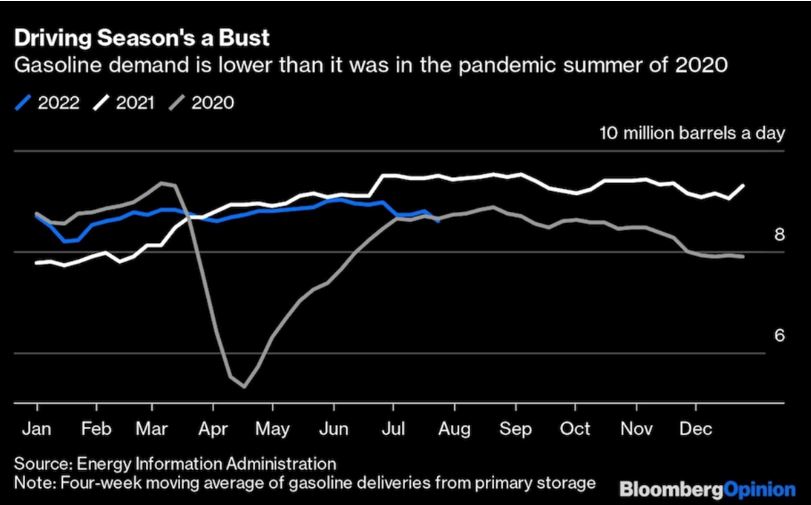

‘With less than a month until Labor Day, which marks the end of the peak gasoline demand season, deliveries of the fuel have dropped below the level seen during the pandemic summer of 2020.

‘[T]his wasn’t a freak result of one week’s data. Gasoline demand has been tracking close to the 2020 level since the start of July and has only been above 9 million barrels a day once this year.’

|

|

| Source: Washington Post |

This is staggering, considering two years ago, we were in the middle of lockdowns and restrictions.

Demand destruction is even worse in Europe.

I mean, my family and friends over there are constantly grumbling about the current heat wave and electricity prices, but they are also very concerned as they head into winter.

No access to affordable energy is already hitting manufacturing over there, which will impact growth.

European factories and industries are slowing production to save gas for winter, Bloomberg reports. Gas demand has already dropped by 15–20% because of high prices, with more to come.

In the UK, industrial gas demand destruction has been even worse, dropping by around 49% in May. I mean, the UK is already talking about the possibility of winter blackouts.

Skyrocketing energy prices are causing demand destruction…but also drive us towards alternatives.

High energy prices are boosting renewable investment

All in all, 2022 is turning out to be a record year for global renewable energy investment.

In the first six months of the year, US$226 billion has poured into green energy, an 11% increase year on year, according to BloombergNEF (BNEF).

US$120 billion has flowed into large- and small-scale solar projects, up 33% from the same time last year.

In fact, solar is having a great year. As Bloomberg Intelligence senior analyst Rob Barnett told Yahoo! Finance:

‘The global solar picture is just staggering at this point. We are on track to install something like 250 gigawatts of solar capacity this year.’

But wind is also having a cracker year.

Even with global supply chain disruptions and inflation hitting the sector, BNEF expects that there’ll be a record 106 gigawatts of wind power installed globally in 2022.

Much of that is coming from China, but more recently, too, from the European Union as it moves away from Russian gas.

But of course, when it comes to investing in renewables, the motherload came from the US this week.

After months of negotiations and an all-nighter, the US Senate passed the Inflation Reduction Act of 2022 on Monday.

As we mentioned last week, this landmark deal will bring in one of the most significant investments in clean energy until now. It provides US$369 billion in funding to cut US emissions by about 40% by 2030.

Investing in increasing energy supplies and developing local renewable energy when energy prices are soaring isn’t a bad idea.

But news of the deal quickly seeped through clean energy stocks.

As soon as the news hit the streets, the Invesco Solar ETF jumped 4%. Both Tesla and hydrogen company Plug Power rose by about 5%.

You can see how investment news can have a big impact on stocks.

More money to flow…

Of course, there’ll be plenty more money to come.

IRENA estimates we’ll need US$5.7 trillion a year to 2030 for the energy transition to hit climate targets.

But make no mistake, this is about more than just climate.

Renewable energy increases energy security and diversifies our energy sources. More energy supply decreases prices.

It’s not too late to invest in renewable energy. This is all just getting started…

Until next week,

|

Selva Freigedo,

For Money Morning

Selva is also the Editor of New Energy Investor, a newsletter that looks for opportunities in the energy transition. For information on how to subscribe, click here.