Before I joined Fat Tail in 2022, I worked as a geologist in the mining industry.

But in all my time writing to readers, I haven’t properly explained what a geologist actually does.

I’ll finally do that today!

You probably know geologists have a rather weird fascination with rocks.

My 2.5-year-old daughter is going through a rock-obsession phase right now…picking up small rocks off the beach (or driveway) and stashing them in hidden spots around the house.

For many kids, a fascination with rocks is a passing fad.

But for others, it stays with them for life.

If they grow up in Australia, they might even make a career out of it!

A geologist is born

Head west, and there’s a fair chance you’ll encounter one of these strange rock-loving creatures. The vast Western Australian outback is full of them!

But not all geologists are the same…

Some prefer to wander the bush, stepping into old mine shafts and hanging around remote pubs with drillers and other mining riffraff.

Others prefer the ‘normal’ lifestyle, an office-based role at a mine site or corporate office in the city.

But it’s the geologists living on the edge who could offer early clues about our position in this mining cycle.

We’ll get to that in a moment.

First, we will describe geologists’ various roles in the mining sector.

First up… The discoverers

Rummaging out in the bush and looking for new ore deposits, these are known as grassroots exploration geologists.

Mapping, soil, auger, and rock chip sampling, and if early signals look promising, send in a drill rig for deeper test work.

Little has changed in the way explorers undertake fieldwork over the last several decades. However, the interpretation of that data has advanced considerably.

Portable x-ray-like devices can zap rocks in the field and provide instant feedback on their mineral composition.

Integrated AI software enables explorers to refine and process data that traditionally took months to digest.

At this early stage, we’ll often draw on the expertise of another type of geoscientist, one who is inclined toward physics—a geophysicist.

These geologists use software to measure electrical signals below the surface. This produces colourful maps, differentiating rocks based on their ‘electrical properties’.

Geophysicists and exploration geos work together with the primary goal of identifying targets for drilling.

You see, the game of discovery is all about probabilities.

Drilling is a mammoth expense for a small exploration company.

A single campaign can make or break a company.

Undertaking this high-risk venture means putting as many ‘odds’ in your favour as possible.

A geological structure, soil, outcrop, or geophysical anomaly… Ideally, all these factors must align before the drill rigs are sent in.

Even then, hitting mineralisation with economic potential remains a low probability.

Usually, drilling just opens the door to further questions… Only after exhaustive drilling efforts through many years of exploration will a true mineable deposit be confirmed.

But on rare occasions, drilling can hit the motherlode early on.

These are the fabled stories in the mining industry—very much the exception rather than the rule.

How big is that deposit?

Enter the resource geo…

They have an inclination for maths and statistics. A rare breed indeed.

Rather than spending days trudging out in the bush or alongside a dusty drill rig, these geos prefer the comforts of city living and daily espressos.

But that doesn’t discount their importance…

Once a discovery is made, companies must determine whether the potential resource can be mined economically.

Resource geos are tasked with measuring the size of a deposit.

Often, they’ll work within a consulting firm or in-house at a large mining company.

Measurement of a resource requires extensive drill data to be market-compliant. The rules are set out in what’s known as the ‘JORC Code.’

The data is collected through intensive resource drilling, also known as ‘infill drilling’.

At this stage, it’s all about connecting the dots between exploration holes—a critical step.

Imagine two exploration holes 150 metres apart; both have mineralisation, but the ground between them is full of ‘unknowns.’

Resource drilling might narrow this down to a 50-metre gap, reducing the chances of error in the geological model.

Infill drilling plays a crucial role in feasibility studies. In other words, whether a project can be mined economically.

If the resource geo is way off in their estimate, it can devastate a project’s viability.

If in doubt, ‘underestimating’ the resource is the best course of action.

I’ve seen many mistakes at this critical point in the development life cycle…

Infill drilling doesn’t generate market excitement like you’d expect from a successful exploration hole.

But it adds to the validity of a project for those paying close attention.

Exploration geologists are often asked to stay and assist the resource team; that’s what happened to me after Barrick took over Equinox in 2011.

I’ve had my fair share of resource drill programs.

They’re critically important but very monotonous. Nothing beats exploration in the mining game, and that’s what I keep falling back to.

Next… Where to send the diggers?

Further up the mining life cycle, you’ll encounter mine geologists.

Typically, this is a high-pressure job.

Mining geos map the ore body inside an open pit or underground mine, tracking the deposit’s precise trajectory as mining occurs.

For iron ore, that’s easy… one giant ore body.

But tracking something like gold mineralisation is much harder.

Firstly, you can’t see gold. Modern gold mines extract this commodity in minute quantities; most mineable gold is invisible to the naked eye.

Furthermore, mineralisation is usually hosted within narrow geological structures (like veins) and is often cut off by faulting.

Mine geologists map these structures to guide mining crews so they can extract the right rock within a mine.

Mining barren rock is a costly mistake!

But so are delays… If mine geos and engineers fail to keep up with the excavators or blast crews, costly ‘standby’ charges kick in.

The mining contractor charges this added cost as they wait for the geos and engineers to give directions on where to mine.

Recurring delays could impact a company’s production guidance.

Here’s the key point for today’s market

Exploration geologists have always played an important role in the mining industry.

Yet that appears to be diminishing.

Take this from a recent S&P Global report evaluating trends in the exploration sector:

| |

| Source: S&P Global Intelligence |

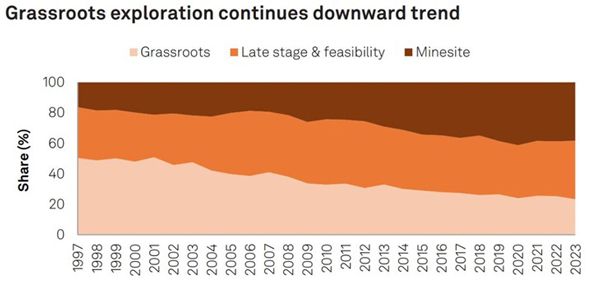

The share of grassroots exploration in the sector has fallen from around 50% in 1997 to just 20% today.

In other words, far less investment is being directed into discoveries.

Instead, budgets are more focused on near-mine brownfield exploration.

This will have long-term implications.

Brownfield exploration means expanding existing resources, usually low-grade and marginal for mining.

The inclination to make meaningful discoveries is in a multi-decade terminal decline.

And this sits at the heart of what I believe will become the greatest investment opportunity in the resource sector…

Junior mining stocks holding large undeveloped deposits.

The highly prized projects desperately needed to fill the long-term gap left by the lack of grassroots exploration.

I believe this is the best investment tactic for investors right now, and it’s a key strategy for my Diggers and Drillers advisory service.

One of my recommendations, Filo Corp [TSX:FIL], just received a multi-billion-dollar takeover bid from Lundin Mining and BHP.

It owns a giant undeveloped copper, gold, and silver deposit.

The deal aligns perfectly with what I’ve been spelling out to readers for years…

Declining grassroots exploration means supply shortages are coming.

The largest miners must compete heavily for the limited number of economically viable deposits juniors hold.

And I’ve identified THREE of them in a report I’ve just compiled.

Companies that are ripe for takeover potential.

You can now access the names of those stocks by clicking here.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments