During its 2022 Investor Day, agribusiness Graincorp [ASX:GNC] reaffirmed its FY22 guidance and touted its confidence in its strategy and long-term outlook.

Graincorp stated that it is ‘extremely well positioned, delivering outstanding results.’

GNC shares rose as high as 4.4% on Tuesday.

GNC shares are up 80% over the past 12 months, but have corrected somewhat in recent weeks, down 5% in the last month.

Source: Tradingview.com

Graincorp’s investor presentation

Graincorp today outlined its strategy and commented on the macro trends impacting the agricultural sector.

Graincorp also said that its recent financial performance can be attributed to sound capital investment, optimal delivery, efficient supply chains, well-planned crop yields and a continuing strong demand for Australian gain, oilseeds and vegetable oils across the globe.

GNC believes that a ‘modest growth capex’ has played out this cycle, allowing the company to deliver a ‘short-term payback.’

Graincorp also said it possesses a surplus of cash flow, which it will — subject to arising growth opportunities — reinvest in its business and return to shareholders.

GNC reiterated sentiments it expressed earlier this month, that its products are experiencing ‘above-normal’ returns due to current market conditions driving volumes and commodity value higher.

GNC share price outlook and the future for grain

Graincorp said its ‘recent financial performance, strength of balance sheet and positive outlook provide optionality for GrainCorp to invest in growth and return capital to shareholders.’

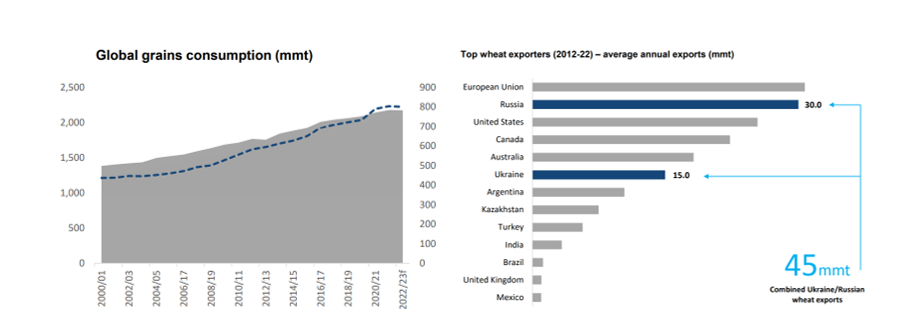

On a macro level, GNC reported that the grain and oilseeds consumption rate is on the rise as the global population is expected to reach 11.2 billion at the end of the century.

Asia’s demand is forecast to far outstrip other regions, having taken 50% of the world’s food supply in 2020.

Source: GNC

Graincorp said the global wheat-stock market has reached its severest point in twenty years, with the war in Ukraine further squeezing grain supplies and disrupting wheat, corn, barley and sunflower oil supply chains.

It’s not just a growing population and the conflict in Ukraine that’s causing prices to surge to such degrees.

Rampant inflation. Stock markets faltering. Bonds having their worst returns since 1842.

Many investors are calling it a ‘nowhere-to-hide’ market.

But, like Graincorp has proven today, there are stocks out there that can buck the trend.

And some of the strongest stocks to withstand the selling pressure this year have been dividend stocks.

Once regarded as relics during the pandemic bull run, dividend stocks have ‘trounced practically everything this year’, according to The Wall Street Journal.

Now, the Daily Reckoning has just released its latest report, five Aussie dividend stocks that have the potential to protect your income in these trying times.

Access the Five ‘Inflation Buster’ Stocks for 2022 report here.

Regards,

Kiryll Prakapenka,

For Daily Reckoning