For two decades, Google’s search monopoly has been the invisible engine powering everything from your morning news to your investment research.

But that dominance is cracking, and the implications stretch far beyond Silicon Valley.

The numbers tell a stark story that should make every tech investor sit up and take notice.

The Zero-Click Revolution

At a recent event, Cloudflare’s CEO, Matthew Prince, dropped a statistic that should terrify traditional web companies.

You see, Google used to be the king of sending traffic to websites. Now it keeps most people on Google instead. Here’s what’s happening:

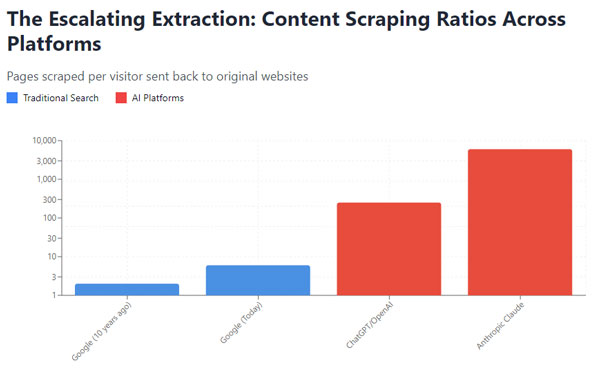

Ten years ago, for every two pieces of information Google took (called scraping) from a website, it would send one person to visit that site. It was a fair trade.

Google takes content from a website, and in return, provides traffic back to the source. This has been the bedrock of the ‘free’ internet we have enjoyed for decades.

However, today that scrape-to-visitor ratio has tripled to six to one.

Prince explained the mechanism driving this shift:

‘Today, 75 percent of the queries that get put into Google get answered without you leaving Google.’

But here’s the kicker that matters for your investments: With the rise of AI (Artificial Intelligence), this trend is now turning on Google.

When it comes to AI platforms like OpenAI’s ChatGPT, the ratio explodes to 250 pages scraped per visitor.

For Anthropic’s Claude? A staggering 6,000 to 1.

| |

| Source: Claude, AI Generated |

This isn’t just a technical curiosity. It’s the fundamental destruction of the web’s business model. And it will only get worse in a world of AI.

Is Google in trouble?

That question reminds me of a famous quote from musician Frank Zappa.

| |

| Source: AZ Quotes- Frank Zappa |

Google isn’t dead yet, however, your online business could be.

How Every Online Business Faces a Crisis

Think about what happens when websites can’t convert traffic into revenue.

Publishers that once relied on advertising income from page views watch their visitor numbers plummet.

Subscription models become harder to sustain when potential customers never visit the original source.

This isn’t just theory — it’s happening now.

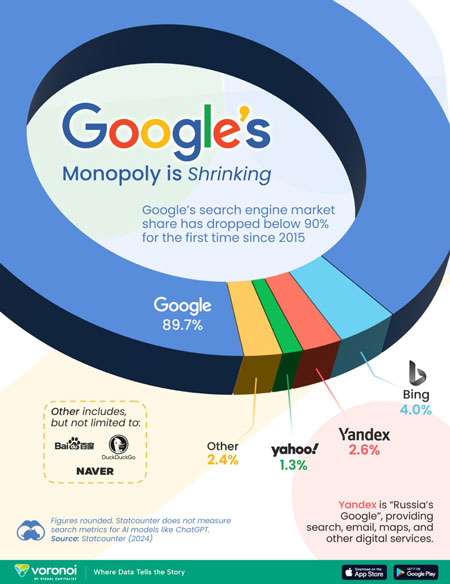

According to recent data, Google’s search market share has fallen below 90% for the first time in a decade.

Who’s taking the pie? Microsoft’s Bing and other AI services.

| |

| Source: VisualCapitalist |

What does this mean for Google?

60% of their revenue comes from search, so they won’t sit idle.

They still hold the lion’s share and could hold the tide with their AI, Gemini.

But we can imagine a future where AI entirely replaces Google search. This is already becoming a reality in our office.

With AI as the centre of gravity for the internet, things begin to break.

Traditional ads no longer support our information economy. Subscriber walls go up, and only the large survive.

This creates a vicious cycle: as content creators struggle to monetise, they cut costs and produce less original content.

AI systems then increasingly train on synthetic, AI-generated material rather than human-created sources.

The quality of information degrades, but more importantly for investors, the economic incentives that built the modern web evaporate.

The Opportunity Hidden in Disruption

The current ad-supported web model won’t survive the shift to zero-click answers and AI.

The bright side is that we can gain from Google’s loss.

When economic systems break down, new investment opportunities always emerge.

I believe that while Google’s monopoly weakens and the pay-per-click model breaks down, two things are likely to happen:

Either A), AI companies will extract enormous value and become the new Googles of this era.

Or B), companies that can effectively address the monetisation challenges will capture enormous value.

I don’t know which will win. But here are some ideas for directions to invest.

Three Investment Themes Worth Watching

First, look for companies that are getting paid by AI to use their content.

The smart money recognises that AI systems desperately need trusted, human-authored content to ground their outputs.

Meanwhile, traditional media needs alternatives to collapsing search revenue.

Reddit [NYSE:RDDT] licensing agreement with OpenAI provides a template, but the opportunity extends far beyond social media platforms.

News sites, data companies, and content platforms that move first will command premium valuations as AI companies compete for quality training data.

Second, find companies that can prove where information comes from. When AI-generated content floods the web, systems that can verify authenticity and track original sources become invaluable.

Adobe [NASDAQ:ADBE] has taken the lead with its ‘content credentials.’ A digital stamp that proves human or AI authorship — like a watermark for money that shows it’s real.

However, other companies developing blockchain-based attribution systems or advanced content verification tools could also see explosive growth.

Third, watch for new monetisation models emerging around AI query layers.

Spotify [NYSE:SPOT] shows how this can work: Its AI DJ can give personalised recommendations, pay royalties, and earn billions.

These are just a few examples that show companies can create sustainable revenue in an AI future.

Positioning for the Post-Search World

Smart investors should ask different questions about their tech holdings or even their own businesses.

Instead of focusing on traditional metrics like search rankings or page views, consider which companies are building for an AI-first future.

Does the business model depend on users clicking through from search results? That’s a red flag.

Can the company monetise attention even when users never leave the AI platform? That’s worth investigating.

I believe we’re watching the fundamental economics of information transform.

Those who adapt their investment strategy to this new reality won’t just survive the great search disruption. They’ll profit from it.

Regards,

|

Charlie Ormond,

Editor, Alpha Tech Trader and Altucher’s Early-Stage Crypto Investor

Comments