It’s 2023 and I wish you all good health and spirits!

2022 was a forgettable year for those who speculated on gold.

Not the yellow metal itself — that was one of the most solid assets for the year. It ended down 1% in USD terms by the end of 2022, while up almost 8% in AUD.

I’m talking about the mining companies. After all, you don’t get rich buying gold. You do so by speculating on the fortunes of the mining companies that explore and produce it.

Things looked bright in late January as gold producers started to rally. The momentum picked up when conflict broke out between Russia and Ukraine the following month, sending gold soaring to levels near the 2020 highs.

Many, including myself, were of the view that gold would have a stellar year given that central banks finally admitted inflation was a lingering problem.

These were the same experts who refused to admit this in 2021, despite everyone on Main Street experiencing rising costs of living thanks to a strained global supply chain.

Rates started to rise in mid-March with the next occurring in May.

Markets laughed off the first as it was a feeble 0.25%. That gave gold another boost, and gold stocks were poised for a breakout by mid-April.

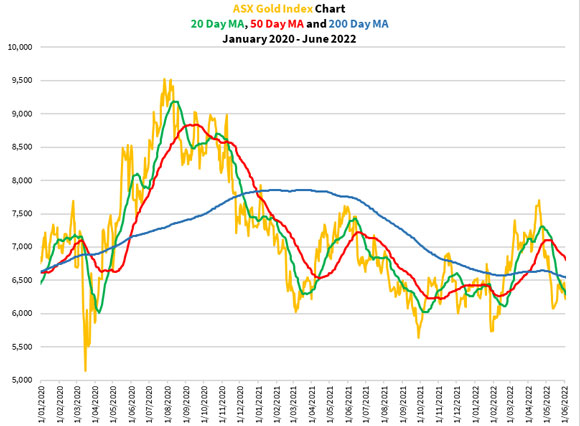

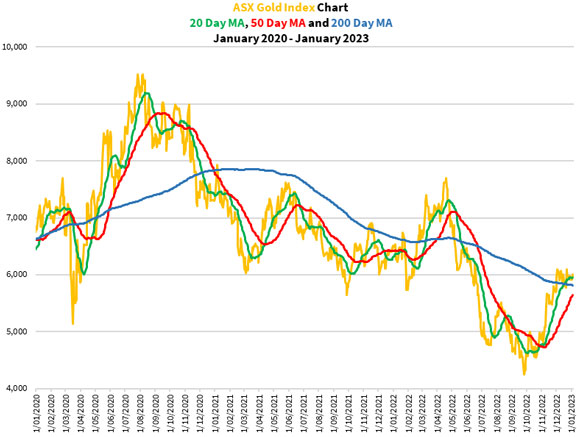

Let me show you what the ASX Gold Index [ASX:XGD] looked like at the time:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The 20-day moving average was above the 50- and 200-day moving average. The 200-day moving average started to turn positive.

At that time, my sights were set on what I believed would be a replay of 2019 or even 2020. In both years, gold stocks delivered rewarding gains.

Few saw a bear market coming for gold stocks!

I expected a bear market as the Federal Reserve decided to accelerate its pace in raising rates from May onwards, as I wrote in this piece. And I thought the bear market would cause people to seek refuge in gold, benefiting gold stocks at the same time.

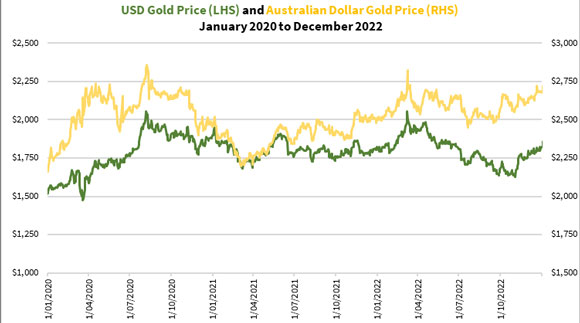

I got the first part right, but terribly wrong on the other. Gold did pull back in US dollar terms amidst the rate rise, but stood firm in ours:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Gold stocks, well, they took a beating more severe than what we saw in 2020:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

How did that come to be? Allow me to analyse with the benefit of hindsight.

Not quite a Volcker rate rise, but a hammer all the same

The Federal Reserve and other central banks around the world aggressively raised rates from May onwards. Rate rises of 0.5% or more reined in liquidity and dramatically cut spending across all sectors. While the Consumer Price Index climbed in many countries, it was doing so at a decreasing pace; signalling inflation was being brought under control.

So, in a way, the central banks were able to alleviate concerns of runaway inflation with monetary policy. That kept gold’s rally at bay. On top of that, a rising interest rate made fiat currency more attractive than gold as it pays a yield, while gold doesn’t.

The US dollar gained more than 15% from May 2021 to September 2022, as you can see in this figure depicting the US Dollar Index [DXY]. Even now, it’s trading at levels not seen since 2003:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Looking back, Federal Reserve Chair Jerome Powell did take a swing at inflation and appeared to have brought it under control to some extent. He didn’t do a Volcker and therefore the asset markets took a beating, but it hasn’t come crashing down in a screaming heap.

At least not in 2022.

But what I believe is coming next could be interesting.

Economy hanging by a thread, threatens to teeter in 2023

One of my favourite Peter Schiff sayings is about how the Federal Reserve tries to conduct a magic trick with monetary policy. You can hear it along with his other jokes in this stand-up comedy sketch (6:20–7:00). Note he was referring to the previous chair Janet Yellen on this, but it still applies today.

How’d you like that? Yes, economists can be funny, but they’re few and far between!

Anyway, Jerome Powell may have averted a market disaster raising interest rates as he did last year. The Federal Funds Rate ended the year sitting at 4.25–4.5%.

And apparently the Federal Reserve isn’t done with raising rates yet.

How high could it go?

5%? More?

This is where things will get very dangerous, if it wasn’t already.

You see, the US Government debt is well into the US$30 trillion mark, if you run by the numbers from the US Debt Clock. Total US debt is at US$93 trillion!

Taking the government debt alone, we are talking about each US citizen owing US$94,000! So their annual interest bill is around US$4,500 right now.

Throw on top of that their own personal debt — home, mortgage, credit card, etc. It’s a heavy burden and it’s about to get heavier.

I had a chat with a world-renowned gold stock investor, Don Durrett, almost two months ago about what to expect this year. He’s of the view that everything could come crashing down if the Federal Reserve raises rates to 5%.

And should there be a crash this time round, central banks are out of the game. They’ll have to reverse their monetary policy, create currency like never before, and risk hyperinflation.

Perhaps this is part of the plan. Those who are aware would know of The World Economic Forum and their ‘Great Reset’ to usher in their Fourth Industrial Revolution. A central bank digital currency, decarbonisation, and an AI-driven world of surveillance.

Let’s hope for our sake that the central banks succeed in destroying their own petrodollar system but fail in rolling out ‘The Great Reset’!

But make no mistake, they’re preparing for a collapse and bought record amounts of gold last year.

A mighty gold rally for 2023? You can bet the central bank on that!

And based on that, I’m pretty confident about gold’s prospects this year.

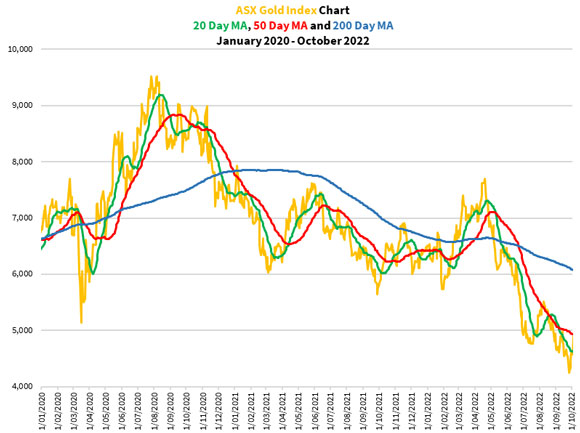

Moreover, gold stocks are setting up for a rally once more. Check out how the ASX Gold Index is playing out now:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Notice that the 20-day moving average is leading the 50-day moving average? That’s a bullish short-term signal. What’s most encouraging is that the 20-day moving average has crossed the 200-day moving average from below, with the 50-day moving average soon to do the same. The picture is complete when the 200-day moving average turns upwards, and then we’re off to the races.

So why do I think it’s different this time?

Because the central banks are no longer standing in the way, they’ve moved in line with us gold enthusiasts.

So now it comes down to whether 2023 will be like 2019, when gold producers rallied hard as gold started breaking out.

Or could it be like 2020, when we had the manic buying phase with gold where explorers made monumental gains averaging 300% across the board in the space of six months?

Gold producers have jumped out of the gates since October and there’s still room to run.

If you don’t want to miss out, join me here.

But for the main event, and the potential to make life-changing gains if my outlook turns out right, you may want to get started buying up some good quality gold explorers and developers. Of course, this is for those with a much higher risk tolerance.

Head over here if this sort of high-risk, high-reward speculation is what you’re seeking.

Regards,

|

Brian Chu,

Editor, The Daily Reckoning Australia