Gold miner St Barbara [ASX:SBM] rose 7% on Friday after achieving its FY22 production guidance.

Friday’s spike comes during a trying time for the gold sector, with the price of gold dipping below US$1,800 in July.

Gold is currently hovering around US$1,740 an ounce.

SBM shares themselves are down 40% year to date and 50% over the past 12 months.

Source: Tradingview.com

St Barbara achieves guidance

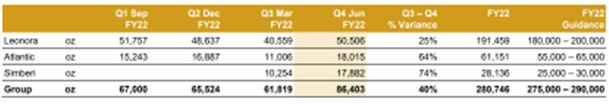

SBM reported a ‘strong’ June quarter, with all three of its providences’ achieving guidance.

The highlights included:

- ‘Total Group gold production of 281koz (meeting FY22 production guidance)

- ‘Total Group gold production for the June quarter FY22 of 86.4koz representing a 40% quarter-on-quarter increase (March quarter FY22 61.8koz)

- ‘Cash balance increased by 24% to $98 million compared to March quarter FY22’

SBM said the quarterly production demonstrated ‘successful execution of its Leonora Province Plan’.

St Barbara also reported on some key ‘value drivers’ for its projects:

- ‘Largest Mineral Resource base of 10.3 million ounces and Ore Reserve base of 2.5 million ounces in the Leonora region

- ‘Near term Mineral Resource and Ore Reserve growth

- ‘Further Mineral Resource extension and infill drilling planned throughout FY23

- ‘Significant exploration potential with a land holding that more than doubled with the Bardoc acquisition

- ‘Leonora Processing Plant to be expanded from 1.4mtpa to 2.1mtpa’

SBM said its Gwalia mineral resource of 25mt at 5.8g/t with Ore Reserve base 12.9mt at 5.1g/t is the ‘only sizeable +5.1g/t mine outside the majors’.

How to pick winning ASX gold stocks

What’s the outlook for gold and gold stocks?

It’s a tricky time right now, with the price of gold falling below US$1,800 an ounce.

The strength of the US dollar isn’t helping, which is trading at 20-year highs against the euro.

Investors are potentially seeing in the greenback as a better safe-haven asset than gold at the moment.

Unsurprisingly, gold stocks have been hit hard.

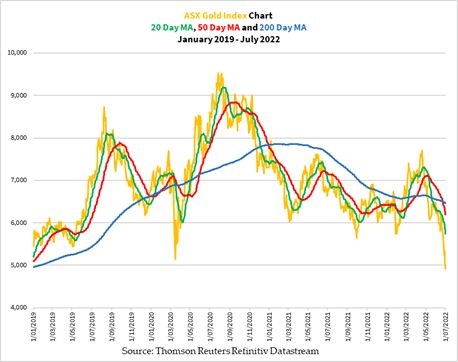

The ASX Gold Index [ASX:XGD] is down 12% over the past year.

As our resident gold bug Brian Chu noted earlier this week, the index is trading below the key moving averages as you can see below.

Source: Refinitiv

Brian thinks the selling is overdone:

‘The bearish trend seems quite overdone now. Whether it’ll bounce or turn bullish depends on the near-term inflation figures and central banks raising rates.

Meanwhile, gold relative to gold stocks is now at its highest in the last seven years, meaning that gold stocks are more undervalued now than in March 2020.’

Now, gold may still fall further from here.

But given the growing fears of a likely recession — coupled with bets central banks won’t be able to tame inflation for a while — the safe-haven appeal of gold isn’t likely to die.

And if gold has its moment once more, what gold stocks should you look for?

How do you go about evaluating the dozens of gold stocks on the ASX?

Brian recently put together a report that should help answer these questions.

In his report, Brian outlines what to look for in a winning gold stock and the types of gold stocks to consider according to your risk profile.

If you’re interested in reading Brian’s report, access it — for free — here.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia