Gold may seem like a strange choice for inclusion in a series of articles on the future of money. Observers are well aware that gold has served as money — usually the best form of money — for more than 3,000 years of civilisation and perhaps longer.

As recently as the 1910s, a traveller departing London carried a purse of British gold sovereigns — a 7.98-gram 22-karat gold coin (about one-quarter ounce) — on overseas trips. On arrival in Bombay, Shanghai, or Sydney, the traveller could be completely confident that the coin would be accepted at full face value. It was literally worth its weight in gold. It was world money.

Gold lost its role as money in slow stages over the following decades. In 1914, most gold coins were surrendered to banks in order to boost gold reserves needed to finance the First World War. Citizens accepted paper bank notes in exchange.

In theory, the bank notes were redeemable for gold, but were seldom redeemed. Physical gold was still around but it was melted and recast as 400-ounce bars held in bank vaults. Banks claimed the notes were still backed by gold, but gold rarely saw the light of day. No one went shopping with 400-ounce bars (about 27 pounds) in their purse.

A slow-motion gold heist

Between 1919 and 1933, central banks required commercial banks to surrender their gold bullion in exchange for credits in their reserve accounts. Then certain finance ministries required the central banks to surrender the gold to the national treasury in exchange for gold certificates.

Then countries began to devalue their currencies when measured in the weight of gold — France in 1925, the UK in 1931, the US in 1933, and France and the UK again in 1936. During this period, the US made it illegal for citizens to hold physical gold. Shipments of gold between nations were halted again in 1939 with the outbreak of the Second World War.

In 1944, the Bretton Woods agreements revived gold as money, but only for international transactions and balance of payments settlements among the major countries who signed the agreement. Currencies of the Bretton Woods signatories were pegged to the US dollar, and the dollar was pegged to gold at US$35 per ounce.

In March 1965, the requirement that commercial bank deposits be linked to the level of gold reserves was eliminated. In March 1968, US President Lyndon Johnson signed a law that eliminated the ‘gold cover’ requirement that Federal Reserve notes be covered by at least 25% physical gold held by the Treasury.

In August 1971, US President Richard Nixon suspended the redemption of dollars held by foreign trading partners for physical gold. By 1974, all major currency issuers had moved from fixed to floating exchange rates. In April 1978, the International Monetary Fund (IMF) ended the obligatory use of gold in transactions between the IMF and member nations.

The forgotten money

The process took 64 years (1914–78), but when it was completed, governments and the IMF held all the official gold in the world and gold was no longer counted as money. Since the 1970s, two generations have been trained in economics with no reference to gold at all except for derogatory clichés such as ‘barbarous relic’ and ‘shiny rock’. Gold has been practically forgotten as money — but not quite.

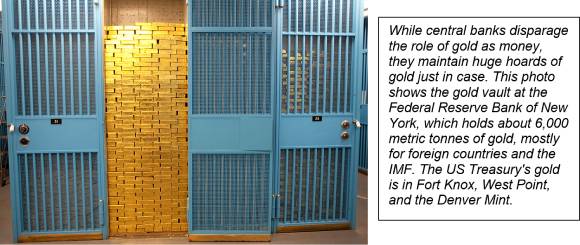

|

|

Ironically, at almost the same time, gold was abolished as money on 14 August 1974. US President Gerald Ford signed a law that once again allowed Americans to own gold coins and bullion. Gold was no longer money as currency, but it could perform the classic role of money as both a store of value and a unit of account. Since then, Americans have been free to adopt a personal gold standard by buying and storing gold bullion.

De facto dormant money

Despite the official demonetisation of gold, it’s remained a form of money de facto. The US holds 8,133 metric tonnes of gold in its reserves. Germany holds 3,362 metric tonnes, while Italy and France hold about 2,450 metric tonnes each. The IMF, which officially demonetised gold, has 2,814 metric tonnes. Russia has 2,295 metric tonnes of gold, but because it has a far smaller economy than the G7 countries, it is a gold power when gold reserves are measured as a percentage of GDP.

China officially has 1,948 metric tonnes of gold but is believed to have far larger reserves of gold off the books inside the secretive State Administration of Foreign Exchange, SAFE, a kind of non-transparent sovereign wealth fund. Even the small and highly dysfunctional economy of Lebanon is backed up with 286 metric tonnes of gold. In total, official gold reserves of all sovereign powers are 35,219 metric tonnes, about 17.5% of the total estimated above-ground gold in the world.

The fact is gold remains the most powerful and reliable form of money. Sovereign States don’t want to acknowledge this fact because it diminishes the power of their preferred alternative — command currencies issued by central banks. The size and timing of command currency issuance give countries enormous power over economic growth, employment, and wealth accumulation within their jurisdictions, and globally in the case of the US.

Physical gold was adopted as a form of money in the age of central banks (1668–2021) as a way to support confidence in paper bank notes (gold was actual money in the form of coins and bars long before bank notes came into use). Over the 20th century, the link between gold and bank notes was gradually erased but gold itself never disappeared.

Today, gold is still money, but it’s dormant as a form of currency. It retains its role as a store of value and unit of account, but it’s used as a medium of exchange by appointment only. The days of exchanging eight-gram gold coins for goods and services are over for the time being.

The moment gold is waiting for draws near

In its store of value role, gold is poised for major gains in response to the rise of inflation in 2022 and later. This inflation will not be caused by so-called money printing. An expansion of the money supply without accompanying changes in saver psychology that affect velocity or other exogenous catalysts has little impact on consumer prices. The driver of inflation is velocity, or the turnover of money caused by lending and spending. Velocity has been plunging for more than 10 years.

Still, an exogenous catalyst of velocity will arrive soon and last for decades in the form of higher wages needed to offset declining working-age populations in China, Japan, Europe, Russia, and the US. This wage increase will be driven in part by the diversion of workers to healthcare for seniors, which is needed work, but not amenable to productivity increases.

Once this demographic wave hits, saver psychology will shift quickly, and cost-push inflation will feed on itself. Inflation combined with decreased confidence in central bank command money will move gold to US$10,000 per ounce or higher. That is the implied non-deflationary price of gold needed to act as a backstop for command money.

Digital gold money

Beyond gold’s role as a medium of exchange, it will most likely be restored by combining physical bullion in secure storage with digital payments systems backed with gold measured by weight. You might have a 100-troy ounce account worth US$1,000,000 when gold is priced at US$10,000 per troy ounce (worth more or less if the per ounce price is higher or lower). Your ability to buy or sell goods or services would be conveyed through a digital token stored on a mobile phone or chip card.

After each purchase, your gold account would be reduced by the amount spent based on the market price of gold at that time. Your account could be topped up with new purchases of gold from the account sponsor.

This kind of gold-backed currency account could be extended through linkage to new central bank digital currencies. A digital interface would replace the gold coin, while bullion in storage would reconstitute a gold standard for the 21st century. In the end, the dollar would be little more than a counting mechanism while the wealth preservation and purchasing power functions of money are slowly ceded to gold.

Look out for next Wednesday’s article, where I’ll do a deep dive into Bitcoin [BTC] as a form of money.

All the best,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.

Comments