In today’s Money Morning…a tactical trade…going after Russia’s finances…bitcoin is immune to war…and more…

The Ukrainians seem to be holding out better than many expected.

Though the capital Kyiv is expected to come under intense attack soon, and by the time you read this, who knows what the situation will be?

It’s a very fluid situation.

And we can only hope things improve soon.

Yet, as investors, we can’t invest on hope. We can only invest in what is, and what we think might be.

The cold hard fact of the matter is that this conflict has big implications for two huge sectors.

Energy and finance…

A tactical trade

These two industries literally make the world go round.

So you can understand why the stakes are high right now for everyone — even those watching from afar.

I wrote two weeks ago about how I thought this conflict would result in higher oil prices, but slower interest rate rises.

You can read my reasoning here for more detail, but the main argument was that oil price rises act as de facto interest rate rises in terms of slowing down economic activity.

So it’ll give central banks the excuse they need to hold off on tightening and hope inflation slows down naturally.

At least one analyst I follow agrees, stating yesterday:

‘Inflation about to come down — hard! No — it was not caused by money printing. Supply-Demand challenges were the culprits. And they are now getting resolved.’

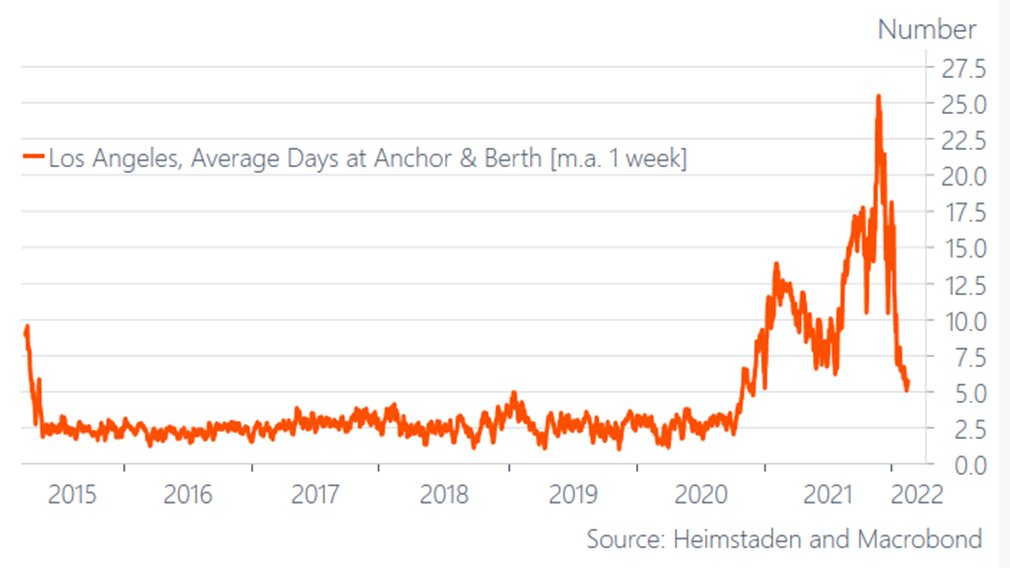

He posted this chart in support of his argument:

|

|

| Source: Heimstaden and Macrobond |

It shows delays for ships waiting to port at Los Angeles.

As you can see, waiting times had ballooned out during COVID but are rapidly contracting back to more normal levels, indicating supply backlogs are disappearing.

If inflation does fall and I’m right in thinking that central banks will ease off on the interest rate rises, we could see ‘risk-on’ assets rebound sharply.

I’m talking tech stocks, biotech, property, and crypto.

It’s certainly the contrarian bet right now, as most still expect monetary tightening.

But beyond such short-term tactical trades, there are far deeper issues in play.

Let me explain…

Going after Russia’s finances

After initially shunning such a move, it appears the appetite to shut Russia out of the financial system has done a rapid U-turn.

I’m not sure of the reasoning, perhaps politicians finally found some moral courage?

More likely, they saw the groundswell of public support for Ukraine and decided they could safely take such action, even if there’s some economic blowback.

Whatever the reasoning, first steps have been taken as Yahoo! Finance reported yesterday:

‘A decision by Western allies on Saturday to block “selected” Russian banks from the SWIFT payments system will inflict a crippling economic blow, but also cause much pain to their own companies and banks. And the allies still have room to do more.

‘The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a secure messaging system to ensure rapid cross-border payments which has become the principal mechanism to finance international trade.

‘Russian banks denied access to SWIFT will find it harder to communicate with peers internationally, even in friendly countries such as China, slowing trade and making transactions costlier.’

This is a significant step, but not a killer blow to Russia’s finances. They can find workarounds to SWIFT.

The real killer blow would be sanctioning Russia’s energy exports.

Their budget is heavily dependent on oil and gas revenue. This chart below shows the huge deficits they’d face without it:

|

|

| Source: Russian Ministry of Finance |

Clearly, such budget deficits aren’t sustainable.

But Russia has reserves — gold, US dollars, and euros — so could weather sanctions in the short term.

Longer term?

Sustained energy sanctions would kill their economy, especially as their currency is simultaneously collapsing.

Of course, cutting off Russia’s vast oil and gas exports would hurt importing nations too, especially Germany and the broader EU, who are big buyers of Russian energy.

Which is probably why this is off the table so far.

No, it seems hampering Russia’s ability to work in the financial system is the current plan, but that’s not without consequence either…

Bitcoin is immune to war

Weaponising access to financial networks drives the adoption of alternatives, such as Bitcoin [BTC] and Ethereum [ETH].

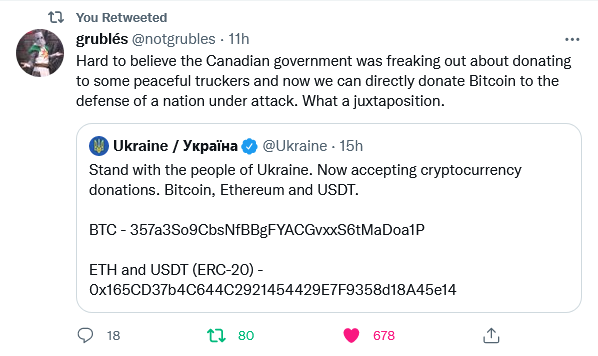

Before you see that as ‘a bad thing’, consider the fact the same decentralised networks are currently providing a financial lifeline to many Ukrainians, as this tweet states:

|

|

| Source: Twitter |

Funny how donating crypto to Canadian truckers one week was criticised, and a week later, a nation-state is literally using it to help finance a defence against an invading nation.

I’ve even read tweets from some Ukrainian refugees in Poland saying their credit cards are no longer working, but they’re managing to get by on their bitcoin.

Like any technology, crypto can be used for good or bad. And sometimes that ‘good’ or ‘bad’ is in the eye of the beholder anyway.

The point is whether you believe a monetary network should be a neutral asset or an asset controlled by ‘some’ entity.

I think any entity controlling such power will always become corrupted, no matter how good the original intentions.

But I’m not going to attempt to persuade the critics today to see things my way. Instead, I’ll leave you with a quote from a US military specialist.

Jason Lowery, a Research Fellow at the US Space Force, wrote:

‘Money is nothing but a shared abstraction b/w prefrontal cortexes. If we choose to make #Bitcoin that abstraction, then our savings become nearly perfectly immune to debasement, denial of service, discrimination, intermediation, & kinetic warfare.’

It’s a point worth reflecting on…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.