You’ve got to hand it to the globalists for their forward planning.

I’m sure many of you are now awake to how there’s a bunch of people at the apex of mankind who dictate where the world should head. They aren’t the people you get to elect, but they’re who select the people you get to elect.

They grace our TV screens, newspapers, magazines, stages in auditoriums and stadiums…you’re meant to look up to them.

They sit at the World Economic Forum, the United Nations committees, non-government organisation think tanks, business councils, and university advisory boards where they direct the future direction of mankind.

How to eliminate global poverty and wealth inequality…

How to tackle the existential threat of climate change by eliminating use of fossil fuels…

How to eliminate extremism and terrorism to bring harmony to society…

How to improve public access to health facilities to win the war on diseases…

How to change the way we think about society…

They make it sound so noble and benevolent. But the impact on society when they implement their plans has not only been short of what they claim, it’s bringing upon hardship and pain worldwide.

Fine words, but what a mess they made!

Think about the mess that the world’s currently living in, thanks to the measures the World Health Organisation has implemented to control a virus that’s now seen as no more serious than a flu.

Or how our supply chain has been seriously damaged because of lockdowns, where countries are facing shortages of necessities due to the interdependence on each other.

And what about central banks coordinating rate rises everywhere in a vain attempt to combat inflation that they all didn’t see only 16 months ago?

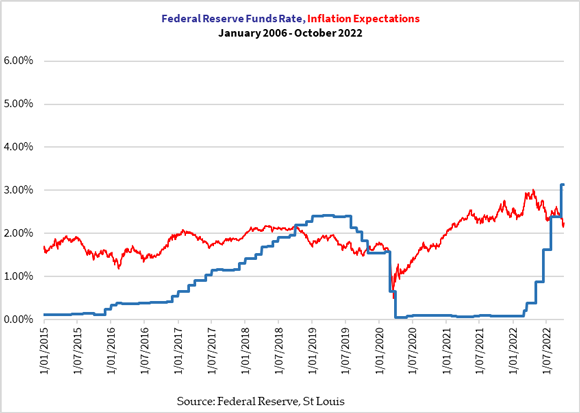

Let’s look at the US Federal Reserve and its attempt to rein in what was supposed to be ‘transitory inflation’. The figure below shows the Federal Funds Rate against the long-term inflation expectation:

|

|

| Source: Federal Reserve, St Louis |

You can see the Fed rushed to raise rates in the last six months. It seems the market is now expecting inflation to start slowing down.

In Australia, the Reserve Bank of Australia (RBA) announced on Tuesday that it would raise the 24-Hour Cash Rate (the interest rate paid on overnight deposits by banks with the RBA) by 0.25%. This brings the rate to 2.6%. It’s a more moderate raise compared to the previous months, but the rush to raise rates has brought much hardship and anger from Australian homeowners who are feeling the pinch on their mortgages.

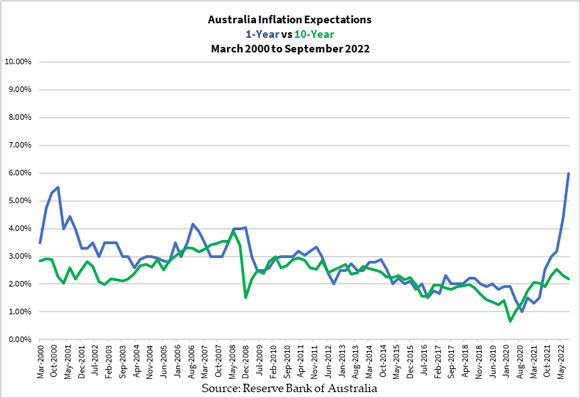

Let’s have a look at the inflation expectations in the short and long term for Australia in the figure below:

|

|

| Source: RBA |

You can see that the lockdowns in 2020 and 2021 brought down inflation temporarily as the world went to a literal standstill during that time. However, since Australia reopened, the effects of massive stimulus spending and global shortages have hit home, causing prices to rise sharply.

You might think that the last few months have been painful as we saw the cost of living rise dramatically and many having to make do with less.

Throw onto this the unforced errors of policies such as reducing the use of fossil fuels and imposing health mandates as a requirement for work. The hardship it’s brought onto people around the world is causing social unrest.

But I believe the societal decline is only beginning. You and I probably knew that ages ago.

Even those at the top are starting to realise that it’s about to crumble under their watch, so they need to try and avoid reaping the storm that they’ve sowed.

When globalists fail, double down with communism

The speed at which the global economy is declining is such that there’s little room for the central planners to fiddle around and try to distract the masses from what’s at hand.

It’s time to try something else.

In steps another globalist body, the United Nations, who’s urging central banks to stop raising rates to fight inflation.

Their suggestion? Price control.

Now, communist regimes in the past have tried this before and it has resulted in abject failure.

But then, Western democratic nations have done the same in the past, to some extent.

In Australia, we’ve had price controls too. Think about in recent times a moratorium on rental price increases and a cap on electricity prices.

You can control prices for a while, but don’t expect there to be no consequences.

Ask a renter in Victoria and Queensland about how hard it is to find a place as dozens of people compete to secure a property.

Or those in New South Wales who faced a sharp rise in their electricity bill as retailers slapped a rate increase in June/July of more than 20% from last year.

False freedom, false choice…how to stand firm in such a world

We might live in a country where we can democratically vote our leaders.

But then, are we really that free compared to the communist regimes that we shake our head disparagingly at the mere mention of their oppression on its people?

You might be able to read the news from a broad range of outlets, and the authors can criticise their leaders or those in power.

But are we getting a balanced and diverse range of opinions?

Some of you already suspect it’s a stacked deck, where those who are behind it shuffle the cards very well, concealing the truth from us.

That’s why you’re with us here as we dare to speak what is inconvenient.

A few of you already know that the only difference between us and those who live in an authoritarian regime is that our leaders make us think we have choice, when they choose for us behind the scenes. That’s why we are in this mess today — they dictated what we could choose and manipulate us to select what they wanted.

And their plan is to continue until the people say enough is enough and turf them out, or we give into their agenda.

I believe that people worldwide will push for the former as the eventual outcome. But this won’t happen in a clean way.

So it’s best to prepare.

Secure yourself financially with some physical precious metals, some cryptos, food supplies, necessities, and have a community of people who are like-minded to watch each other’s backs.

It’s not a Mad Max world yet, but making a start never hurts anyone.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia