Market action on Wall Street is getting interesting.

More sellers than buyers…putting downward pressure on prices.

Is this a temporary lull in bull market proceedings OR the early stage of a very nasty bear market?

My money is on the latter.

Wall Street has been wildly overvalued for several years…it’s always been a matter of when, NOT if, this market gets hammered.

The fatiguing ‘Everything Bubble’ has the look and feel of past bubbles…it’s tired and it’s deflating.

There’s still time to get your house in order, however, my advice is don’t wait too long.

Today is the final in a three-part series on how to build a solid financial plan.

The advice offered is the product of what I’ve learned from almost four decades in the business.

I make no apologies for it being basic and boring.

Creating and retaining wealth is a lifelong exercise…you can never let your guard down or abandon the sound principles of financial management.

The current boom has done a great disservice to the investing public.

It’s lasted far too long.

Mistaken beliefs have been created.

Bad habits have taken hold.

Fundamentals have been abandoned.

A crash of some significance is coming.

Why?

Balance must be restored.

Thinking you can get rich AND stay rich from chasing meme stocks…that loss-making tech enterprises can perpetually burn cash…or negative rates can become a permanent fixture…these (and many other examples of excess and stupidity) are all in the realm of a fantasy world.

Society needs a massive wake-up call.

We need to get back to the basics of sustainable wealth creation.

Sadly, few are prepared for the brutal reality check that’s coming.

I hope in some small way this three-part series has been of value to you and how you think about your attitude and approach to managing your finances.

Don’t invest for tax reasons

No one likes to pay more tax than they have to, but never invest solely for tax reasons.

The taxman tells you upfront the percentage of your income and capital gain he intends to extract from you. The market gives you no indication of the percentages it can extract from you.

If you are a successful investor, you must pay tax. You can use certain structures to minimise tax, but ultimately, the investment must be sound.

Over the years, numerous agricultural, film, wine, cattle, and tree schemes have offered attractive upfront tax offsets. Very few schemes have been successful. The majority have failed and provided a great source of revenue for receivers.

Negative gearing and depreciation allowances are enticers used by the property industry to make an investment appear more affordable. What happens if the government of the day (in search of tax revenue) abolishes negative gearing and/or reduces the depreciation allowances?

Personally, I’d rather own a positively geared investment property (rental income exceeds interest and other holding costs) — and I’d be more than happy to pay tax on the additional income.

Being motivated to invest primarily for tax reasons is an error of sound investment judgement.

Think of it this way — a massive capital gains tax bill means you’ve been a successful investor. Much better to have that than a capital loss to carry forward.

If it sounds too good to be true…

Listen to your inner voice — if it’s saying ‘this is too good to be true’ — take the advice. You may genuinely miss out on a ‘once-in-a-lifetime opportunity’, but from my experience, you’re more likely to have dodged a bullet.

Guaranteed rental return is one ‘too good to be true’ that comes to mind.

In reality, the property developer (while they remain solvent) ‘guarantees’ to give you back your capital as taxable income.

Another favourite is ‘proven system for growth’.

The Chinese government is the only group I know of that has a proven formula for growth — they pump vast sums of money into infrastructure spending and then pluck a growth figure out of thin air. Presto! Guaranteed growth.

Unless the corporation offering you the ‘proven system’ is backed by the Chinese government…forget about it.

Many years ago, I read about a promotion for a share trading program. The big print boldly claimed a ‘proven track record of 800% per annum growth’ over X years. Sounds impressive until you do some quick maths. If your initial investment were a mere $1, within five years of 800% p.a. growth, your portfolio would be greater than US GDP.

Nigerian scams, lotto wins in foreign countries, etc., continue to thrive because of people’s gullibility.

The prospect of a quick road to riches or instant wealth is tempting. The harsh reality is the ‘too-good-to-be-true’ offering is actually a salivating wolf in sheep’s clothing.

The magic of maths

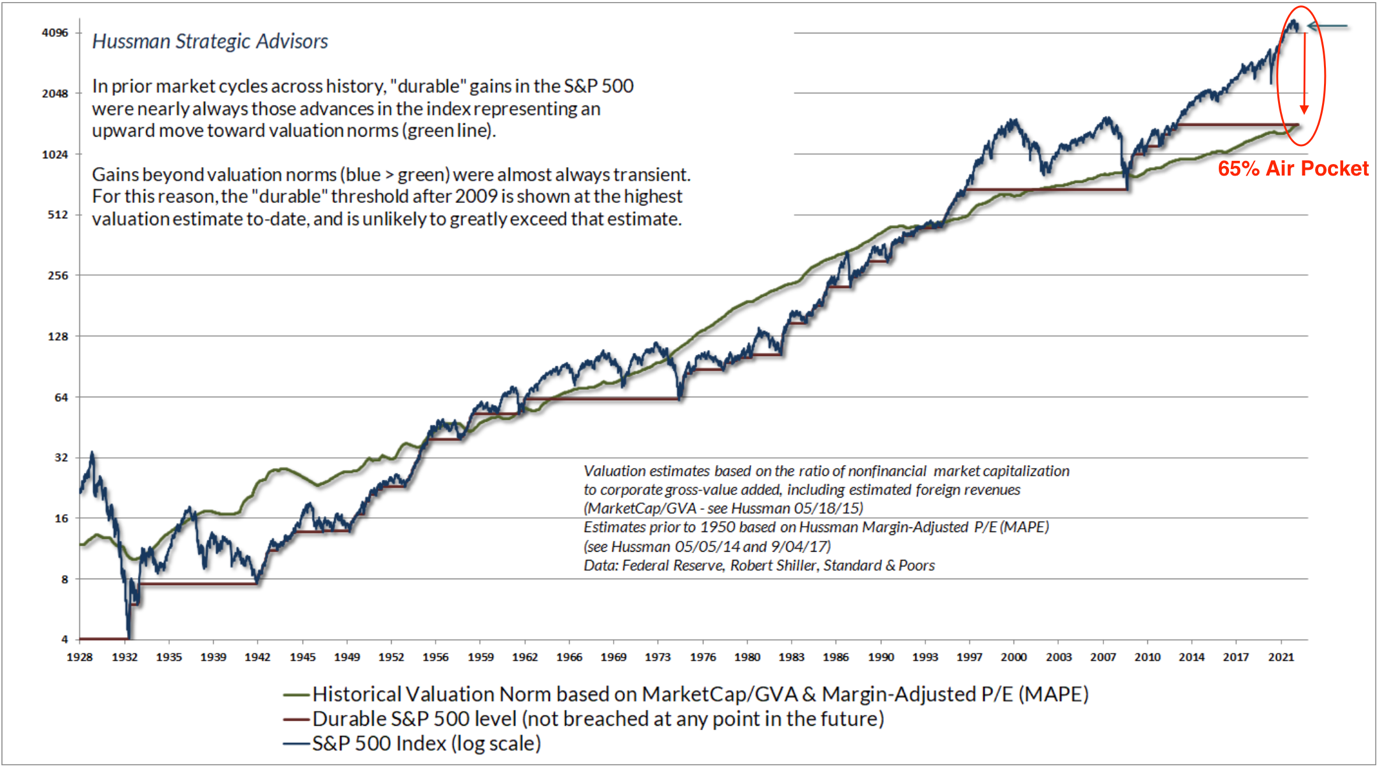

There’s an old saying, ‘Markets take the stairs up and the elevator down.’ If a market loses 50%, it needs to recover 100% for you to breakeven.

The 50% loss can happen in a blink of an eye.

Whereas the recovery process can take years.

Understanding your downside is far more critical than focusing on your potential gains.

The latest monthly issue of The Gowdie Letter included some calculations on the potential hit the US market is facing:

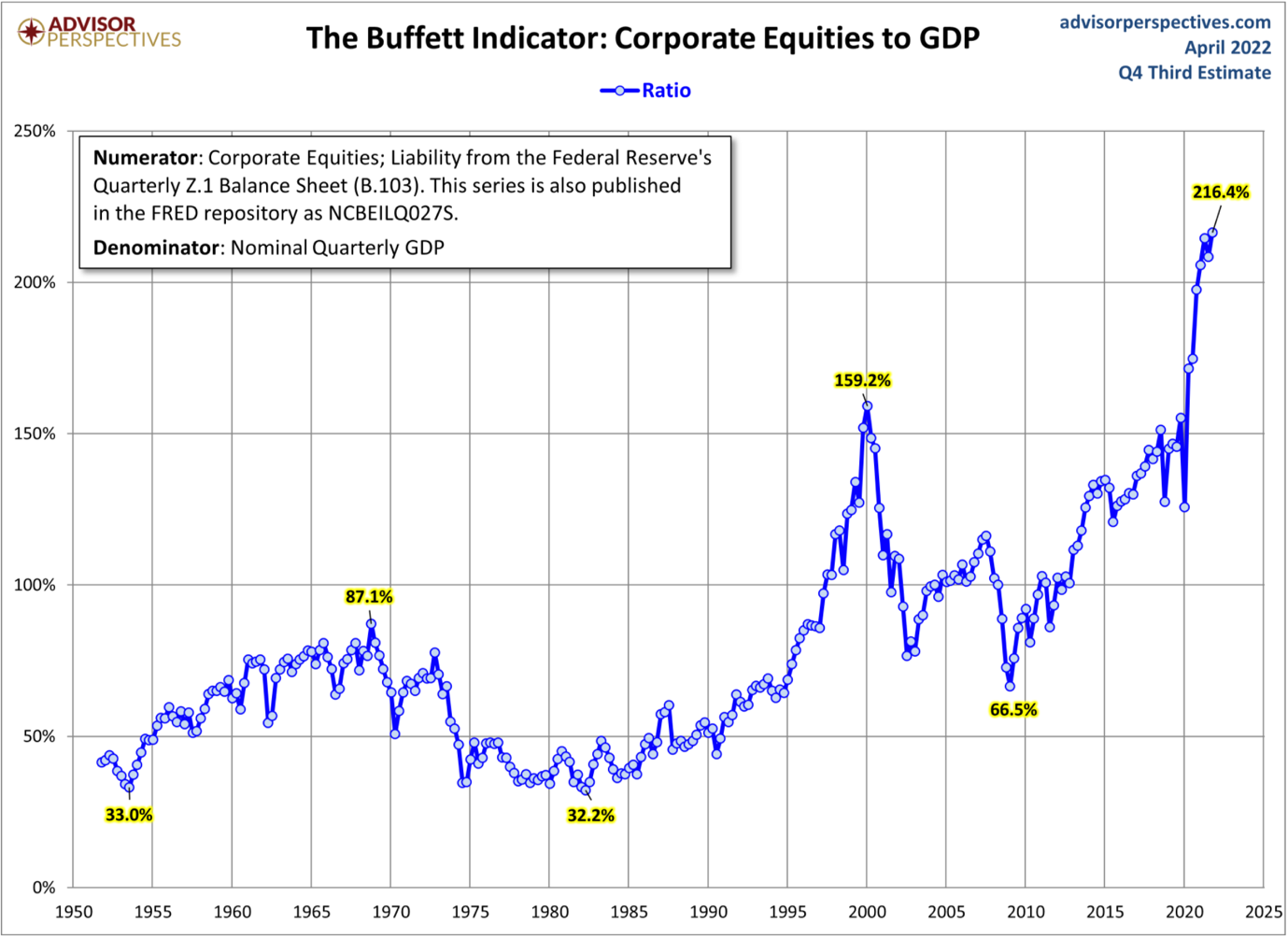

‘The Buffett Indicator is in a stratosphere all its own:

|

|

| Source: Advisor Perspectives |

‘How far down [could this market go]?

‘The components of this equation are…

‘US GDP = US$24 trillion

‘Mean of Buffet Indicator = 78%

‘Based on simple mean reversion, here’s the dollar amount of the market air-pocket we are about to hit:

|

|

‘The amount of capital that’s likely to be destroyed is US$33.2 trillion…64% of the current market cap value.

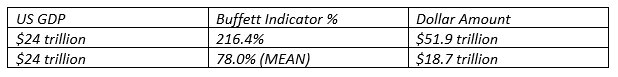

‘The most recent “Durable Gains” update from John Hussman, validates the Buffett Indicator reversion to the mean maths.

‘The latest level of durable gain on the S&P 500 Index is around 1,500 points…that’s 65% below the current level of 4,100 points.

|

|

| Source: Hussman Strategic Advisors |

‘Understanding maths is one way of avoiding spatial disorientation in investment markets.’

Should the US market ‘mean revert’ to a 65% loss, the gain required to make an investor’s dollar whole again is 186%:

|

|

| Source: Shurwest |

If, over the long term, market growth averages 6% per annum, it’s going to take more than two decades to get back to breakeven.

Understanding the maths is absolutely critical to your ability to take calculated risks.

Summary

In a boom, investors (inexperienced and experienced alike) ‘hang on tight and enjoy the ride’. Everyone is happy. Rarely is the sustainability of the boom questioned. Don’t jinx the market. Enjoy it.

However, we know from history, the party always ends.

In my experience, investors are not mentally prepared for the bust…especially one that wipes 65%-plus off market values.

There’s rarely a Plan B.

No one told you this could happen, which explains why the default position is panic followed by fear…and plenty of it.

My Plan A is also my Plan B.

My strategy is firmly focused on understanding the downside…what can go wrong, and if it does, what is the likely cost? Is this an acceptable or unacceptable cost? If these factors have been accurately assessed, you can make a reasoned decision on where to allocate your capital, and the upside can take care of itself.

Knowing your tolerance for loss is far more important than dreaming about the riches that await you.

Personally, my tolerance for loss is around 10–20% of our total portfolio, any more than that would make me uneasy.

The following chart of the S&P 500 Index clearly shows the prospect of a significant fall from current levels isn’t without precedent.

What’s your Plan B for a fall from this height? If you don’t have one, seriously consider reducing your market exposure to a level that can handle the next (and possibly most severe) downward leg in this secular bear market.

The rise and fall wave pattern in the S&P 500 are clearly evident in this next chart. The current wave appears to have crested…do you have the stomach for the potential plunge ahead?

|

|

| Source: Macrotrends |

If not, then you may want to consider hopping in a life raft before this happens.

My investment strategy these days is best summed as ‘Winning by not Losing’.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia