I saw this in the Australian Financial Review this morning:

‘International investors are piling into Australian-listed commodity stocks at the fastest pace in years, according to UBS, as they chase strong returns from the ASX’s booming materials sector and protection from inflation.’

You betcha!

I can see this playing out in the market every day. My goodness…the lithium boom just keeps rolling on.

And no wonder. The current high price of oil is making the EV alternative look fantastic.

That’s both economically and politically because oil use naturally subsides Russia and Saudi Arabia — two countries currently waging devasting wars in Ukraine and Yemen.

Clearly, Putin is, unintentionally, turbocharging the West’s drive away from fossil fuels.

But electric vehicles need a whole lot more than lithium. There’s a suite of metals each battery and car require. As above, that’s another reason international investors are chasing the gains on offer here.

Recently, our small-cap team put together a report on the opportunity here…and few come bigger. Make sure you check it out here!

Now, over to Vern for his take on today’s markets…

All the best,

|

Callum Newman,

Editor, The Daily Reckoning Australia

***

Dear {% if user.firstname == blank %}Reader{% else %}{{user.firstname}}{% endif %},

War. Food shortages. Shanghai in lockdown. Commodity prices rising. Interest rates being dialled up.

None of this seems to matter. Since its early 2022 sell-off, Wall Street has stabilised.

The Fed still presents an outward appearance of having matters under control.

Don’t be fooled by these fools. They’re beyond incompetent.

In opting for the easy growth option…suppressing rates for way too long to encourage an already overleveraged system to leverage up even more…these economic buffoons will make us reap what they’ve sowed.

And the harvest is going to be anything but bountiful.

If the Fed tries to play catch-up on runaway inflation by dialling up rates, the debt servicing pain in household, corporate, and semi-government will be excruciating. Defaults are sure to follow…the weak hands fold first, but it won’t stop there.

If the Fed doesn’t act on the higher-than-desired inflationary conditions, we have stagflation…high inflation and slow growth.

While it may not seem like it now, the good times are well and truly over.

Are we entering a 1930s (deflationary) or 1970s (inflationary) environment? I don’t know. It could be a bit of both…deflationary shock from a massive collapse on Wall Street followed by an inflationary surge from a panicked money-printing Fed.

What I do know is that now is the time to get your house in order…the decade ahead is going to be nothing like the one we’ve been through.

Over the next three weeks, I’d like to share what I’ve learned from 36 years in this business.

My prudent approach to managing finances was far from fashionable during the greatest speculative boom in history. With hindsight, we know that period was a time when caution should have been thrown to the wind.

Now is the time when caution should be treasured…not tossed.

Lessons learnt from 36 years in financial planning

The past four decades have been an exciting time to be involved in investment markets.

From its humble beginnings in the early 1980s, the investment industry has evolved into a multi-multibillion-dollar industry.

This phenomenal growth has not been without its fair share of heartache and setbacks. Each market downturn and product failure provided valuable learning experiences.

There have been many drivers contributing to the industry growth — compulsory superannuation, massive credit expansion, baby boomers moving towards retirement — but in my mind, the industry’s success was largely underwritten by the US share market’s 35-fold increase in value.

This history-making performance supported the industry’s narrative ‘In the long run, shares always go up’. Investors and industry players had little reason to doubt the legitimacy of this storyline.

While the market went from high to high, interest rates were falling from 18% to zero. Without these dynamics at play, it’s my contention the investment industry would not have prospered to the extent it has.

The bursting of this massive credit bubble will give rise to a new set of dynamics. Ones that I suspect — in time — will see social mood switch from overly optimistic to extremely pessimistic.

The global economy is undergoing structural transformation…the end of globalisation is a huge game-changer. In due course, the bubble economy is going to deflate in almost every corner of the world.

Based on the established principle of ‘For every action, there is a reaction’, the next decade (or possibly two) is unlikely to be as friendly to share investors.

The tailwind of credit injection now becomes the headwind of credit rejection.

So after 36 years in the investment industry, what have I learned to prepare me for the difficult market conditions that appear destined to confront us?

Humility

Being respectful is an important quality of life. Pride and arrogance often lead to spectacular falls, as demonstrated by the long list of failed entrepreneurs.

The world’s central bankers would do well to exercise a little humility. The hubris on display from the Fed chairpersons past and present has been particularly galling.

Consider this extract from the CBS 60 Minutes interview with former Fed Chair Ben Bernanke, conducted 5 December 2010:

60 MINUTES: ‘Can you act quickly enough to prevent inflation from getting out of control?’

BERNANKE: ‘We could raise interest rates in 15 minutes if we have to. So, there really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation, at the appropriate time. Now, that time is not now.’

60 MINUTES: ‘You have what degree of confidence in your ability to control this?’

BERNANKE: ‘One hundred percent.’

100% confidence in his ability to control the economy — what conceit.

This is the same Ben Bernanke who told us in March 2007:

‘…the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.’

And, two months before Fannie Mae and Freddie Mac collapsed and were nationalised, Bernanke said:

‘They will make it through the storm.’

Janet Yellen and Jerome Powell have proven to be just as clueless as Bernanke.

Bubble? What bubble?

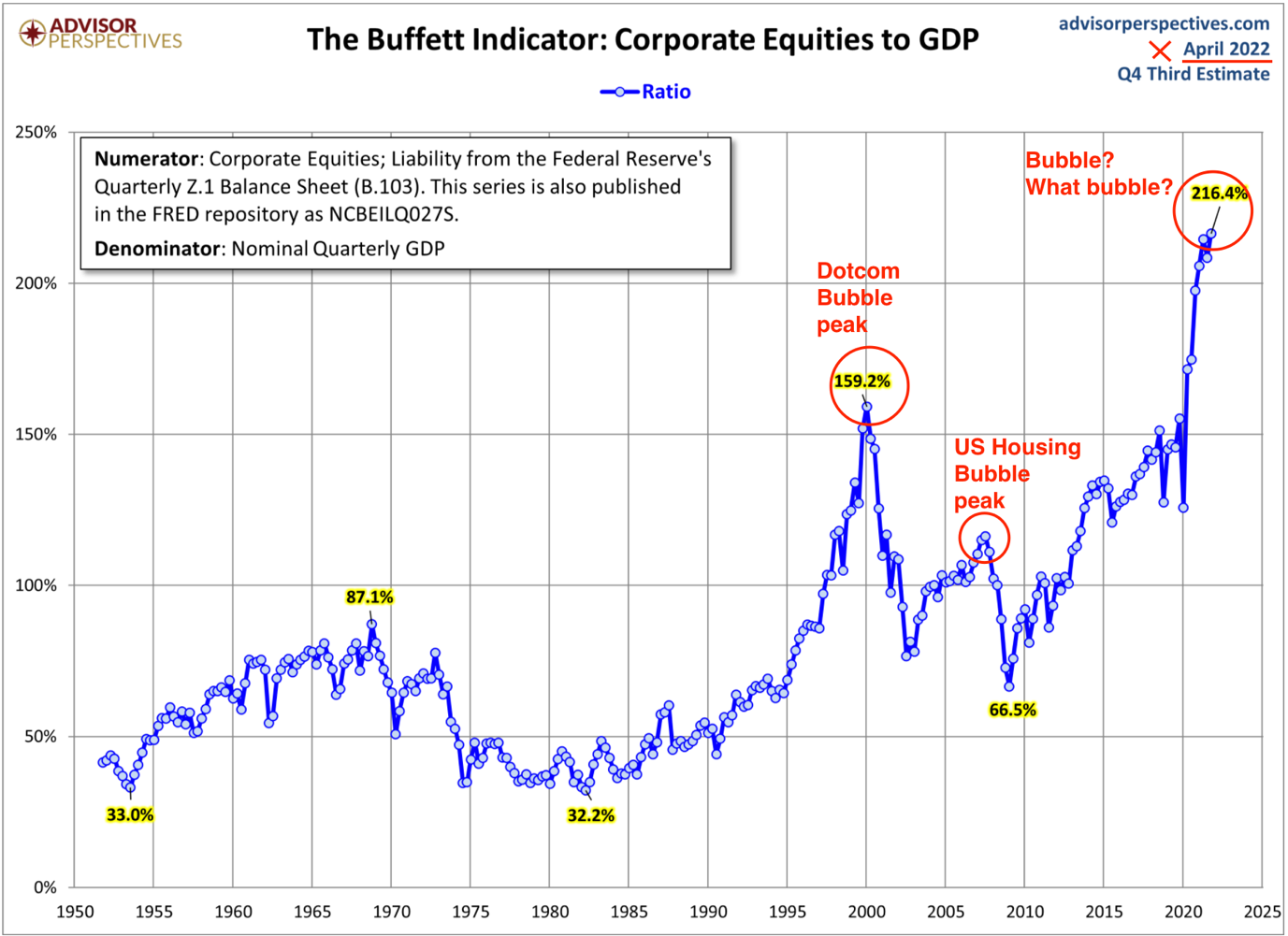

The latest Buffett Indicator (named after Warren Buffett, who called it ‘probably the best single measure of where valuations stand at any given moment’), is in a valuation stratosphere all on its own:

| |

| Source: Advisor Perspectives |

I lack the academic pedigree of the Fed’s FOUR HUNDRED PhD economists, but the school of hard knocks has taught me to respect markets. My cautious outlook and simple approach on portfolio construction is borne from being taught very painful lessons from markets.

When this bubble does burst, the Fed is going to suffer irreparable reputational damage…of that I am certain.

However, for investors who mistakenly believed the Fed has the power to control market forces, their damage will be…financial.

When it comes to protecting your hard-earned capital, a little humility goes a very long way.

There are no new ways to go broke — it is always too much debt

‘Panics do not destroy capital; they merely reveal the extent to which it has been destroyed by its betrayal into hopelessly unproductive works.’

John Mills, On Credit Cycles and the

Origin of Commercial Panics, 1867

155 years ago, John Mills recognised the folly of man, money, and mania. Nothing has changed. Debt is the common denominator in all financial disasters.

Those who live by the creed ‘You have to bet big, to get big’ can be lucky…but they’re in the minority.

The majority end up wrecked on the rocks of financial reality.

Hyman Minsky said, ‘Stability breeds instability.’

The longer a trend is established, the greater the certainty in the investors’ minds it is going to continue…forever.

This is a repeatable pattern.

I witnessed it firsthand during the last speculative boom.

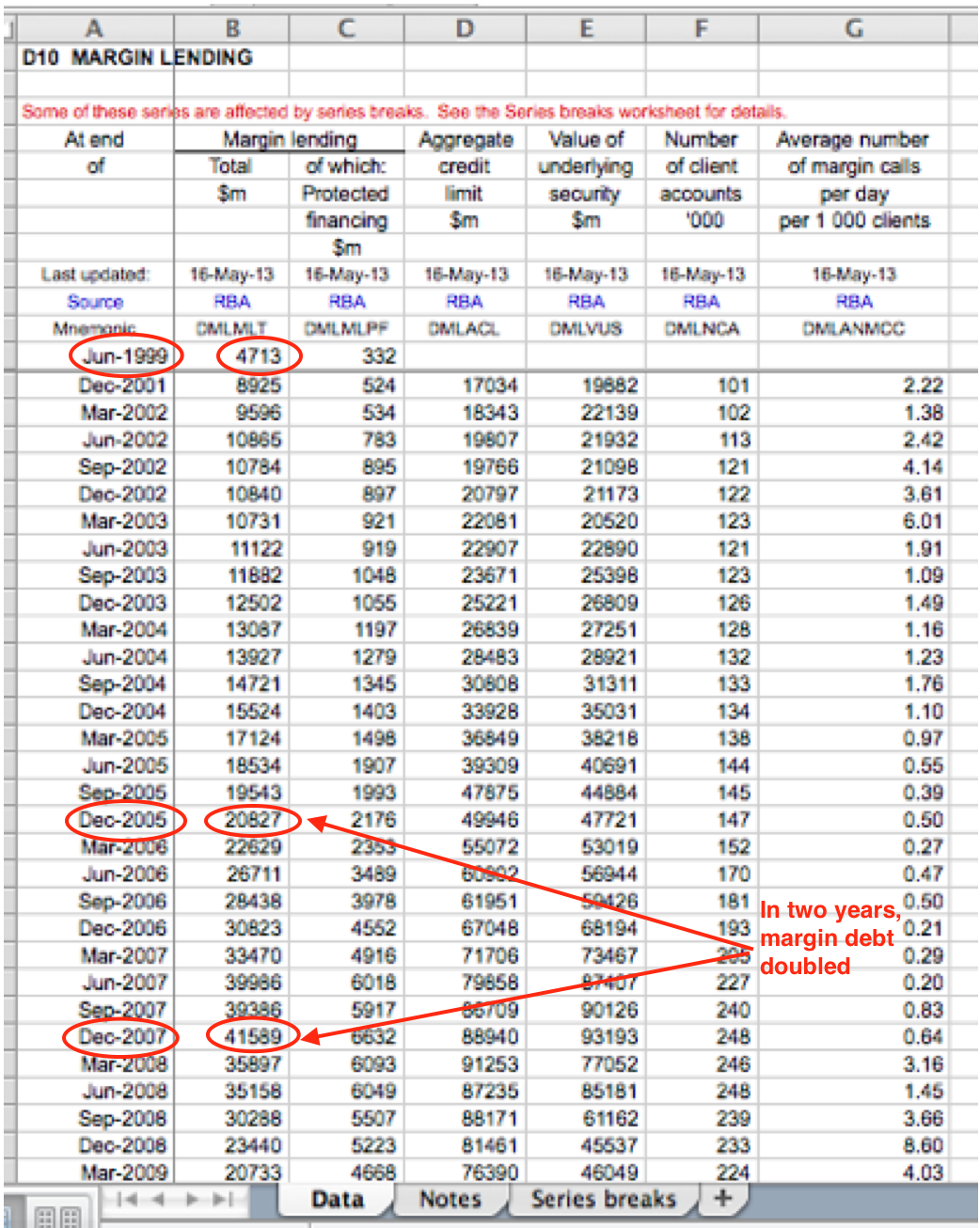

The following spreadsheet from the Reserve Bank of Australia (RBA) website shows the volume of Margin Lending from June 1999 to March 2009.

In June 1999, total margin lending stood at $4.713 billion. Fast-forward to December 2007 (the peak of the Australian share market), and total margin lending had increased to a mammoth $41.589 billion — nearly a ninefold increase in the decade.

The quarterly data provides a fascinating insight into the greed mentality that gripped investors during the 2003–07 bull market. Four straight years of 20%-plus returns per annum bred complacency.

The longer the boom continued, the more investors borrowed to participate in what they (incorrectly) perceived as a perpetual growth machine:

| |

| Source: RBA |

The Storm Financial debacle should be a warning on how badly this ill-conceived ‘borrowing to invest’ strategy ended.

Belief in the myth of perpetual growth cost many Storm Financial clients their life savings and their homes…and they were at a stage in life when they could ill afford losses of this magnitude.

Be prudent.

If you have debt, make sure you’re able to weather a sustained period of negativity.

My preferred creed is ‘Slow and steady wins the race’.

The best luck is bad luck

Success without bad luck is a disaster waiting to happen. Bad luck and misfortune teach you to appreciate the good times. Success without setbacks is conditioning you for a Minsky moment — your continual success will inevitably breed your failure.

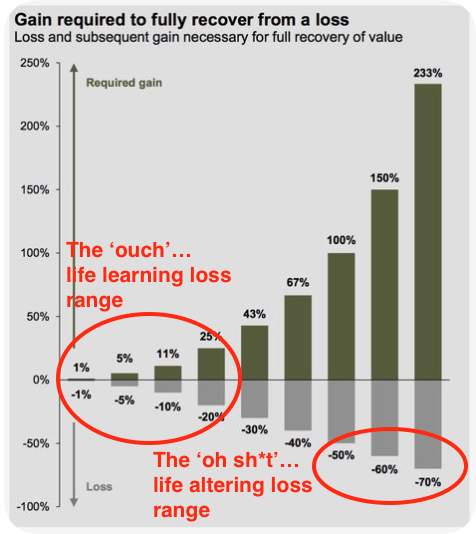

You’re not an investor unless you’ve lost money. The secret is to avoid the ‘Oh sh*t…life-altering loss range’, like those invested with Storm Financial.

These ‘ouch’ moments (should) teach you the respect I mentioned above — sometimes we (mainly males) need more than one lesson.

| |

| Source: Pinterest |

Don’t beat yourself up over your loses, look at them as ‘school fees’.

Looking back at my ‘bad luck’ experiences, I recognise they resulted from not really understanding the investment, acting on impulse and/or greed.

Thanks to the lessons learnt, these days my approach to investing is much more disciplined and very simple.

Never bet the house. Be emotionally equipped to handle downside. Never be afraid to take profits.

The adage of ‘The harder I work, the luckier I become’ is so true…you have to work hard on creating and retaining long-term wealth.

We are fast approaching a time when the work you’ve put into understanding why this period of speculative mania cannot continue will reap you substantial dividends.

Until next week…

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia