On Monday, I came across an interesting article on the Australian Financial Review titled ‘ASX gold stocks: Gold may have doubled, but miners remain a gamble’.

That piqued my interest. I decided to check out what they had to say. I wasn’t expecting them to hold buying gold stocks in high regard. Nor did I expect much useful advice on how to profit in this space.

Briefly, the article covered how gold has done well this year, how market interest soared including people queuing up to buy bullion, and how investors are eying gold stocks to profit off the fortunes of this precious metal. It proceeded to explain how gold stocks aren’t stable investments like gold, and that their prices usually don’t follow gold’s movements.

So far so good. I’d say the same thing too. Investors who think buying gold stocks to potentially outperform gold’s returns will learn the hard way that it’s not as easy as it sounds.

But then the article went down the wrong track. It presented a case that gold stocks weren’t as good as they sound based on their performance over the past ten years. Having studied 172 gold mining companies on the ASX in 2015, analysts in this news outlet found that only 100 are still trading. They found that the average annual return of these companies was 3%. 40% of the sampled companies delivered a negative return during this period.

The general mood of this article was to point out how gold stocks are inherently risky and their overall returns are disappointing. They did present the top performers over the period. But I felt that those who read the article might conclude that it’s best to buy only the largest companies. Or to steer clear from the space altogether.

But I believe the article failed to capture what’s important. We’re deep in the bull market and there remains significant opportunity to capitalise on what is left of this bull market. They’re telling you why it’s not a good idea to buy gold stocks, when the best potential for returns might well be in these! So they are stopping you from winning. The key to doing that is a good game plan. You’re not going to find that from them because they don’t have it!

Want to know more? Read on!

Just 3% p.a. returns over

10 years? Not quite!

Let me start by addressing a key claim in the article that gold stocks delivered only 3% annual returns on average over the past decade. They studied the returns of 172 companies ranging from large producers to tiny explorers, and those in between.

The premise of their analysis is flawed. You can’t put producers with mature operations with tiny explorers where the company owns land and have a field team surveying the ground for signs of mineralisation. Producers are leveraged to the price of gold. Explorers revalue through discoveries and acquiring valuable deposits, so they’re not going to move much with gold and silver prices.

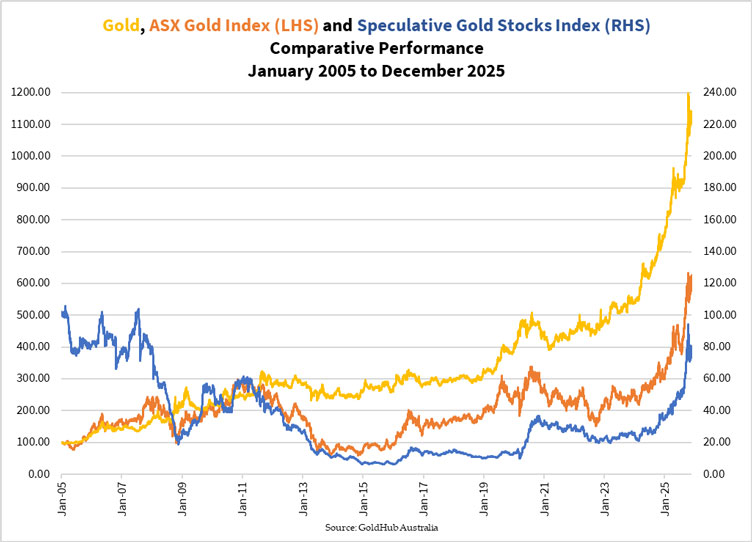

I’ve compared the performance between gold, established gold producers, and explorers by using the ASX Gold Index [ASX:XGD] and my own in-house Speculative Gold Stocks Index to track the performance of the various types of gold stocks. Here’s how they performed over the past 20 years:

Source: GoldHub Australia

This leads me to my second point. Notice how established gold producers have increased over time. They slumped sharply during the bear markets when gold’s out of favour but they recover with gold’s trend.

Meanwhile, explorers and developers fell for a significant part of the two decades. The most recent bull market propelling some from their sharp losses to nearly breakeven. The movement in the last few months came about because the speculators started buying into this space.

Merely lumping all gold stocks together will cause you to conclude that they’re not attractive investments. Their long-term returns don’t justify the risk.

But that’s not true. Investors are more likely to enjoy better returns investing in producers than the earlier stage explorers.

Looking at the ASX Gold Index from early 2015 till now, that’s increased by over 600%. It’s clearly far more than the 3% p.a. average returns claimed in the article. Even the Speculative Gold Stocks Index increased significantly over the same period, although many companies that still exist are trading at well below the price over the last decade!

Beyond buy-and-hold:

Ways to maximise gains

The next point is that gold is cyclical, meaning gold stocks aren’t good buy-and-hold investments. Even the larger producers, such as Northern Star Resources [ASX:NST], Evolution Mining [ASX:EVN], Perseus Mining [ASX:PRU], and Regis Resources [ASX:RRL], all slumped during the bear markets in 2012-15 and recently in 2022-23 as their operating margins declined with a falling gold price and a rising oil price. Even in good years, only a few producers pay dividends. Many prefer to reinvest their surpluses back into the ground or to acquire new mine properties.

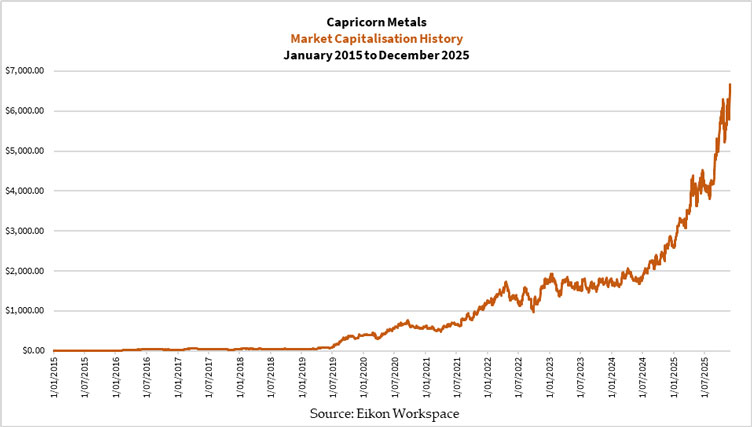

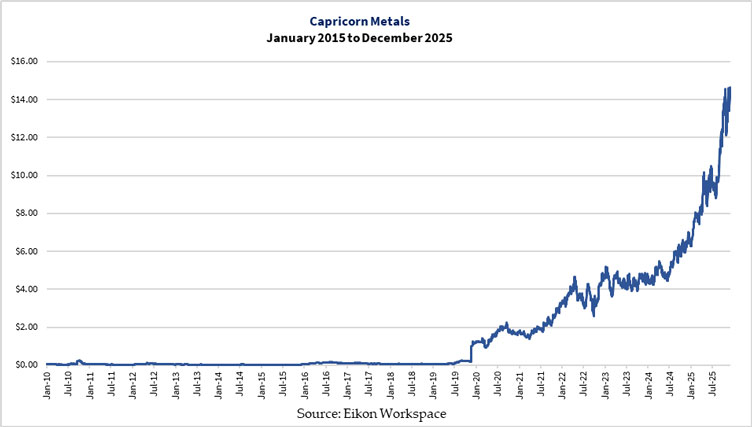

Smaller explorers and developers must create value by advancing their projects, expanding their portfolios, and bringing their mines into production Otherwise they risk diluting their shareholders to oblivion, become a takeover target, or go broke. However, several companies that are established producers now worth a several billion dollars were minnows worth less than $50 million in 2015. Capricorn Metals [ASX:CMM] (see chart below), Genesis Minerals [ASX:GMD], Greatland Resources [ASX:GGR], and West African Resources [ASX:WAF], for example.

Shareholders who bought back then and held on would’ve enjoyed quadruple digit percentage gains, perhaps even more.

In summary, successful gold stock investors do their homework to pick quality stocks to deliver outsized gains. They also pay attention to the different phases of the gold price cycle, increasing their exposure to undervalued companies while taking profits when investors are exuberant about them.

I hope that you can see that there’s more to investing in gold stocks than what mainstream media analysts and fund managers tell you. Sure, it’s not like investing in blue-chip companies where you enjoy dividends and steady growth over time. However, they can be even more rewarding once you grasp the dynamics of this market.

If you want guidance in riding the gold price cycle and finding the right stocks to buy, I invite you to sign up for my precious metals newsletter, The Australian Gold Report.

Over the past four years, my readers enjoyed triple digit percentage gains with producers such as Pantoro Gold [ASX:PNR], Ramelius Resources [ASX:RMS], Regis Resources [ASX:RRL], West African Resources [ASX:WAF], and more.

I also saw the potential for substantial profits in Adriatic Metals (April 2022), Barton Gold Holdings [ASX:BGD] (February 2022), and Genesis Minerals [ASX:GMD] (March 2022) well before they rose several-fold.

Gold still has room to run higher, but what’s more important is having the right mindset to play the long game and reap significant rewards in the coming decades.

God Bless,

Brian Chu,

Gold Stock Pro and The Australian Gold Report

Comments