Last week, I wrote about how the world is changing so fast it’s hard to keep up.

For investors, this is a double-edged sword.

It provides bigger risks, bigger opportunities, and more uncertainty than ever before.

And in my opinion, the risks of staying on the sidelines are bigger than most people realise.

Last week, I talked about how dangerous ‘safe and boring’ investments actually are.

People are blind to a number of hidden risks including but not limited to the risk of exponential change.

This means the pain of any losses is magnified as they weren’t expected.

Surprisingly (to me anyway), this idea — that investors underestimate the effect of rapid change on their investing models — isn’t a popular view in my industry.

But the contrarian in me thinks this probably means it has more chance of being right!

Anyway, today, I want to continue on that theme.

Specifically, I’ll look at some amazing examples of the speed at which change can occur.

And if things do indeed get worse before they get better, that’ll be your golden opportunity to strike.

It’s happened before…

Tough times make strong companies

Yes, I know it’s cherry-picking the winner, and maybe it’s an overused cliché too…

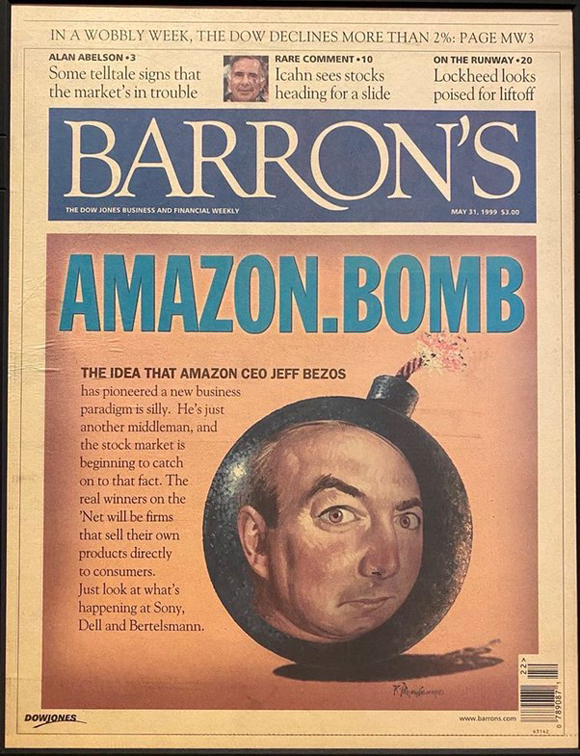

But the rise of Amazon.com Inc [NASDAQ:AMZN] to one of the most valuable companies in the world really is something you need to keep in the back of your mind.

Amazon famously fell by 86% in the dotcom bloodbath of the year 2000.

Prompting negative stories like this:

| |

| Source: Barron’s |

Here’s what happened after:

| |

| Source: Companiesmarketcap.com |

You’d be sitting on 200 times your investment right now if you’d bought in back in 2001. And almost 400 times your money at the peak.

The point is stock prices follow paradigm shifts, not the other way around.

Sometimes stocks rise too fast in a boom. And sometimes they fall too far in a bust.

But in the end, the trend wins out…

Three examples of how fast things change

As I said at the start, the amazing thing nowadays is just how fast thing change.

And in all areas of life.

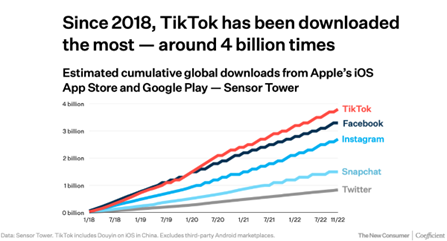

Consider this amazing chart:

| |

| Source: The New Consumer |

In just four years, TikTok — an app where people share short video clips of themselves dancing, singing, or doing various other things to try and entertain others — has been downloaded four billion times.

That’s half the world’s population!

The app has a very strong hold on its mostly younger audience, with users spending an average of 100 minutes a day on it.

There are a few lessons here…

Finding and investing in fast-moving consumer trends remains a highly lucrative space.

Established entertainment models like network TV, cable, and even other social media like Facebook and Twitter now face stiff competition.

Next…

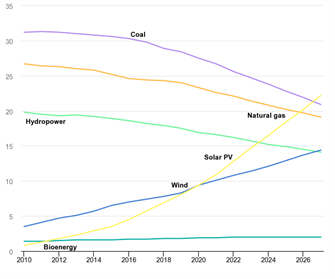

How about this chart?

| |

| Source: IEA |

Check out the yellow line.

It shows that solar tech is set to surpass coal and natural gas cumulative power capacity share by 2027.

It’s a stunning rise.

The lesson?

Like it or not, energy markets are evolving fast.

This means there are big opportunities in key materials like rare earths and potentially new ideas like hydrogen set to emerge.

One area specific to solar is the niche mining space of silica sands.

High-purity silica sands are needed to make solar panels. And a lot of the current supply used in Asia comes from rivers where environmental concerns are increasingly restricting mining.

Australia has a few interesting small-cap miners specialising in this space.

Lastly…

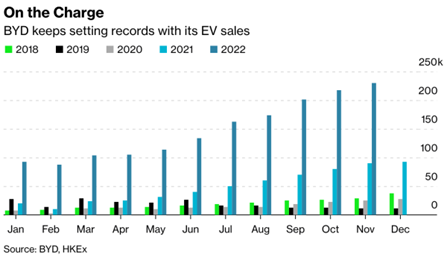

This chart shows sales of electric cars from Chinese auto manufacturer BYD.

| |

| Source: Bloomberg |

As you can see, 2022 has been a year of stunning growth in sales for the company. If it continues, they’ll surpass Tesla by early next year.

The rise of EVs has already minted fortunes for some early investors.

Especially in the lithium space.

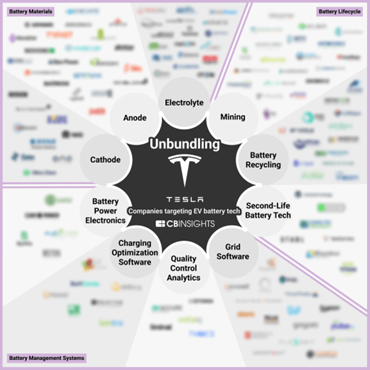

But there are other areas to explore in this industry, as this chart shows:

| |

| Source: CB Insights |

You can download a free report here if you’re interested in exploring the various different areas in depth.

But the broader lesson is that big trends don’t just grow vertically.

They also grow horizontally.

Meaning some of the best investment opportunities come from areas driven by the primary trend, but maybe not directly.

Not to talk my own book here, but in our Exponential Stock Investor service, we tipped a stock called Neometals [ASX:NMT] back in February 2020 (during the COVID panic falls, funnily enough) at 21 cents.

It was a small stock that had multiple early-stage projects related to the growth of EVs.

They had a lithium battery recycling plant, a lithium refinery project, and a potential nickel mine all on the go.

Anyway, the stock has ridden the EV boom and is up 361% in just over two years.

My point is…

No matter what comes

Things might or might not get rocky over the next few months.

But if they do, that’s not the time to throw the towel in.

There’s a popular view from the perma-doomsayers that recent falls in tech stocks are the return of ‘normality’.

And that the stock price rises of the past decade were nothing more than a mirage.

The ‘everything bubble’ will come crashing down to nothing, they confidently tell us.

But they’re wrong…or at least not as right as they think.

While certain industries and companies have had their values juiced up by irresponsible central bank policies, the truth, as always, lies somewhere in the middle.

Innovation and technological advances continue to occur at a breakneck pace. And this pace of change is only accelerating.

I mean, we live in a world where a phone app can go from zero users to overtaking Facebook downloads in just four years!

My firm conviction remains…

Whether it’s a bull or bear market, the best opportunities for you lie in investing in that change.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.