Oh man, I’m pumped!

In more than 10 years as an analyst, I don’t think I have ever seen so many opportunities to allocate capital into shares with big upside and low downside risk.

Yes, I know. Likely, your portfolio has taken a battering since 2022. Your super fund balance is probably down from 2021. It’s been a tough 12–18 months.

But so much bad news has been hammered into the share market now it would take a second Great Recession to clobber many down even further.

And, to me, things are looking up!

Inflation is cooling. Rate rises are off the table, as far as the market is concerned.

Many of the sectors hit in 2022 — tech stocks, property, bonds, and Bitcoin [BTC] — are reversing.

Why?

Global liquidity is now growing again.

See this investment manager writing in the Australian Financial Review today:

‘The stresses and failures in the US regional banks sector are clearly an unintended consequence of Fed tightening. The central bank lifted rates until it broke something, and the regional banking system was one of the things I’d have really preferred them not to break.

‘Dysfunction in credit markets has historically been a key ingredient in broader dislocations and all data now shows that we are in the middle of a severe credit crunch in the US. This will result in a recession in short order.

‘As usual, the Fed has responded by flooding the system with massive liquidity, unfortunately with uncertain effectiveness. The Fed claims this is an idiosyncratic issue and that it still plans to tighten rates further, but the market knows the game is over, and the Fed will be cutting rates aggressively this year and next.’

I’m not so sure that a US recession is baked in. But I do think money is going to wash over the world’s asset markets.

Not only is the Fed bailing out the US banking system, but the Chinese authorities are also reflating their economy. Credit growth is growing.

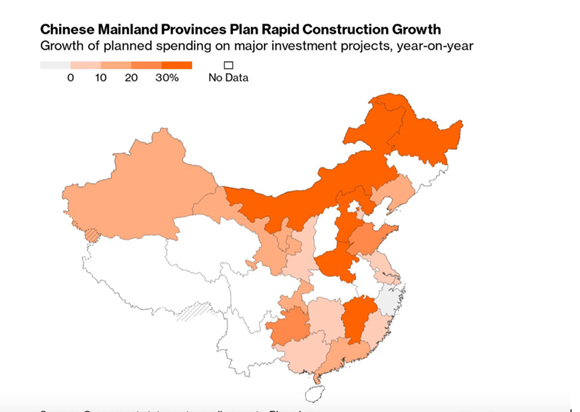

And they have the plans in place to do what they usually do:

|

|

| Source: Bloomberg |

This is fascinating in the context of the iron ore market. It could rally higher against all previous expectations.

I must admit I was ready to buy non-WA iron ore stocks in a big way when I saw that big cyclone mustering over Port Hedland last week.

Who knows what might have happened to the price if any — or all — of the big three had their shipments or infrastructure disrupted or damaged.

That threat seems to have passed. But it’s highly probable Chinese stimulus takes iron ore up from here over the next quarter.

One wonders how high it might go. Now, of course, I could be misreading things here. However, the share market is all about risk and reward.

Considering how bearish everyone has become about the world economy, it only takes the news to be ‘less bad’ to get a rally.

And if things really start improving? We could be off to the races!

Now, this is where the housing market could be important. Clearance rates are lifting strongly. See this from the Australian Financial Review:

‘Auction clearance rates have jumped, hitting 72 per cent in Sydney, as listings doubled nationwide, with buyers taking heart from a pause in rate increases and signs the market has bottomed in the biggest markets.’

Here’s a very important point also cited in the same publication from ASX strategist Hasan Tevfik:

‘The strategist notes that during the past two tightening cycles, the end of the RBA’s rate rises preceded the bottoming of housing finance by around three to six months. Tevfik expects similar timing this cycle too.

‘Given the trough in housing finance typically coincides with the end of declining house prices, MST has declared it is no longer bearish on the Australian housing market.’

Personally, I’m keeping a sharp eye on finance related stocks here. The market will move on these long before it becomes apparent in the data.

All in all, the above is just a taste of why I’m excited for the market this year.

My latest issue for my small-cap advisory Australian Small-Cap Investigator contains a whole lot more…and two stocks I expect to roar as the bull market gets going.

I also put down five ideas in a special ‘bargain report’, available by clicking here.

One of them is already beginning to really lift now. The other four, in my view, won’t be far behind.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia