In today’s Money Morning…‘virtually unknown’ company tacks on 667%…GameStonk rally was pure, but there are plenty of sharks in Oz…how things have changed…and more…

A few days ago, a friend who is into the r/wallstreetbets cultural phenomenon sent me an absurd video.

It was a mashup of various regulators saying day traders were clueless, with GameStop Corporation [NYSE:GME] chart livestreams, images of rocket ships, a Fight Club snippet intro, and of course, lots of primates doing silly things.

All with near constant trap horns in the background.

Truly ridiculous stuff.

But there’s an underlying message here about the huge divide between institutional investors and retail investors.

As well as what you can do for yourself as an individual retail investor.

One commentator in the video who was trying to describe the GME phenomenon called it, ‘Art of War mastery by a bunch of idiots.’

As someone who first read Art of War by Sun Tzu around the age of 10 in my father’s university office, I get it.

Sun Tzu once said, ‘To know your enemy, you must become your enemy.’

And I think what is happening with the Reddit crowd is something similar.

They’ve in essence become their own rogue hedge fund that blows up the short positions of their enemy, whether that’s Melvin Capital or their buddies at Citadel.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Which brings me to how this relates to Aussie investors at the moment.

‘Virtually unknown’ company tacks on 667%

The occasionally insightful, usually boilerplate Australian Financial Review covered it in this way:

‘There’s evidence the Reddit-fuelled retail trading frenzy time-stamped by GameStop on Wall Street is accelerating in Australia as wild price moves in penny stocks and small caps spike in regularity.

‘Data out of Australia’s leading retail broker Commsec last week showed a virtually unknown Alaskan oil explorer named 88 Energy was the most traded stock on the entire ASX by contract note volume over the week ending March 29.

‘An emoji-powered social trading frenzy helped 88 Energy soar 667 per cent. The Australian Financial Review

‘In fact an emoji-powered social trading frenzy helped 88 Energy soar 667 per cent over the month of March, which included five operating updates, an ASX speeding ticket, and share placement to sophisticated investors.

‘In February its chief executive David Wall lit the rally’s fuse by boasting that 88 Energy was targeting more than 1 billion barrels of recoverable oil across its Alaskan tenements, with the Merlin-1 well results “potentially transformational for our shareholders.”’

Evidence, they say — like it’s some forensic investigation that requires experts to decipher the puzzle.

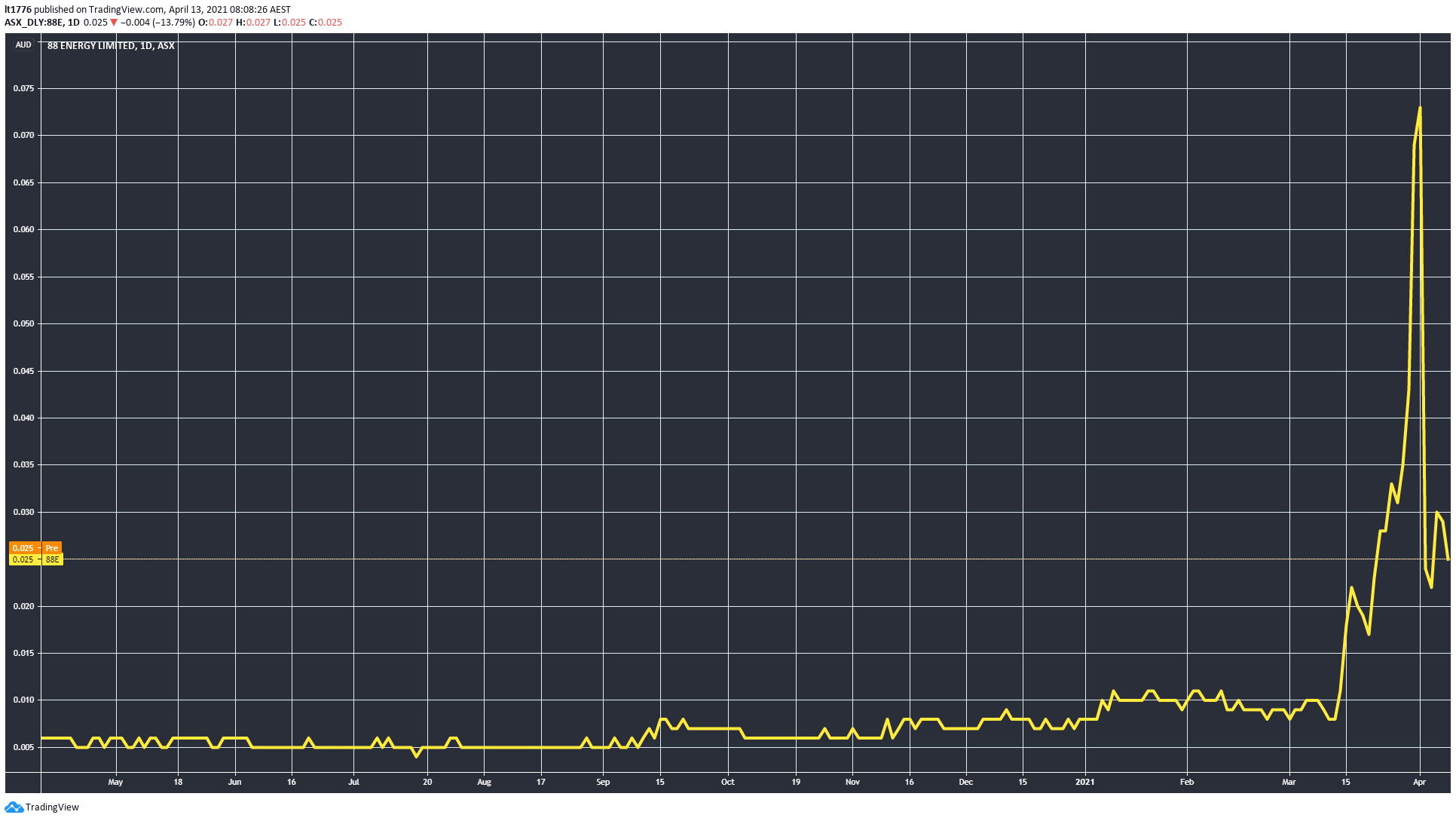

I’ve known about 88 Energy Ltd [ASX:88E] for years — it’s got a potentially massive project but faces a significant number of hurdles.

Meaning, it’s little surprise that the chart looks like this:

|

|

| Source: Tradingview.com |

This is actually a pretty common looking small-cap chart, just with the added intrigue of financial social media thrown into the mix.

Point is, this is nothing new.

The Australian Financial Review goes on to explain how Race Oncology Ltd [ASX:RAC] and Oneview Healthcare Plc [ASX:ONE] experienced similar things.

The culprits — a one Wombat777 and a string of alternative financial media outlets in Australia who will remain nameless.

Here’s the difference between what’s happening in Australia and what’s happening with GME though.

GameStonk rally was pure, but there are plenty of sharks in Oz

The GME phenomenon was a rebellion, one which was driven by a single phrase:

‘I LIKE THE STOCK’

With Australia though, the rallies in the three stocks profiled here, were in part fuelled by alternative financial media outlets more so than genuine grassroots motivations.

Not too long ago, I remember a host of lithium companies were consistently the most heavily shorted stocks on the ASX.

How things have changed.

The key takeaway from all this is a simple one — do your own research. That’s because much of the research out there, or at least easily accessible or search engine optimised research, is either paid for or analogous to advertising.

Know where the information is coming from.

If you believed in the lithium story during the 2018–19 doldrums/winter, you could’ve hung onto your shares or topped up despite the huge short positions.

And you’d be far happier now.

I was recently asked by an employee of our company — ‘Do you ever talk to the companies you recommend for Exponential Stock Investor?’

The short answer is — not at all.

The long answer is that it can cloud your judgement and give you a warped view of the potential of the company.

Every CEO or Managing Director is going to say they are the best thing since early Amazon shares.

Conference calls are largely a waste of time in my view too.

And I think you will actually do better consuming all the bits of data around a company when they aren’t fed to you on an advertising-funded silver platter.

The ASX is its own beast, and I think the GameStonk story isn’t playing out here in the same way.

That being said, I’m tempted to make the final words of our next recommendation ‘I LIKE THE STOCK’ purely out of homage to the fearless primates of r/wallstreetbets.

If they proved one thing at all, it’s that retail investors need to take matters into their own hands if they want to beat the institutions.

That doesn’t necessarily mean operating as some sort of hivemind either.

It means using your own reasoning capacities and sticking to your convictions where appropriate.

This is about thinking for yourself and being an individual.

That’s the message.

Regards,

|

Lachlann Tierney,

For Money Morning

P.S: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.

Comments