Galileo Mining [ASX:GAL] announced assays from recent drilling at the Callisto palladium-nickel discovery in Western Australia have revealed a new sulphide zone.

The newest find consists of the ‘widest drill intersection recorded to date’, with 72 metres of mineralisation and, according to Galileo’s Managing Director Brad Underwood, is ‘confirmation of our view that we have only just started to comprehend the full extent and potential of our Callisto discovery’.

Shareholders reacted with strong enthusiasm, boosting the GAL share price by more than 44% on Tuesday afternoon.

Shares were worth 78 cents at the time of writing, having been inflated 271% over the past 52 weeks, and taking the mining stock 285% above the S&P 200 average

Galileo’s sulphide zone discovery

Shares were soaring for Galileo after the group posted its latest discovery at the Callisto palladium-nickel project, part of the company’s 100% owned Norseman project in WA.

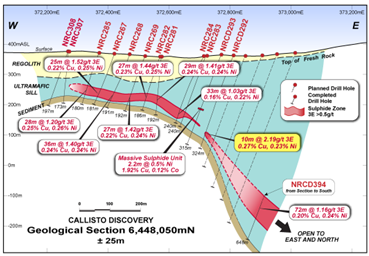

Galileo reports step out drilling has resulted in the manifestation of a ‘thick sulphide zone completely open to the north and east’, the group’s widest drill intersection recorded to date with 72 metres of mineralisation.

The new zone suggests Ni (nickel) discoveries of:

-

‘72 metres @ 1.16 g/t 3E1 (0.95 g/t Pd, 0.16 g/t Pt, 0.05 g/t Au), 0.20% Cu & 0.24% Ni from 498m (NRCD394) including higher grade interval of

-

‘39 metres @ 1.46 g/t 3E (1.19 g/t Pd, 0.20 g/t Pt, 0.06 g/t Au), 0.26% Cu & 0.28% Ni from 503m’

These results support Galileo’s initial geological interpretation that the five kilometres of untested strike length to the north of Callisto will come out with highly prospective results upon making further discoveries in the area.

Galileo said it has already begun with follow up drilling, with immediate drilling of the area facing NRCD394 to commence right after current step out drill hole NRDD420.

Galileo says that it is fully funded to go through with planned drilling programs with $20 million in cash and reports its cash backing puts it in a secure position during current market volatility, with no need to raise short-term capital.

Mr Brad Underwood commented:

‘To intercept 72 metres of sulphides from our northernmost drill line targeting the centre of the host intrusion is an extraordinary result and a highly encouraging sign for the potential discovery of more mineralisation along strike to the north. We have five kilometres of prospective rocks to the north of Callisto and, with $20 million in cash, we have the funding to thoroughly explore the area without needing to raise money in a difficult market.

‘Our geological interpretation indicates that there are multiple mineralised rock units in the area and that the source of these rocks may exist further to the north and east. We will be testing this concept over the coming months and are very excited to be exploring a newly discovered palladium-nickel district.’

Source: GAL

‘Drill Baby Drill’

Speaking of tenements, projects, and prospects…

Some industries are making raging bull market-like gains regardless of recession fears, interest rates and what the wider market does.

Compared to other industries, they’ve made some extreme gains, while most other stocks were battered last year.

This can be described as an alternate universe, the universe of booming drillers.

And guess what, more booms are marked to happen for every single metal that can be found on the period table.

It’s been described as a ‘new golden age’ for junior explorers who get in early.

Aussie mining is at its best right now, but who, where? If so many of them topped 2022, can they really do it again in 2023?

There are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

It’s a big universe, and you may need a little help — that’s where our commodities expert James Cooper comes in.

He’s found six ASX mining stocks that are heading to top the charts for 2023.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia