Lithium small-cap explorer Galan Lithium [ASX:GLN] saw shares for its stock surging more than 10% in the early afternoon on Wednesday, investors supporting it taking 100% of the Candelas Project in Catamarca, Argentina.

Taking full ownership of the project will mean all proceeds will go straight to Galan, a mine with a 25-year mine life and 14ktpa of battery grade lithium carbonate.

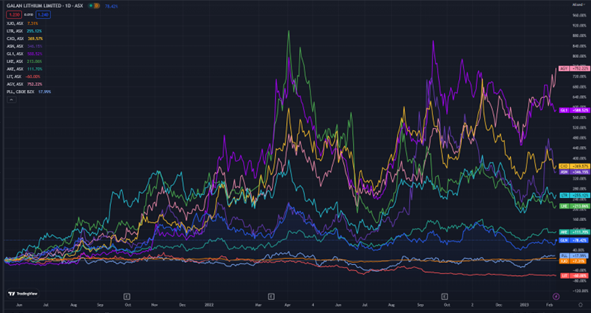

GLN’s share price was valued around $1.23 in the early afternoon trade, a 15% rise in share price for 2023 to date.

However, the lithium stock is still trading at a 24% deficit to the wider sector average.

Fellow lithium miners Argosy Minerals [ASX:AGY] and Global Lithium [ASX:GL1] have moved up 34% and 13% in the year, respectively, though they have improved 121% and 39% respectively in the past full year, whereas GLN has slumped 17%.

Source: Tradingview

Galan takes all of Candelas

The company’s Candelas Project has already had a full Preliminary Economic Assessment (PEA) back in November 2021, in which the company confirmed firm economic results such as unleveraged Pre-tax NPV (Net Present Value) of US$1.25 billion at an 8% discount rate, and IRR (Pre-Tax Internal Rate of Return) of 27.9% across a four-year payback period.

The company’s JORC 2012 Resource assay has already confirmed the project has a mine life prediction of 25 years to produce 14ktpa (thousand tonnes a year) of battery grade lithium carbonate (LCE) in that time.

Indicated mineral resources were also noted as 685kt LCE with 672mg/l of low impurity lithium.

Candelas is a promising mine with much potential in the years to come, hosted within a 15km by 3–4km-wide structurally controlled basin infilled with sediments that host the Li-bearing brines, and it is easily accessed with a reverse osmosis water source.

Galan’s Managing Director JP Vargas de la Vega commented:

‘The Candelas Project was our first project foray into Argentina and we now have final full ownership of the project. Over the journey, our focus has understandably been on Hombre Muerto West but once we complete the DFS and associated works and infrastructure projects we will move forward on Candelas. With our five years of lithium knowledge in the region, we will initially re-visit all our geological data and analysis. Don’t forget, Candelas is a stand-alone, lithium brine project in the Catamarca province, with no water access concerns, that shows robust economic returns.’

Financial gains and a strong outlook for GLN

Now that Galan has taken full ownership of Candelas, it can look forward to some preliminary economic milestones that involve US$188 million in an average annual EBITDA, with the project earning US$1.25 million in pre-tax net value.

With greater reward comes great responsibility, and so capital costs will also be fully footed by Galan as the sole owner, CapEx is to be expected around US$408 million, with average annual operating costs of US$4,277 a tonne.

Yet the lithium pioneer can still boast the complete ownership of a 14,000 tonnes-a-year lithium carbonate production site, something that has certainly excited investors and the shine of victory will remain.

Galan has decided to complete its Hombre Muerto West DFS before its geological team completes thorough and full review of Candelas’ data.

Australia’s next commodity boom is nearly here

Our resources expert and geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…a boom where Australia and its stocks stand to benefit.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out this interview with James and Greg at Ausbiz.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia