The FYI Resources Ltd [ASX:FYI] shares are down today as a potential joint venture agreement with Alcoa Australia gets pushed back.

FYI and Alcoa mutually decided to extend the decision date on their potential exclusivity agreement regarding a joint venture high-purity alumina (HPA) project.

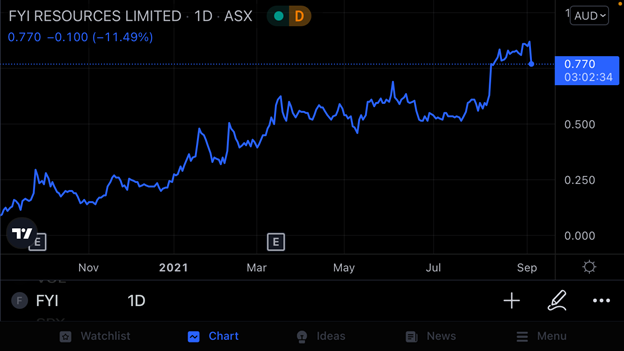

FYI shares are currently trading at 77 cents per share, a drop of 11.49% at time of writing.

Both companies agreed to give themselves more time to deliberate on a potential partnership and refine the term sheet.

Despite investors’ disappointment today, FYI shares still managed to gain 755% over the last 12 months.

Mutual extension of HPA joint venture

Late last year, FYI entered a memorandum of understanding with Alcoa of Australia regarding the commercial development of FYI’s high-purity alumina (HPA) project.

For reference, high-purity alumina is a processed premium non-metallurgical alumina product whose market price varies according to degree of purity.

HPA is resistant to corrosion and scratch, possesses high brightness, and can withstand extreme temperatures.

Predominantly used in the manufacture of light-emitting diodes (LEDs), HPA is also finding growing use in certain battery and power storage components.

Now, FYI and Alcoa entered a 90-day exclusive discussion period in May this year.

But this was extended another month when the 90-day period lapsed.

The primary reason was to continue to assess the content and potential of the project.

Well, today marks the second extension, to 5 October 2021.

While FYI said it formed a significant relationship with Alcoa, it wasn’t enough to come to an agreement on real terms and conditions.

The companies said they aim to further understand the potential development options and future opportunities presented by the HPA JV.

FYI has been working hard to develop a number of broader HPA ‘value-added initiatives’ that could enhance and strengthen the position of the JV in the market.

The primary reason for this mutual decision to extend the Exclusivity Agreement period to 5 October is to allow these additional HPA opportunities to be fully considered.

Managing Director of FYI Roland Hill commented on the situation:

‘Both companies have invested a considerable amount of time and resources to progress the JV discussions to this point, it is a mutual decision to extend the negotiations to consider the value-add opportunities.

‘We see the extension as positive as it allows both parties further time to assess and implement their intentions in order to achieve a positive outcome.

‘We are simply giving the potential JV discussions all the time and consideration that the strategy deserves.’

Outlook for FYI shares

The big question FYI shareholders will have is likely this.

How certain is it that the joint venture with Alcoa will come about?

Today’s big drop suggests some investors thought the chances weren’t certain enough for their liking and exited their positions.

On Alcoa’s side, Alcoa Australia president Michael Gollschewski said:

‘Alcoa remains encouraged by the progress made towards the possible joint development of a HPA project with FYI Resources.

‘We continue to carefully consider this opportunity that has the potential to be a natural complement to Alcoa’s existing alumina refining operations.’

Will investors see these as encouraging words or careful, non-committal words?

Bullish shareholders may point out today’s extension doesn’t change FYI’s fundamentals, while some may see today’s slump as a loss of trust in FYI management.

In any case, it will be an interesting few weeks ahead for FYI as the market sets about calibrating today’s development.

HPA, LEDs, lithium-ion batteries, new-age tech.

If you’re interested in these things and want to know how you could possibly profit, then I recommend reading our free lithium report.

It outlines three stocks that could surge on the back of renewed demand for lithium in 2021.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.