In today’s Money Morning…running out of land, the world needs to become more efficient, fast…precision agriculture offers efficiency gains…how to invest in agtech: two ideas…the key takeaway…and more…

In this week’s episode of The Money Morning Podcast, I discuss the future of farming with the CEO of Agtuary, Angus Muffatti. Agtuary is an Australian start-up that uses satellite imagery and machine learning to smooth out the financial planning of farms.

Believe it or not, farming could be the next frontier for forward-thinking investors.

As my guest in the podcast says, it’s a ‘data poor environment’. One that is ripe for disruption by some powerful technological trends.

These include Big Data, automation, and artificial intelligence.

That’s what I learned in my most recent discussion on The Money Morning Podcast.

It’s a fascinating chat so definitely check that out.

In the meantime, I want to flesh out exactly how important these advances could be for humanity.

Because at the end of the day we all need to eat!

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Running out of land, the world needs to become more efficient, fast

The population is on course to hit more than 10 billion by the end of the century.

Meanwhile, the UN Food and Agriculture Organisation (FAO) estimates that in 2020, ‘arable land per person stood at 0.23 hectares (ha), down from 0.38 ha in 1970 and is expected to fall to 0.15 ha per person by 2050.’

On top of that, soil may erode up to 100 times faster than it’s formed in an extreme climate change scenario.

And according to the Grantham Centre, in the last 40 years around a third of the total available arable land was lost to erosion or pollution.

These are just a few things that humans do to their external environment.

In terms of things internal to us, as the world develops and people become richer, so too does their taste for complex proteins.

More farms mean more debt as well.

In fact, the amount of debt tied to agriculture has tripled since 1990.

This debt weighs down farming operations and many farms go bust and get absorbed into larger and larger entities.

So, that’s the big hairy problem all laid out.

And big problems generally lend themselves to big solutions.

Here’s how humanity might be able to address this looming crisis.

Precision agriculture offers efficiency gains

Precision agriculture is defined as:

‘A management strategy that gathers, processes and analyzes temporal, spatial and individual data and combines it with other information to support management decisions according to estimated variability for improved resource use efficiency, productivity, quality, profitability and sustainability of agricultural production.’

A research report by the World Economic forum notes that, should precision farming uptake increase by 15–25%, we could generate 10–15% more yield while at the same time cutting emissions and water use by 10% and 20% each in this decade.

That doesn’t sound like much, but it could be just enough to get us going in the right direction.

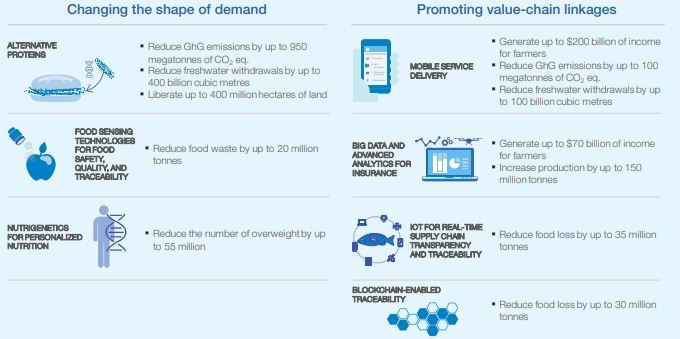

The organisation proposes the following tech-based solutions on both the demand and supply side:

|

|

| Source: World Economic Forum |

So, how do you invest in the agtech age?

I’ll give you two example companies which are in no way recommendations.

How to invest in agtech: two ideas

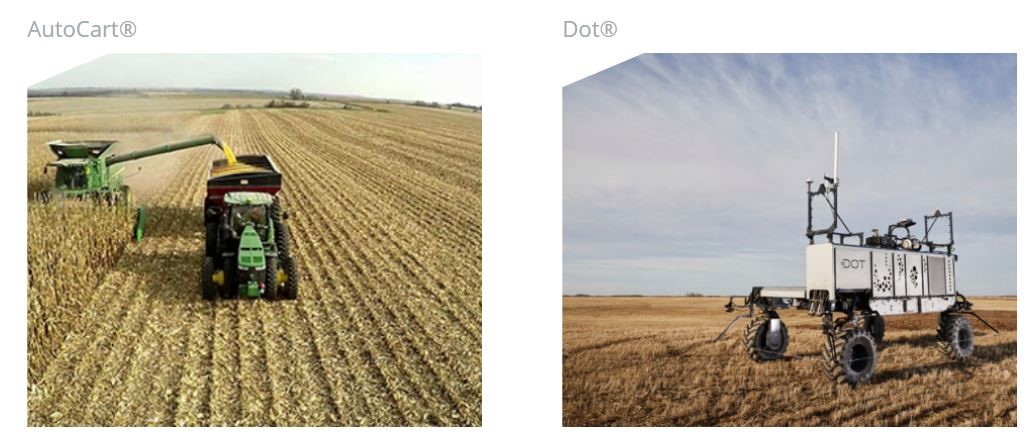

One company I’ve watched closely is NASDAQ-listed Raven Industries Inc [NASDAQ:RAVN].

Among their range of other products and services are driverless vehicles for farms which look like this:

|

|

| Source: Raven Industries Inc |

Their Applied Technology business segment also does a whole range of high-tech gadgets to help farmers in their day-to-day operations.

As for ASX-listed companies, there are a handful of options out there.

One company I’ve always liked the idea behind is called Bio-Gene Technology Ltd [ASX:BGT].

BGT does an insecticide called Flavocide.

Flavocide is based on a compound found in eucalyptus trees, that may prove to be significantly less toxic than existing insecticides out there.

Some of the existing insecticides are encountering resistance in the target pests, leading to crop loss.

And to this day, malaria carried by mosquitos remains a significant problem.

Any natural solution to the various bug problems in the world strikes me as an important breakthrough.

The key takeaway

Farming is due for a tech upgrade.

As one report notes, there were ‘$14 billion in investments in 1,000 food systems-focused start-ups since 2010, while healthcare attracted $145 billion in investment in 18,000 start-ups during the same time period.’

This seems like a very backwards way of doing things.

But that being said, things are starting to accelerate. 2019 saw a fourfold increase in agtech start-ups compared to 2015.

I expect this trend to continue and will be looking at ways to capitalise on it for subscribers of Exponential Stock Investor.

It’s time to stop thinking of food as an expense and start thinking of it as an investment.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments