Multibillion-dollar fund management corporation GQG Partners [ASX:GQG] and fellow billion-dollar fund management group Magellan Financial Group [ASX:MFG] both posted respective decreases in FUM (funds under management) for February 2023.

However, the lower performance for both fund managers weren’t enough to shake shareholder’s confidence.

GQG was rising more than 2% by midday on Monday, hours after posting its update. Whereas MFG was rising at a similar rate, taking a 2.5% increase in the early afternoon.

At time of writing, a share in MFG could be bought for $8.91, whereas GQG shares were worth $1.47.

By comparison, GQG has risen nearly 12% in share value over the last full year, yet MFG has plummeted more than 42% in that time:

www.TradingView.com

GQG drops on January FUM count, as does Magellan

Both fund managers have revealed an uninspiring month for their investing businesses between January and February.

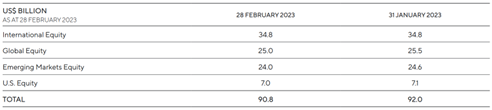

Operating out of Florida, US, GQG Partners posted its total funds under management had slipped from US$92 million in January to US$90.8 million in February.

The group reported net inflows of US$3 billion for the first two months of 2023.

However, the fund manager did not provide explantion as to what may have caused the decline, nor did it provide commentary on the market, exchange rates, or any other factors that could have impacted its results.

Below are the key segments for GQG’s FUMs month-on-month:

Source: GQG

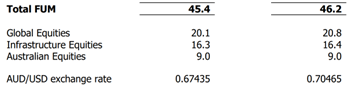

By contrast, Australian company Magellan also reported a dip in FUMs dropping from $46.2 billion in January to $45.4 billion in February.

Magellan also revealed outflows had gone up as high as $800 million last month, with retail coming in at $500 million and institutional at $300 million.

As like GQG, no further information or commentary was provided.

Magellan’s FUM segments were as follows:

Source: MFG

Equities and investing outlook

These results have not seemed to shock shareholders, which may be as they already have been expecting some decline in a month that has publicly battered equities.

Bond yields have risen sharply, and some of the widest losses were taken in equity markets, all while the US dollar rose in comparison with global currency.

January’s green light soon flicked to red once February kicked into gear, which was most likely due to many global economies changing their outlook as sticky inflation continues to taunt markets.

Markets have certainly tipped back into a volatile pattern once it became known that the extension of continuing high rates, and further rate increases yet to come will be a narrative which remains for some time yet.

JPMorgan analysts have said that despite the expected recession for 2023, events have not quite turned out as many anticipated, leading to a ‘surprising resilience in the global economy and stronger than expected economic data’ with imminent recession less of a concern.

Australia faces big changes

Australia has had 30 years of abundant, robust trade…but it’s now broken.

The global supply chain is not what it once was. You can see it every day on our supermarket shelves.

Let’s not even get started on the issues with inflation.

Maybe you’ve not noticed, but change is all around us.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has — certainly not the mainstream media.

He says ‘no one is talking about how this could end the Australian economy as we know it’, perhaps within the next 12 months.

If you want to learn more click here.

Regards,

Mahlia Stewart

For Money Morning Australia