Earlier on Monday morning, hydrogen and renewable energy pioneer Frontier Energy [ASX:FHE] announced the conclusion if its Definitive Feasibility Study (DFS) for Stage One of the Bristol Springs Renewable Energy Project, located 120km from Perth, WA.

With the DFS now complete, Frontier says it can reaffirm the potential for the project to ‘be a leader’ in the Australian green (low carbon) hydrogen industry, with an annual production of green hydrogen up to 4.9Mkg per annum (pa).

At a total cost of $2.77/kg (inclusive of capital costs), the company claims one of the lowest reported costs for a green hydrogen project of this scale in Australia to date.

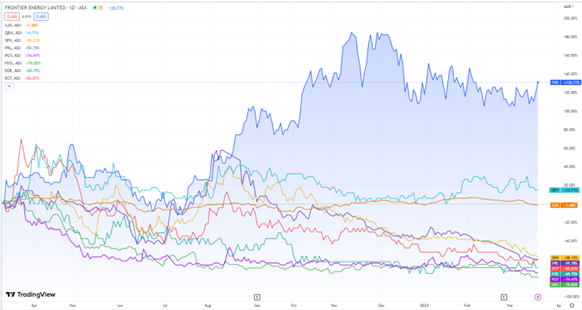

FHE was rising more than 4.5% in share value by midday, trading for 45 cents a share time of writing.

Frontier is up 91.5% on average in the past 12 months, high on the S&P 200 and its sector:

Source: TradingView

Frontier Energy completes cost positive DFS for Bristol Springs

Hydrogen and renewable energy developer Frontier Energy has today announced its completion of Stage One’s DFS for the Bristol Springs Renewable Energy Project, a project said to be one that will possess the lowest reported costs for a green hydrogen project of this scale in Australia.

Located 120km from Perth, Frontier says Bristol Springs is a project that benefits significantly from its proximity to existing infrastructure, which will assist in driving annual production of the green hydrogen to 4.9Mkg pa at a total cost of $2.77/kg — capital costs inclusive.

The company’s Pre-Feasibility Study initially marked down 4.4Mkg a year of green hydrogen production from the plant, with today’s results displaying a significant improvement for the company.

The higher production rate was reported by Frontier as being due to increasing the load factor of the electrolyser to 84% (PFS 75%), which was, in turn, thanks to better utilisation of the grid connection in off-peak electricity conditions.

Total initial capital cost for Stage One is estimated at $242.5 million (PFS $236.2 million), inclusive of the 114MW solar farm and the 36MW alkaline electrolyser.

Frontier said the low capital costs were driven by the proximity to existing infrastructure, but also the ability to use existing mechanisms for solar revenue.

Source: FHE

Frontier’s future in hydrogen

A DFS assessing Stage One green hydrogen production at the Project has now confirmed its potential to be a low-cost, ‘early mover’ in the development of Australia’s green hydrogen industry.

Frontier explained that it continues to advance offtake and funding discussions ahead of a final investment decision anticipated later in the year.

Managing Director Sam Lee Mohan commented:

‘We are delighted with the outcome of the Study as it again highlighted the unique opportunity we have at Bristol Springs to be a first mover in the green hydrogen industry.

‘The infrastructure surrounding the Project not only allows for our forecast costs to be some of the lowest in Australia for green hydrogen production, but also provides an opportunity for early production as the industry continues to mature over time.’

An Australian drilling boom

There’s an industry making huge bull market-like gains in the face of recession fear, interest rate hikes, and market volatility.

This can be described as an alternate universe, the universe of booming drillers.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped in 2022, can they really do it again in 2023?

It’s very possible indeed.

Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

Our commodities expert James Cooper has found six ASX mining stocks that are heading to the top of the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia