It’s great to be back after spending a month-long holiday in Spain.

The summer is in full swing over there and the trip was packed-full spending time with friends, family and taking short trips around southern Spain.

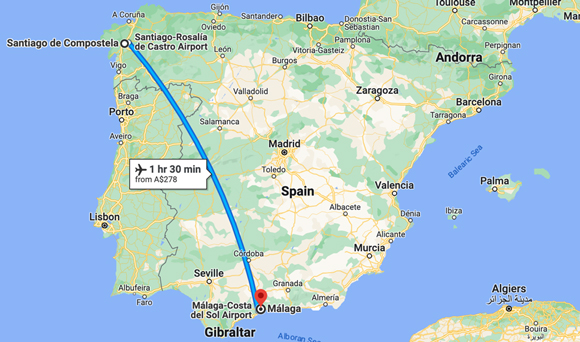

On my last week, as temperatures soared in Malaga, we left tourist crowds and packed beaches behind to travel north and visit extended family in the province of Lugo in Galicia.

Lugo is a short plane ride away from Malaga, followed by a close to two-hour drive from the Santiago de Compostela airport to get to my family’s place.

|

|

| Source: Google Maps |

It’s not a long trip, at least not by Australian standards, but the two areas — Malaga and Lugo — couldn’t be more different.

Malaga is one of the most populated areas in Spain with a desert-like landscape that’s peppered with palm trees. It has a subtropical hotter, sunnier climate prone to droughts.

On the other hand, Galicia is one of the greenest areas in Spain, filled with extensive forests and vegetation. It’s colder and rainier, and it feels quite empty as its population continues to decline.

The two regions don’t even speak the same language…while people in both areas do speak Spanish, in Lugo most people frequently speak in ‘Galego’ or Galician, a language like Portuguese.

While there are plenty of differences, one similarity caught my eye.

As we flew over Galicia, along with large extensions of forests, all you saw were kilometres of interconnected wind turbines.

Wind turbines are also a common view in Malaga. Here’s a photo I snapped just before leaving where you can see them on top of the hill in the background:

|

|

| Source: Selva Freigedo |

Renewables are becoming quite a significant source of power for Spain.

Europe continues its move towards green energy

According to Rystad Energy, Spain is well on its way to generating over 50% of its power from renewable sources in 2023.

As they wrote:

‘Spain has been one of the long-time leaders in the European renewables sector, making substantial investments in solar and wind capacity over the last 10 years. In particular, the country was an early adopter of onshore wind, technology that now accounts for more than 20% of Spain’s power generation. Significant solar PV investments have also ramped up capacity and related generation in recent years. Hydropower, which used to be Spain’s largest source of renewable energy, accounts for approximately 10% of its total generation today.

‘In the deployment of solar and wind power capacity, Spain has outpaced its European counterparts, securing second position in onshore wind installations. Although Germany maintains dominance in solar and onshore wind, Spain’s trajectory in solar and wind energy exhibits remarkable growth prospects for the coming years. These achievements can be attributed to Spain’s higher installation rates of new renewable energy, which have played a vital role in increasing the share of renewables in its power generation mix.’

In fact, it’s not just Spain, but Europe continues to make great strides when it comes to renewables.

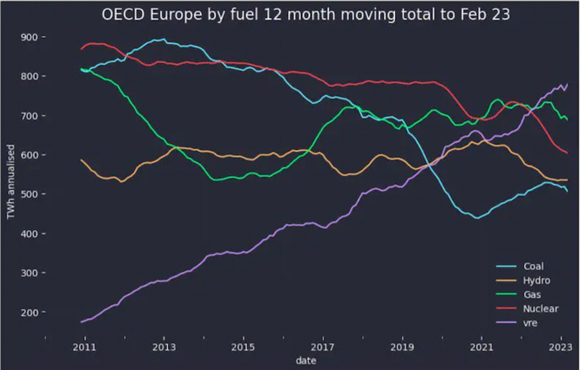

As you can see below, variable renewable energy (VRE) in Europe has been increasing steadily in the last decade and is now the largest fuel source. Meanwhile, coal has declined, and gas has remained steady.

|

|

| Source: Renew Economy |

Europe continues to add solar and wind farms. It’s significant considering how Europe has relied on foreign energy.

And what’s crucial to this will continue to be mining.

Long term direction is clear

The global mining market has grown from US$2 trillion in 2022 to US$2.1 trillion in 2023. That’s a compound annual growth rate of 6.1%. The industry is expected to reach US$2.8 trillion by 2027.

In Australia, growth has been remarkable with the market size of the mining industry growing by 15% per year on average between 2017–22.

It’s true that commodities haven’t done that great lately over concerns of growth in China, central banks continuing to talk about higher interest rates for longer and a tight labour market. All this could continue to affect commodities in the short run.

But over the long term, I think we will continue to see a move away from fossil fuels and a push into renewables. Sure, there will be challenges and ups and downs, but this is a trend that’s not going away.

All the best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

Comments