Fortescue Metals Group [ASX:FMG] has made several announcements over the past couple of years pertaining to leadership departures, a sign that perhaps there could be some hidden issues hovering under the surface.

The latest was announced yesterday, when long-serving Chief Financial Officer Ian Wells declared he’ll be the next to exit the company in as little as three weeks.

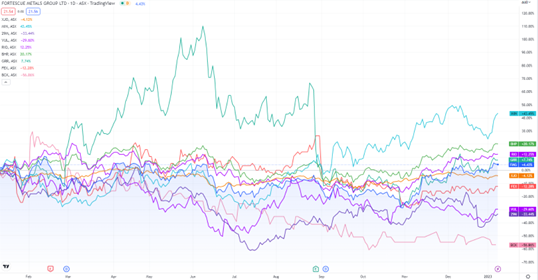

FMG’s share price dropped more than 1% from $21.80 on Friday to $21.39 Tuesday morning.

Despite the shifting sands, Fortescue rose 5% in the first week of the year, a touch more than was accrued in the entirety of 2022, in which FMG rose 4.80%.

Source: TradingView

Fortescue, CEOs, CFOs, chairmen, and leadership

Mr Wells served 13 years with Fortescue, yet the departure was abrupt, and no direct statement was offered.

Analysts at the Australian Financial Review raised questions, as Mr Wells marks the ninth senior executive within two years to depart FMG, which may be a reflection on the group’s founder, Andrew Forrest, and his managing style.

In November 2022, the Australian Financial Review’s Chanticleer column published an article that explored the relationship of the iron founder, and his track-record in company leadership.

At the time, it was former Reserve Bank of Australia Deputy Governor Guy Debelle that was leaving his post in hydrogen-focused subsidiary Fortescue Future Industries (FFI), albeit, after a rather nasty bike accident.

By December, FMG’s CEO Elizabeth Gaines stepped down from her role. Forrest commented that her successor wouldn’t need iron ore experience given the sheer scale of his company’s success and ambitions.

Gaines’s exit followed other senior departures like Greg Lilleyman, who quit after the company’s mounting Iron Bridge cost blow outs seemed unfixable.

Now, with Mr Wells, there are more questions floating over the iron giant’s high staff turnover, with concerns voiced as ‘challenging’ and ‘not ideal’.

Forrest described Wells as a trusted and well-regarded CFO who reportedly left to ‘pursue other opportunities’, and yet it was a Morgans analyst that drew the link between Fortescue’s policy and the deficit of an extra five months in lieu of Wells’ notice period.

‘The optics of the short notice and timing of Ian’s departure are challenging, particularly given FMG has stated that Ian has resigned to pursue new opportunities’, Morgans told the Australian Financial Review.

What does this mean for FMG?

With neither Debelle nor Wells present at the company’s half-year financial presentation, it’s worth considering why.

After all, now only two of the 11 original executive member leadership team from 2021 remain.

‘Ian has made a huge contribution to Fortescue over what we will look back on as the formative years of Fortescue’, Forrest commented.

‘Ian has been a trusted member of the Executive team which has led Fortescue through a number of iron ore market cycles, more recently the impacts of COVID-19 together with global volatility.

‘Despite these challenges Fortescue has retained a reputation for consistent and predictable performance as well as operating and capital cost discipline.’

The search for Mr Wells’s successor has begun. Meanwhile, it has been decided ex-Woodside oil and gas executive Fiona Hick will run the traditional iron ore mining division as CEO, and Mark Hutchinson will run FFI’s hydrogen and clean energy projects.

Despite the company’s managerial restructuring and constant evolution, the company remains flexible in matters of spending, projects and its overriding iron businesses. However, more change and flexibility is to be expected and the company should navigate with caution.

An incoming boom for commodities

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multiyear boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit…

The next big mining boom is predicted to happen in the next few years.

You can access a recent report by James on exactly that topic, AND access an exclusive video on his personalised ‘attack plan’, right here.

If that isn’t enough to sate your curiosity, we can also share with you a recent interview with James and Greg at Ausbiz at the end of last year.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia