Investors have spent the past year fixated on Trump’s return, rate cuts, tariffs, and AI valuations.

But while we’ve been navel-gazing, China has been quietly reshaping global trade, flooding markets, and luring back the very investors who fled years before.

This August saw the most significant buying of Chinese stocks by global hedge funds in six months. The Hang Seng Index is up ~30% this year — double the Nasdaq.

Foreign companies are dipping their toes back in after years of money flowing out, thanks to new policies in July.

Tax incentives. Promises of market access. The usual playbook, but this time with urgency. Premier Li Qiang recently called openness ‘the golden key to prosperity.’

China’s move away from America is an alluring hedge to some.

Rightly or wrongly, a low correlation to Western markets is all big money wants.

The Other 85%

Trump’s tariffs have exacerbated this bifurcation, making each country less dependent on the other.

The US share of Chinese exports has fallen from 20% to around 15%. The remainder has been something worth watching.

Source: ING

Belt and Road countries now absorb over 40% of Chinese exports, up from 20% at the turn of the century.

Hundreds of billions in trade and loans now flow into Africa.

China’s not retreating. It’s redirecting.

And that redirection is creating waves that Western markets are only beginning to feel.

The Dumping Ground

European mobile crane makers just filed an urgent complaint with the EU Commission.

Chinese manufacturers, they claim, are flooding Europe with state-subsidised equipment at prices that ‘don’t come close to covering raw materials.’

Latin America is drowning in cheap Chinese steel. The EU has launched probe after probe into everything from electric vehicles and lawn mowers to solar panels.

Brazil’s massive chemical industry recorded its lowest production in 17 years. Driven out by low-cost Chinese products.

Thailand and Indonesia have seen thousands of factory closures due to the influx of low-cost Chinese textiles.

For a more visual example, look no further than our own backyard.

Chinese car giant BYD has been caught storing thousands of unsold vehicles (over the winter closure period) at Jamberoo Action Park, south of Sydney, without approval.

Source: News.com.au

The reason? Gaming our new vehicle emissions standards and incentives. Import the cars, stockpile them and cash in on the rebates.

They claimed credits for 50,000 EVs last year but only sold 38,000 to consumers.

Some are concerned these sit just meters from RAAF Base Amberley — our largest operational air base.

Security analysts called these modern EVs potential ‘listening and surveillance devices.’ Defence says they’re monitoring the situation.

I’m less inclined to panic, but other geopolitical moves have my ears pricked.

The Semiconductor Surrender

If you want to see how quickly the West folds when China flexes, look at what just happened in the Netherlands.

In September, The Hague intervened at Nexperia, a Chinese-owned chipmaker, citing ‘serious governance shortcomings.’

The Dutch were worried about semiconductor supply chains, about strategic autonomy, and not being held hostage by Beijing.

Beijing’s response was swift and brutal. It blocked all Nexperia chip exports.

The standoff lasted less than three months.

This week, the Dutch government relinquished control after ‘constructive talks’ with Beijing.

In other words, Europe blinked first.

This wasn’t just any chipmaker. Nexperia supplies critical components to the European car industry.

When Beijing turned off the tap, it reminded everyone who really controls the supply chains.

This is the new leverage China has built while we weren’t watching. It’s not just about rare earths anymore.

It’s basic semiconductors, solar panels, EV batteries — the entire infrastructure of the energy transition and digital economy.

And now this week, we’ve learnt it goes even further. A new bombshell report highlights how close China has come to the West’s most sensitive industries.

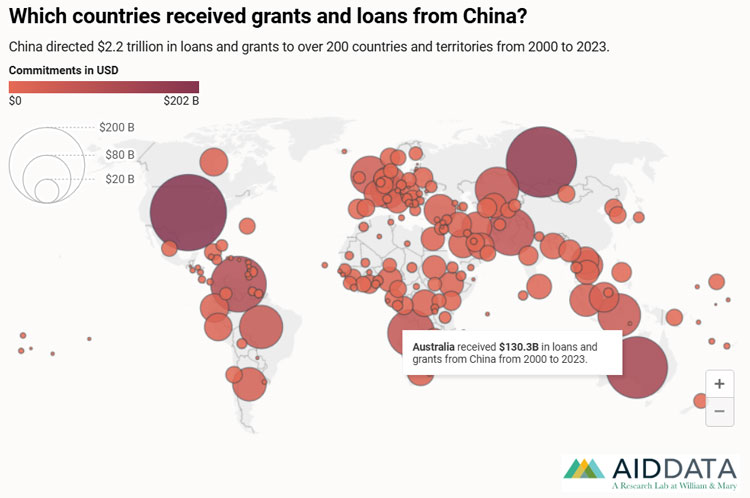

The report found that between 2000 and 2023, China lent US$2.2 trillion around the world — double the highest previous estimates.

Much of this unaccounted lending was hidden through shell companies and offshore banks.

And while we assume much of this goes to the global south, in fact, since 2005, most has gone to wealthy countries.

And what are they investing in? Most investments were focused on critical minerals and high-tech assets, including US$130.3 billion into our own.

Source: AIData.org

Keep Your Friends Close…

China has spent this time building an economy that doesn’t need us as much as we need them. All while quietly spreading its influence into our most critical sectors.

They’ve diversified trade routes through Belt and Road. They’ve moved up the value chain from cheap manufacturing to critical components. They’ve turned our climate commitments into their strategic advantage.

While we’ve been debating rate cuts and recession risks, China has been playing a different game.

One where economic leverage matters more than military might. Where supply chains are weapons.

Foreign capital isn’t flocking back because Beijing is suddenly trustworthy. It’s because investors are hedging their bets on the US.

They also understand something simple: you can’t build the next decade without Chinese supply chains. Europe learned this the hard way. We may soon too.

This isn’t about being pro-China or anti-China. It’s about recognising reality.

China has transformed from the world’s factory to its gatekeeper.

From price-taker to price-maker.

2026 is likely going to be a contentious one for global trade.

Because while you’ve been watching Washington, Beijing has been busy.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments