The 88 Energy Ltd’s [ASX:88E] share price is up following a $24 million placement to fund drilling of Merlin-2 appraisal well.

88E’s share price is currently up 6%.

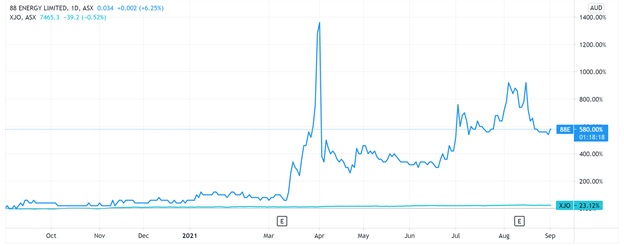

88E shares have run up in price recently, with the oil and gas explorer gaining 580% over the last 12 months.

Let’s take a closer look at today’s placement announcement.

88E to raise $24 million

88E announced today that it has successfully completed a bookbuild to domestic and international institutional and sophisticated investors to raise $23.96 million, before costs.

This will be carried out through the issue of 855,856,369 fully paid ordinary shares at an issue price of 2.8 cents.

The issue price represents a 12.5% discount to the firm’s last closing price of 3.2 cents a share.

Now, following placement, 88E will have 14,400,403,996 ordinary shares on issue, all with voting rights.

The fresh capital, along with 88E’s existing cash reserves of $14.9 million, will be used to fund the Merlin-2 appraisal well.

These funds will also fund broader acreage lease payments and efforts to identify and execute potential new project opportunities.

Three Ways to Invest in the Renewable Energy Boom

88 Energy Managing Director and CEO Ashley Gilbert commented:

‘Completion of this placement positions 88 Energy strongly as planning and preparations continue for drilling of the Merlin-2 appraisal well in Q1 CY2022.

‘We will continue to evaluate potential strategic partners for the Peregrine Project, in which we maintain a 100% working interest.

‘However, ensuring our ability to fully fund Merlin-2 via this placement delivers us excellent commercial leverage and optionality with respect to these discussions.’

What’s next for the 88E share price?

In June 2021, 88E sold Alaskan oil and gas tax credits for US$18.7 million, enabling it to repay debt.

That meant 88E ended the half year to 30 June 2021 with $14.8 million in cash and zero debt, if you exclude typical trade creditors.

Today’s announced $24 million placement gives the company more runway to execute its exploration and drilling activities and likely gives shareholders more peace of mind.

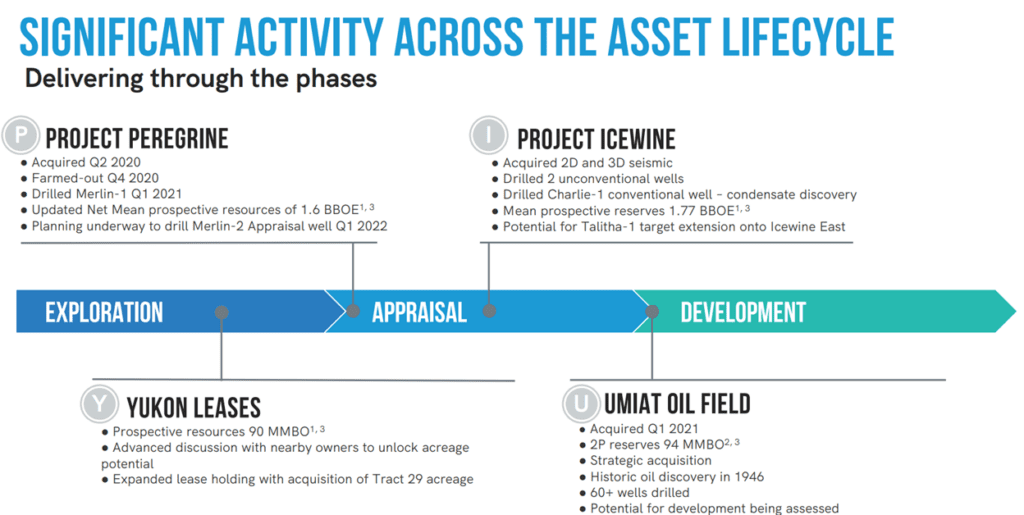

Now, 88E’s Merlin-1 and Merlin-2 remains the backbone for 88E.

With Merlin-1 well confirmation of light oil with appraisal planned for Q1 2022, the Merlin-2 well is designed to test the Nanushuk formation further to the east where enhanced reservoir thickness and quality are expected.

Merlin-2 is targeting a net entitlement mean Prospective Resource of 652 million barrels of oil (unrisked) and is scheduled to be drilled in Q1 CY2022.

The bottom line is that the next few years will be crucial for the company and today’s placement will likely be welcomed by shareholders.

If you are interested in energy sector stocks, I suggest reading the latest the latest briefing from our market analyst Murray Dawes.

He uncovers seven Aussie stocks having the potential to dominate in the future, including a stock aiming to ‘crack’ fossil fuel and turn it into clean energy.

An illuminating read.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here