Will the share price of Australia’s largest travel agency fall further?

The $2.4 billion dollar travel agency, Flight Centre has continued to fall in share price with the corona virus becoming a global pandemic.

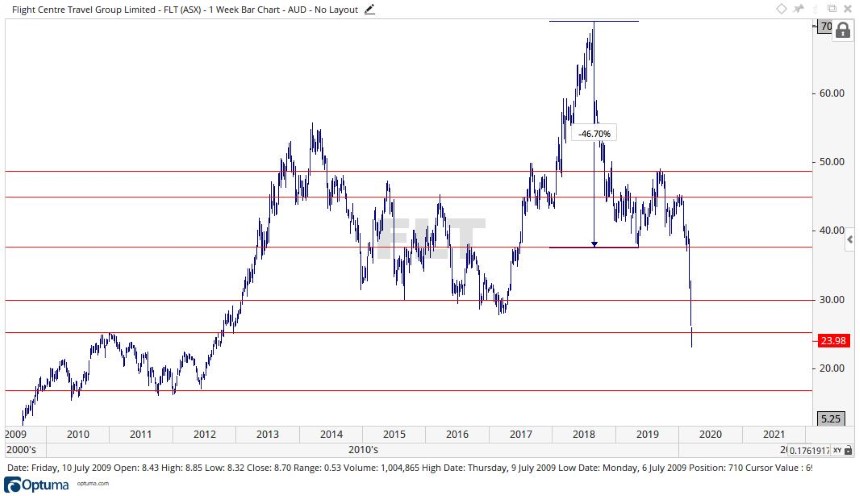

Source: Optuma

The last decade has seen some truly great growth for Flight Centre Travel Group Ltd [ASX:FLT], being as low in price as $3.39 in 2009 through the GFC to becoming the go to company for travel with a share price of $70.53 in August 2018 to reflect their status as one of Australia’s most trusted travel companies.

Flight Centre has recorded a 1,980%-plus rise in share price from the days of the global financial crisis with more people wanting to travel for business and pleasure. After such a rise, a natural correct wasn’t too much of a surprise.

The case of the price correction and Coronavirus

Flight Centre reached its peak of $70.53 in August 2018 before starting to fall away into a correction and finding support around $37.59 before moving sideways for the remainder of 2019.

In January 2020, the Chinese government announced the emergence of the novel coronavirus being found in the city of Wuhan with a large number of people quickly becoming infected and the virus moving globally at an excelling rate to now be classed as a pandemic by the World Health Organization.

Coronavirus has now caused a wide-spread slowdown or cease in national and international travel with some countries closing their boarders and many major sporting events in jeopardy or being cancelled altogether, so what dose this mean for Flight Centre?

With a core business consisting of booking flights, hotels car hire and many more travel related needs it makes sense that Flight Centre earnings and therefore share price will be affected by the global lockdown stemming from coronavirus.

Flight Centre Managing director, Graham Turner recently stated that while it was to early to predict the overall impact of the virus, it would make 2H earnings more difficult to deliver.

Source: Optuma

Taking a closer look at the weekly movements of Flight Centre hit the peak price of $70.53 before falling just past 46% to the level of $37.71.

Price retraced to the upside 33.3%, which happened to coincide with the natural resistance level of $48.55, before heading down again, as seen in the chart below.

Source: Optuma

With the outbreak of coronavirus and the global slowdown in travel at the start of 2020, Flight Centre experienced a significant fall in price.

At time of writing price closed at $23.98 after three weeks of heavy falls and had moved down past the 75% extension level of $24.43 from the peak of $48.55. With no slowdown to be seen in the near future of coronavirus, how far could Flight Centre fall?

With historical levels of support and resistance being evident at $24.43 and $16.20 will either or these levels be enough to hold price steady or can it fall further?

Interesting to note, other travel and tourism centric companies such as Crown Resorts Ltd [ASX:CWN] and Webjet Ltd [ASX:WEB] are experiencing similar declines in price.

In this free report, Money Morning analyst Lachlann Tierney reveals two assets set to benefit as the ‘corona crisis’ worsens. Click here to claim your copy today.

Regards,

Carl Wittkopp,

For Money Morning

Comments