In the world of finance, few things can excite investors as much as a company’s improved earnings outlook, and that is precisely what happened with Flight Centre Travel Group [ASX:FLT].

Investors were elated as the travel stock’s share price increased by 4.95%, trading at $21.84 per share on the back of the company’s upgraded guidance for the 2023 financial year.

As airline travel has returned after COVID restrictions, the company has seen a remarkable turnaround with a staggering 51% year-to-date increase in share price.

Source: TradingView

Swift rebound as Aussies fly

Flight Centre Travel saw its share price increase 4.95% today after upgrading its 2023 financial year guidance.

The new guidance is for underlying EBITDA between $295–305 million.

That’s up from the previous $270–290 million and a massive $483 million improvement from the loss of $183 million the company posted in FY22.

The company also expects total transaction value (TTV) to reach $22 billion in FY23, up almost 115% year on year.

This would represent the second-best full-year result, beaten only by FY19’s $23.7 billion in TTV.

Managing director Graham Turner said he was pleased with the company’s ‘continued recovery as demand has generally rebounded solidly across both our leisure and corporate travel businesses.’

He noted that Flight Centre delivered record (time to value) TTV ‘while investing significantly for the future by securing large volumes of new accounts, expanding our sales force and introducing innovative new platforms and products for our customers, which should lead to stronger returns in the years ahead.’

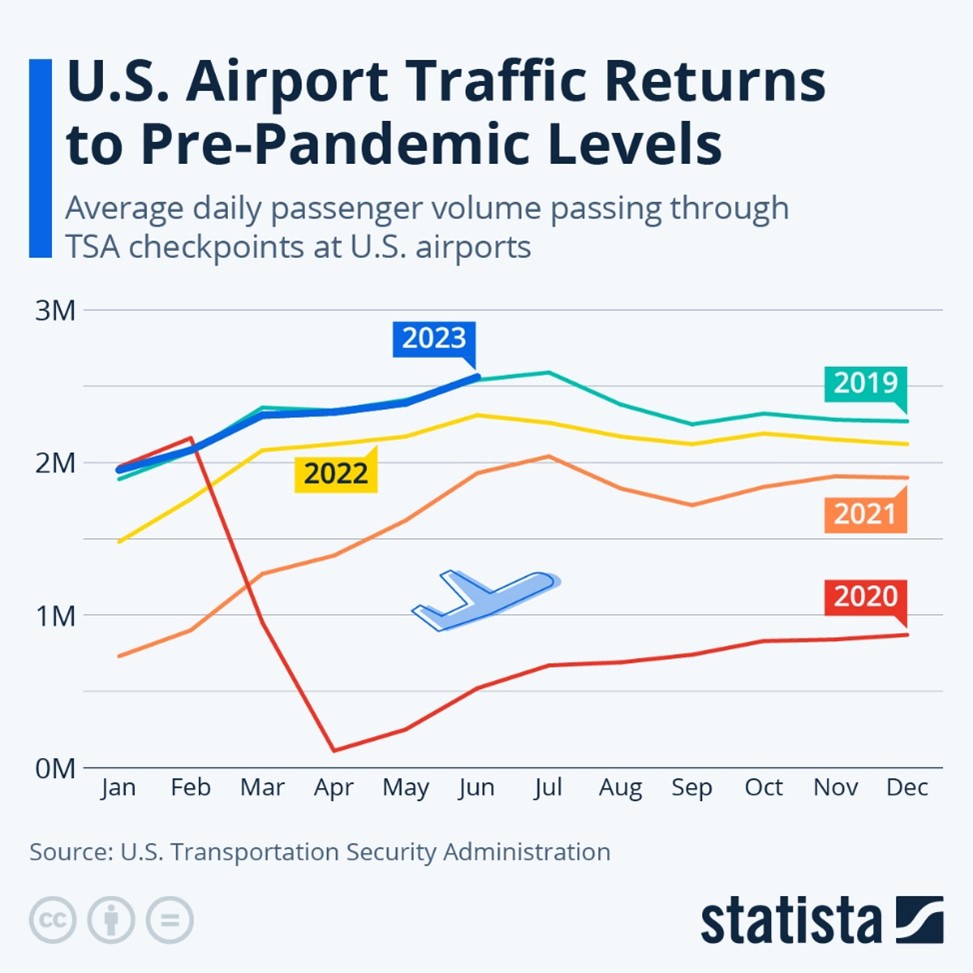

The slow recovery of international flights has plagued the company’s revenue. Still, the latest stats show flights in the US are back to pre-pandemic levels — and Australia is nearly there.

Source: Statista

With pent-up demand for travel after lockdowns, the higher costs of flying could be outweighed by consumers’ collective desire to travel.

Turner said the company expects leisure travellers to continue to prioritise holidays and experiences over other areas of discretionary spending, as seen in the past.

He also said that the large volume of new business that Flight Centre is winning in the corporate travel market will offset the impact of lower-than-normal client spending.

Flight centres’ outlook

The upgrade to Flight Centre’s earnings guidance is positive news for investors. It suggests that the company is well-positioned to benefit from the continued recovery in the travel industry.

The upgrade will likely boost the share price in the near term. However, investors should be aware that the travel industry is still potentially volatile as it battles with high prices.

We have struggled with sky-high flight costs for over a year, which are finally falling.

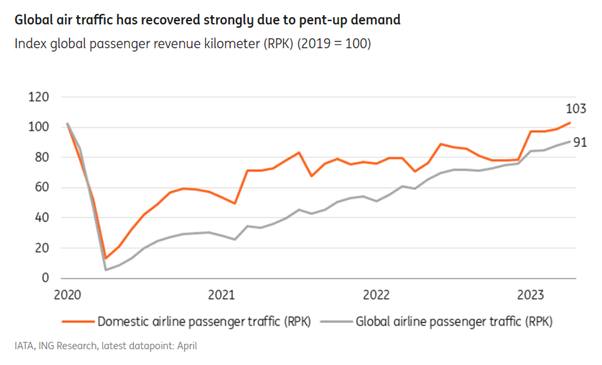

Airline capacity has slowly returned, and flight scheduling has regained most of its footing after pandemic lockdowns.

Source: ING

Overall, passenger volume in the Asia-Pacific region is expected to surge more than 60% this year compared to its low 2022 base.

There may be some economic headwinds and geopolitical tensions that could dampen the astonishing recovery of travel, but for now, it seems that Flight Centre is making hay while there are clear skies.

If market conditions worsen, it may not just be Flight Centre looking for defensive strategies.

Investors are increasingly wary of high-growth stocks and are moving towards income strategies like high-dividend stocks.

But what about trying to get a bit of both?

Dividends that can offer growth

The stock market has been volatile recently, and many investors are looking for ways to reduce their risk.

One way to do this is to invest in dividend-paying stocks.

However, not all dividend stocks are created equal.

Some stocks pay high dividends but may not be well-managed or have a sustainable business model.

Others may pay lower dividends but may be more likely to grow in the long run.

That’s why it’s essential to do your research before investing in dividend stocks.

Our investing expert, Greg Canavan, has spent his time researching dividend stocks and has created a portfolio that he believes is the sweet spot between growth and dividends.

The Royal Dividend Portfolio is a collection of high-quality, well-managed dividend stocks with a sustainable business model.

The portfolio also has a mix of growth and value stocks, so it’s well-positioned to weather market volatility.

If you’re looking for a way to protect your portfolio and generate income, then the Royal Dividend Portfolio is worth considering.

Click here to learn more about the portfolio and how you can get started.

Regards,

Charles Ormond,

For Money Morning