Today, we start talking properly about what I call my ‘Age of Scarcity Attack Plan’.

If you sense the shift that’s taking place toward real asset stocks, I’ve created a little temporary sub-group for you to join today. It’s free, and you can learn more here.

We’ll begin discussing specific stocks to own on the back of the basic theory we’ve been covering over the last few weeks.

I have initially identified FIVE.

It’s been a pretty dicey year in markets and in geopolitics.

Both are very much linked. I think these five real asset plays could perform very well next year…even if markets and geopolitics slide into even murkier waters.

Let me explain that a little…

It seems like eons ago now that Scott Morrison made accusations that China deliberately released COVID-19 into the public sphere as some kind of insidious act.

As you can recall, the Chinese Communist Party was not impressed…firing back with severe embargoes hitting everything from Barossa Valley red wine to Western Australian lobster.

With Morrison’s undiplomatic outburst, Australia more or less ripped off the hand that fed it.

Was it justified? Who knows? But it put the wheels in motion for what comes next, which is why I’m looking at iron ore today.

Now, this is a potentially explosive issue for BOTH Australia and China.

It’s exactly why we need to think ahead and look at it BEFORE it starts to heat up in the mainstream press.

The central problem is THIS: What happens to iron ore exports IF geopolitical tensions continue to boil over between China, Russia, and the West?

Perhaps even a global war?

It pays to be prepared. Tensions build quickly. The unimaginable can manifest far more rapidly than anyone feels possible at the time.

History shows this.

Let me explain by turning back to 1938…84 years ago, from today.

Iron ore was making MAJOR national headlines.

Just like today, our nation’s wealth was heavily reliant on commodity exports…iron ore, wool, and wheat drove our fledgling economy.

And in a reflection of today, BHP was the principal producer of iron ore; the company was critical in supplying this commodity to a hungry Japanese economy.

But 1938, as you know, was a turbulent time in world history…Adolf Hitler was on the cusp of waging war in Europe and the Japanese Imperial Army was already engaged in an all-out invasion against China in the Sino-Japanese War.

In a reflection of today, the world was fearing a major global conflict.

Australia was playing a critical role too.

In 1938, parliament was faced with the ethical dilemma of making enormous revenue from iron ore exports, knowing full well it was feeding the Japanese war machine responsible for mass atrocities in China — including the infamous Nanjing Massacre.

It was also nervous about Japan’s expansion ambitions across the Asia-Pacific, which we all know led to the second phase of the Second World War.

Australia was stuck between a rock and a hard place. With war raging in Asia and the potential spill over into Australia, the threat was real, but the export revenue was addictive.

With growing geopolitical hostilities, it wasn’t surprising that Australia’s then Prime Minister Joseph Lyons suddenly banned iron ore exports to Japan.

While he publicly stated it was on the pretext that Australia’s iron ore reserves were ‘so limited as to compel their conservation’. In reality, Lyons feared the growing threat.

But the ban was short-lived.

The next government led by John Curtin were hopeless optimists, they ‘hoped’ Japan would avoid raging war against Australia; proclaiming Japanese interest in Asia was a matter for its own national security. Curtin warned parliament from creating any trade tensions:

‘It is in Australia’s highest interests to remain in the best possible terms of goodwill with so important a neighbour in the Pacific [Japan].’

Thus, he’s tenure as prime minister was tarnished with his decision to reopen iron ore exports with Japan right up until 1941, just before the Pearl Harbor attacks.

Notoriously ironic, it was noted by historians years later that Australia’s iron ore exports from the late 1930s to early 1940s came back from Japan in the form of bullets and bombs, mainly over Darwin.

In fact, my grandfather was on the receiving end of all this while stationed with the Australian army in Darwin through various Japanese air raids.

But there seems to be some stark familiarities between THEN and NOW.

This time round, Australia will need to navigate growing geopolitical tensions between our ‘new’ major trading partner, China.

So, hypothetically speaking, how would a China-led invasion of Taiwan look to iron ore exports?

In my opinion, ALL iron ore shipments to China would cease (eventually).

Parliament would delay the trade cut-off for as long as possible while pampering to Western allies. Eventually, though, it would break under pressure from the US.

We’ll be keeping a watchful eye on Chinese leader Xi Jinping over the coming months to see how iron ore producers react to an increasingly nationalistic and defensive dialogue.

Obviously, THIS WOULD NOT be a good outcome for Australia’s economy, at least initially, which I’ll explain below.

Conflict and commodity booms

Don’t let growing tensions scare you from investing in commodities. As you’ll see if you sign up to see my ‘Age of Scarcity Attack Plan’, wars (or the very threat of war) have hosted some of the largest commodity booms in history.

Copper is one example, a metal that has historically boomed during major global conflicts, see for yourself:

|

|

| Source: Winton Private Advisory |

Copper prices boomed leading into and during the US Civil War, then spiked rapidly into the First World War. We also witnessed a surge during the Korean War in the early 1950s.

You’ve probably noticed something missing here though…the Second World War. This should have been a boom that went further than all others given the magnitude of the conflict.

However, government-imposed price controls during the Second World War to prevent ‘profiteers’ from benefiting in the enormous demand for commodities generated by the war effort, a situation that was rife during the First World War.

So how has iron ore fared during conflicts?

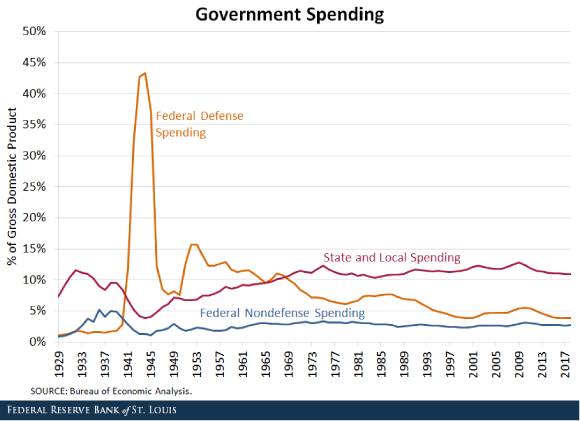

Historical prices for copper are far more reliable than those for iron ore, but we can gauge the demand for this commodity too by looking at a nation’s GDP allocation to defence during past conflicts.

Remember, iron ore is the principal metal used in building a nation’s defence munitions.

|

|

| Source: Bureau of Economic Analysis (Federal Reserve Bank of St Louis) |

The above graph shows US expenditure commitments as a percentage of GDP.

As you can see, the Second World War witnessed a massive allocation toward military spending from less than 3% (pre-war) to almost 45% of GDP at the peak of the war.

Nearly half the nation’s GDP allocation to defence is simply staggering!

Considering today’s allocation is historically low at just 3.5% of GDP, it indicates the US will continue to increase its commitment as tensions build.

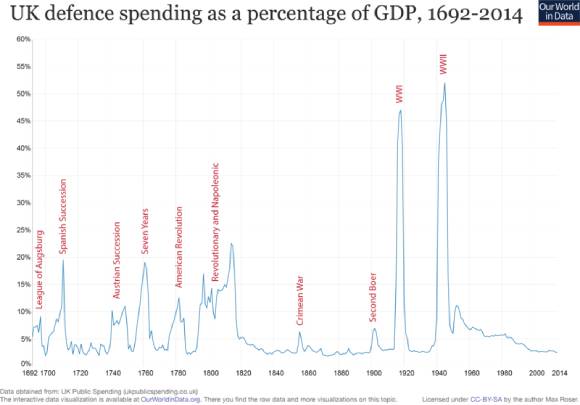

Taking this further, we can look at major conflicts involving the British Empire and its allocation to military spending during past war episodes.

Not surprising that the First World War and the Second World War witnessed the largest commitments with more than 50% of the nation’s GDP allocated for both these wars.

The correlation is clear…defence absorbs the lion’s share of a nation’s earnings during major global conflicts:

|

|

| Source: UK Public Spending |

Commodities are the building blocks for these munitions. That’s why military conflicts are responsible for creating some of histories largest commodity booms.

Which brings me to…

The situation today

Assuming Australia (at some future date) does succumb to pressure from its Western allies and ceases iron ore exports to China, how would an iron ore embargo look to our country?

After the initial shock, it’s quite likely producers would secure alternative markets as global demand for the commodity invariably picked up on the back of heightened tensions.

Iron ore, like many commodities, would benefit from the very threat of war as countries increased expenditure on defence to deter foes.

But some strategic commodities will outperform, and THIS is why…

China dominates the supply of critical metals to the world’s major manufacturing companies. This includes rare earth metals, battery-grade graphite, copper, lithium, cobalt, and zinc.

Companies such as Tesla, Hyundai, Mitsubishi, Apple, and Microsoft need these critical metals to build their products.

At the moment, vast supplies of their raw materials are sourced from China.

This presents a consequential risk for international manufacturers.

Quite simply, it means a mining company able to offer an alternative supply chain WILL BE at a distinct advantage in a global economy experiencing heightened geopolitical tensions.

These are the companies I’ve identified in my special stock recommendation report.

Now, I’m certainly not suggesting you become a war profiteer as a reason to invest in commodities. No sane person wants war to happen.

But the fact is, growing political tensions will see a major uptick in demand for raw materials as nations allocate a far greater percentage of their GDP to military spending.

But this could be a volatile time in markets; Ukraine has given us some insight into what could happen. Therefore, it’s prudent to prepare for the worst while hoping for the best.

Using history as our guide, I’ve given you broad details on how YOU can prepare your portfolio.

But this is an excellent time for me to give you specific stock recommendations set to benefit from a multi-angled boom in commodities.

This what ‘The Age of Scarcity Attack Plan’ centres around.

I’ve initially identified five Australian companies in the early stages of their growth cycle holding deposits of key commodities outside of Chinese- or Russian-dominated supply lines.

As geopolitical, scarcity, and winder financial market tensions escalate going into 2023, I reckon these five companies could be very smart investments.

If you want to learn more, go here.

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia