Fisher & Paykel Healthcare [ASX:FPH] released its 2022 financial year interim report, showing ‘strong results’.

In late afternoon trade, the FPH stock was down 2.5%.

Year-to-date, FPH shares are down 40%:

Source: Tradingview.com

Fisher & Paykel announces ‘strong results’

Reporting from Auckland, FPH announced its interim results for the year ending 31 March 2022.

FPH said that over the last two financial years, it supplied $880 million of hospital hardware. According to Fisher & Paykel, this was equivalent to about 10 years’ worth of hardware sales prior to COVID.

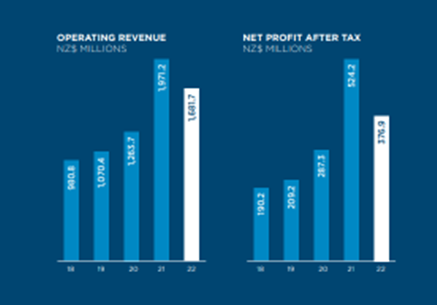

This ramp-up saw operating revenue rise 33% above the pre-COVID 2020 financial year.

Despite this, FY22 total operating revenue came in 15% lower compared to FY21, hitting $1.68 billion.

Net profit after tax hit $376.9 million, down by 28% on the last financial year.

Hospital products totalled $1.21 billion revenue, which is a 19% decline on 2021 revenue, however new applications consumables revenue saw a 3% rise.

Homecare product revenue was up 1% and brought a total of $469.5 million.

FPH’s gross margin fell 59 basis points to 62.6%.

Fisher & Paykel attributed the reduction to high air-freight utilisation and ‘elevated freight rates’.

$154 million has gone into research and development, with plans to invest further in coming years.

Source: FPH

CEO Lewis Gradon said:

‘We are excited by the opportunity to change clinical practice and play our part in improving outcomes for patients globally. If the change in clinical practice occurs over a three- to five-year time-frame, it would drive strong growth in hospital consumable sales over this period.

‘During the second half of the 2022 financial year, there was a sharp peak for our hospital consumables sales in December, followed by a low in February. Hospital consumables subsequent trading to date is exhibiting a slow recovery from February.’

FPH share price outlook

Fisher & Paykel did not provide quantitative revenue or earnings guidance for the 2023 financial year.

Lewis Gradon continued:

‘Given the ongoing uncertainties regarding our customers’ stockholding choices and their capacity to implement new protocols with personnel shortages and the possibility of further surges of COVID-19 over the near term, we are not currently providing quantitative revenue or earnings guidance for the 2023 financial year.

‘For gross margin, freight costs are likely to remain elevated, and air-freight a higher proportion of freight than pre-COVID-19. We are continuing to advance our manufacturing capacity and facilities projects, and we also expect to hold higher levels of inventory to help address global supply chain challenges. If freight rates remain at current levels, then we would expect constant currency gross margin in the 2023 financial year to be in line with the 2022 financial year.’

A bearish mood prevails in the markets right now.

However, when there’s uncertainty hanging in the air, it’s usually a prime time to go stock bargain hunting.

You could stumble across some high-quality, powerful stocks that have been discounted to ridiculous prices.

If you’d like to get some tips on where you might find some of these bargains, click to access our free report: ‘How to Find Bargain-Priced Superstars after a Big Sell-Off’.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia