I’m writing this update sitting at a table of a local fish and chips store looking towards the ocean at Torquay, around 75 minutes’ drive from Melbourne.

As you know, I came to Melbourne for the launch of Gold Strike 2024 which kicked off last Thursday evening.

Thank you to those who participated. We fielded many questions at the live Q&A that followed the event.

If you want to find out about the not-to-be-missed opportunity to build a portfolio of gold explorers and early-stage developers before it goes on an anticipated bull run, click here to find out more!

Just remember, we’ll wrap up our event at midnight tonight so make sure you act quickly!

Living out a dream vs living in reality

As I sit here enjoying the light sea breeze and the relaxing atmosphere, I had a few insights relating to investing.

I thought about the contrast of Torquay with the bustling city of Melbourne. It’s similar to the Southern Highlands in New South Wales (where I live) and Sydney.

Different in terms of the environment (Torquay is a seaside village while the Southern Highlands is, as the name suggests, up in the mountains) but similar in terms of the contrasts that exist between them.

Many who live in Sydney and Melbourne look forward to spending a relaxing weekend in these places. They love strolling the quiet streets, checking out the wares in a Sunday market, sitting in a café enjoying the local delights, taking a dip in the crystal blue ocean or snuggling next to the fireplace to ward off the chilly Highlands night.

Some even talk about how they’d aspire to live there one day.

After they retired.

After the children have moved out.

After they win lotto.

It’s a dream to motivate them.

A carrot dangling in front of them to run towards.

But few bite the bullet or follow through until much later. By then, the novelty may’ve worn off.

Who can ‘buy low, sell high’ when it

comes to the crunch?

So how does this relate to investing?

It’s a well-known investment strategy to ‘buy low and sell high’.

It’s so simple.

But given the chance that such stocks are available, few people actually follow through.

Why?

There’re a myriad excuses for that.

The price fell for so long, it could keep falling.

I’ve bought in and I’m losing, I’m afraid it’ll go to zero.

Look at those hot stocks, they’re rising and everyone’s buying!

And so, many will stick to their comfort zone and let the dream remain a dream.

Just as city folks love their getaways and dream about living there one day, the ‘buy low, sell high’ mantra sounds great. But few will follow through when it comes to the crunch.

Someone else will fulfil that. And it’s a precious few!

A spectacular opportunity on offer!

Just so you know that I’m not merely bringing up the hypothetical, such opportunities exist for you right now to ‘buy low’ with the chance to ‘sell high’.

Most of you know that I’m talking about gold stocks.

They’ve been one of the most unloved assets around.

Not just unloved but ignored.

In the case of gold explorers and early-stage developers, they’ve been cast aside for almost three years.

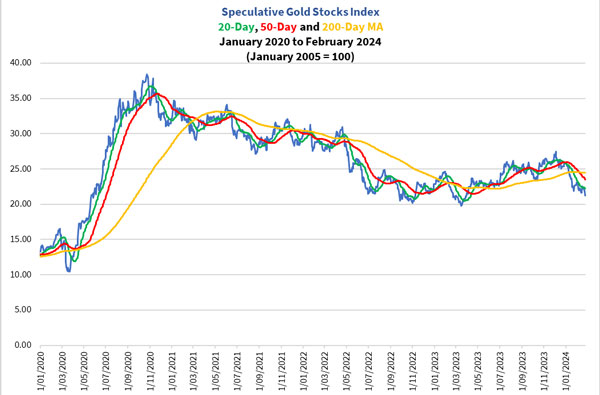

Looking below, you’ll see gold hasn’t won the popularity contest in a while:

| |

| Source: Internal Research |

Gold explorers have been grinding lower ever since the massive rally from March to November 2020.

When that happened many gold explorers surged over 250%.

Note too, this is the average across the sector.

When the sector fired up, some explorers rose more than 1,000%!

And when they retreated, some fell as much as 70–90% from their highs.

You can see how the index bottomed last March. It bounced sharply in April before gradually building up a rally from July to December.

In this recovery, the leading explorers generated triple digit percentage returns.

But that could be the start of an emerging trend.

Yes, this year’s sell-off has trimmed those gains. In fact, some stocks are making new lows.

But can you see how this is presenting as a prime opportunity to ‘buy low’?

There aren’t many asset classes with this opportunity.

In short, here’s your chance to get in and set yourself up by being a contrarian investor!

Final chance for our special offer

on Gold Stock Pro

And if you’re worried about taking this risk alone, let me allay these fears.

With my premium gold stock speculation newsletter service, Gold Stock Pro, I’ll guide you on this journey.

I’ve lined up five ‘priority trades’ that you can make now. These five small-cap gold mining companies have quality assets and are positioned to move ahead of their peers when market sentiment turns around.

I’ll research the markets for you, identify the opportunities and risks and send you regular updates.

You’ll hear from me when I want you to buy or sell, including price targets.

I’ll do the hard work; all you need to do is follow my recommendations and (hopefully) reap the rewards.

Of course, there are no guarantees. Gold stocks are highly volatile and carry risks, but…

It’s why you should check out the Gold Strike 2024 event and see what we’re positioning for.

Remember the event closes at midnight tonight!

Too risky? Established gold producers

offer a good return too!

Perhaps you might find speculating in small-cap mining stocks prove too risky for you.

No problem!

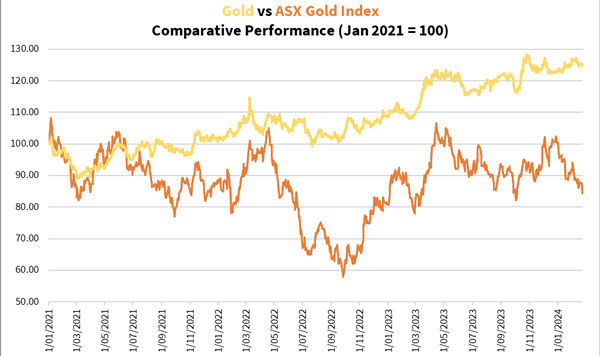

The more established gold stocks are still attractively valued. They made a recovery last year but there’s still room to move, as you can see below:

| |

| Source: Refinitiv Eikon |

As you can see, gold stocks are cheap relative to physical gold.

That to me looks like an opportunity.

If this interests you, check out my Gold Fever event which launched last week.

You can also find out more from my precious metals newsletter, The Australian Gold Report.

Rather than follow the crowd, why not try to build your dreams using a proven strategy?

Gold stocks!

This could be your chance to ‘buy low’. Now’s the time to seize that opportunity!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments