In today’s Money Morning…dodging apples, chanting spells, and inventing money…the tail is wagging the dog in gold…this anti-fragile money continues to confound the critics…better on every metric…and more…

Think the market must be close to a top?

Maybe not…

You see, this strange chart I came across last week suggests there could be plenty more juice in the tank.

Check it out:

|

|

| Source: Trading View |

What you’re looking at is the market adjusted for growth in money supply.

So although numerically we might look like we’re at all-time highs, we’re actually 52% from the highs of 2000, when you account for the denominator of all assets — money supply itself.

Which, given the wanton nature of central banks to ‘print money’ these days, gives you food for thought.

Speaking of food and money…

Dodging apples, chanting spells, and inventing money

It’s no secret that the role of central bank money printing has ramped up a notch this past year or two.

It’s the driver of asset values all over the place.

But to understand what comes next, you need to understand how we got where we are.

A good starting point is England, 1694…

When he wasn’t busy dodging apples, the great Sir Isaac Newton spent a lot of time delving into occult potions and mystical spells.

A strange side gig for the father of modern physics you might think.

But one with a definite purpose…

You see, Sir Isaac was very interested in the mystical pseudo-science of alchemy. In particular the ability to turn worthless base metals into much more valuable gold.

Legend had it a secret invention called the Philosopher’s Stone could create both silver and gold.

If you could do that, you would be a pretty rich man in Newton’s day.

He had to keep this part of his work pretty quiet as studying the occult was very much frowned upon in puritan England.

So writings on his progress are scarce (a fire in his lab that burned most of his work didn’t help either).

But we’re pretty confident that Newton didn’t succeed in his quest to find the fabled Philosopher’s Stone.

Because his failure gave rise to the gold standard that drove British global dominance over the next 200 years.

The thinking went, if someone as smart as Newton couldn’t forge it, then gold had to be a pretty reliable store of value.

And so, it was made the reserve asset of choice by the fledgling Bank of England. Their success in trade gave rise to the gold standard across most of the world.

Newton himself was made ‘Master of Mint’ in 1696 and remained there for the next 30 years.

But gold’s day is long gone…

The tail is wagging the dog in gold

For an asset to prove its worth as a secure form of value, it has to be able to survive all kinds of attacks.

Gold was proven to be unforgeable, even by the brightest minds in the world back in Newton’s day.

But the world we live in has moved beyond gold.

It’s not been part of our currency system since the 1970s. And its effectiveness as a natural hedge against fiat excess seems to be broken.

It’s all because of the paper market for gold.

The paper market for gold is much larger than the physical market and essentially is the ‘tail’ that wags the ‘dog’ when it comes to the gold price.

As published by Gold Broker recently:

‘The gold paper market pretends to be backed by physical gold when in effect it is gold in sheep’s clothes.

‘It is like putting a Rolls Royce badge on a 1950s model Skoda and charging a Rolls price for it…

‘Gold trading by LBMA banks and futures exchanges amounts to $180 billion per day.

‘This is a staggering 350X the daily gold mine production.

‘So we ask ourselves how a dog can function properly with a tail that is 350X bigger than his body? The simple answer is that he can’t.’

The sad fact is gold is now a captured asset.

Central banks own it, and financial middlemen control it.

It might have survived Newton’s spells, but it hasn’t survived the modern alchemists of money.

And it’s no surprise that gold’s demise came about in the century that saw the rise of computers and technology.

The real Philosopher’s Stone, it would seem, was the ability to create paper representations of gold and trade them online!

Which brings me to the only solution for independent money in the 21st century…

This anti-fragile money continues to confound the critics

There’s been no more attacked asset class over the past decade than Bitcoin [BTC].

Warren Buffett, Donald Trump, Jamie Dimon, Hank Paulson, Ben Bernanke, Christine LaGarde, the nation of China!…and many, many more.

They’ve all had a go over the years.

Just last week, our own billionaire boss, Hamish Douglass of Magellan, said bitcoin was going to zero.

His reasoning?

Well, he didn’t have any really.

Something, something, mumble, cult, mumble…about sums it up.

(You can read my colleague Lachlann Tierney’s barnstorming and a more detailed takedown of Douglass here).

These people hate bitcoin because it takes away their Cantillion advantage — the fact that all new money created goes through them somehow first — in money.

They refuse to acknowledge the value the peer-to-peer, decentralised, unforgeable, incorruptible, fair monetary network Bitcoin provides.

Bitcoin has survived in the wild for over 12 years now, without regulators, without safety nets, and yet it continues to run just as reliably as it did on day dot.

With billions at stake it’s never been hacked, despite immense efforts from many to do so.

I’m sure Newton would be impressed.

But not our financial oligarchs.

I suppose if I’d successfully gamed the current system — a system of bail-ins, bailouts, money printing, and pliable central bankers to do my bidding — I might think like that too (though, I hope I would have better morals).

And yet, despite this amazing conga line of attackers over the past decade, bitcoin remains the best returning asset over any meaningful time frame…

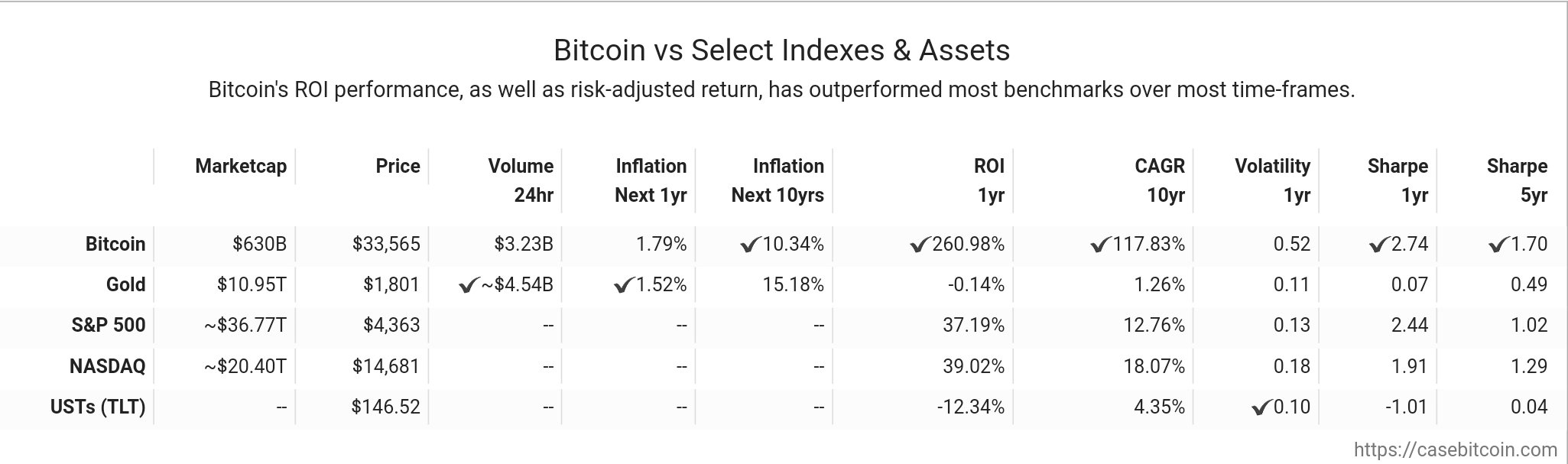

Better on every metric

Check it out here:

|

|

| Source: Case Bitcoin |

Bitcoin has blown every other asset class out of the water.

But critics still say, ‘But what about the risks?!’

So what if we adjust the returns for that risk?

That’s what those two columns on the right-hand side do.

They use the industry standard Sharpe ratio (I prefer using the Sortino ratio myself as upside volatility shouldn’t be a ‘risk’ when it comes to exponentially growing assets) to judge the returns made for the risks took.

Basically, the higher the Sharpe ratio, the better the risk-adjusted performance.

As you can see, bitcoin wins again on that risk-adjusted metric over both one-year and five-year time frames.

It’s even better than the much-vaunted NASDAQ tech index.

The fact is bitcoin and cryptocurrencies aren’t a bubble. They’re not going away.

And in my opinion, they’re still going to throw up the biggest opportunities most investors will see in their lifetimes.

What would Newton do?

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.