A recession, as defined by the Oxford Dictionary, is (emphasis added):

‘…a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.’

OK, are we good with that?

Two successive quarters of negative GDP numbers and it’s official…there’s a recession.

From MarketWatch on 29 June 2022:

|

|

| Source: Market Watch |

One quarter down, one more to go, and the US is officially in recession.

And, if you take the headline on face value, it’s going to be touch and go as to whether the second quarter (ended 30 June) is positive or negative.

However, if you believe a high-ranking Fed official, it’s a case of…‘recession, what recession’?

As reported by Bloomberg on 24 June 2022 (emphasis added):

‘Federal Reserve Bank of St. Louis President James Bullard said fears of a US recession are overblown, as consumers are flush with cash built up during the Covid-19 pandemic and the expansion is in an early stage.

‘“I actually think we will be fine,” Bullard said in a speech in Zurich Friday. “It is a little early to have this debate about recession probabilities in the US.”’

Earth to Jim Bullard…mate, when you’ve already got one negative quarter in the bag and the second one is oh so close to going negative, how can the probability of a recession NOT be THE topic of debate?

The incompetence of these serial bubble blowers is beyond belief.

If you’re holding onto the belief of the Fed having your back, you’re suffering from a serious case of misplaced trust.

They’re going to stuff this up…big time.

A haven for inbred PhDs

The reason why can be found in a recent article in Ben Hunt’s ‘Epsilon Theory’.

The article delved into the employment history of some of the most senior people in the US Federal Reserve.

Here are the findings…this discredited institution is a haven for inbred PhDs:

• ‘John Williams, head of the NY Fed, has never held a job outside of the Federal Reserve system.

• ‘Jim Bullard, head of the St. Louis Fed, has never held a job outside of the Federal Reserve system.

• ‘Esther George, head of the Kansas City Fed, has never held a job outside of the Federal Reserve system.

• ‘Mary Daly, head of the San Francisco Fed, has never held a job outside of the Federal Reserve system.

• ‘Charles Evans, head of the Chicago Fed, has never held a job outside of the Federal Reserve system and academia.

• ‘Raphael Bostic, head of the Atlanta Fed, has never held a job outside of the Federal Reserve system and academia.

• ‘Kenneth Montgomery, interim head of the Boston Fed since Eric Rosengren resigned in disgrace, has never held a job outside of the Federal Reserve system.

• ‘Meredith Black, interim head of the Dallas Fed since Rob Kaplan resigned in disgrace, has never held a job outside of the Federal Reserve system.

• ‘Patrick Harker, head of the Philadelphia Fed, is not a Fed lifer. No, he’s an academia and government lifer.

• ‘Thomas Barkin, head of the Richmond Fed, is also not a Fed lifer. No, he’s a former senior partner and CFO at McKinsey.

‘…while she’s no longer a regional Fed president (but is on the Fed board of governors), Lael Brainard had a stint at McKinsey as her only job outside of government and academia.’

Any employment ad for the Fed should have in big, bold type…DO NOT apply if you have real-world experience.

When all their adult working life has been spent in an intellectual bubble, it’s little wonder the decision-makers in this institution have such an appalling track record in long-term economic management.

The reason we’ve experienced three historic asset bubbles in the last 25 years is due to PhD groupthink.

How anybody thinks these clueless, conceited, career academics — the ones responsible for creating the ‘everything bubble’ — have the skillset to manage a ‘soft landing’ is beyond me. They are completely and utterly incompetent.

Their world is one of neatly calibrated models.

Real-life scenarios involving chaos, unintended consequences, unbridled greed/fear, and unforeseen out-of-left-field reactions are not something they can easily relate to in their perfectly simulated and cloistered world.

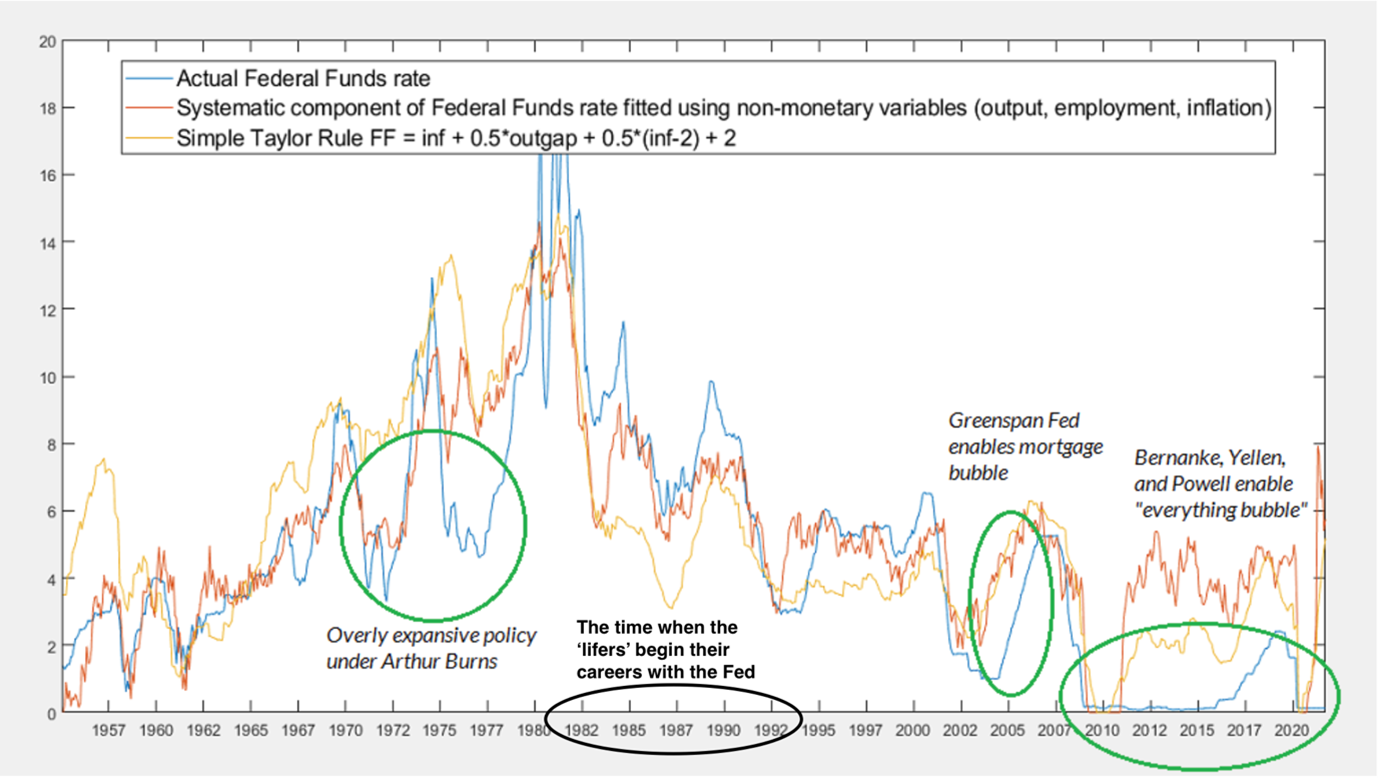

Central banker conceit is evident in the following chart comparing the actual Federal Reserve interest rate (blue line) with the prescribed rates determined by two different methodologies (both based on prevailing economic inputs):

|

|

| Source: Hussman Strategic Advisors |

In the 1970s, then-Fed Chair Arthur Burns kept the Fed Funds rate lower than the methodologies indicated.

The result…inflation got out of control.

Proving there are no free lunches with interest rate suppression, the Fed, in the late 70s/early 80s, was forced to raise rates well beyond the level prescribed by the two methodologies.

During the 1990s, Greenspan closely followed the interest rate methodologies.

However, when the US economic applecart was upset in 2000/01, Greenspan panicked.

He abandoned the disciplined rate approach and plunged the Fed Funds rate to 1% and kept it there too long…laying the foundation for the subprime lending fiasco.

You’d think the Fed lifers, having lived through this period, would’ve had an ‘aha’ moment and thought, ‘let’s not do that again’.

The embodiment of insanity

When the GFC hit, the Pavlovian academics responded as per their institutional programming, dropping the Fed Funds rate way too low for way too long.

Had they followed the setting determined by the two methodologies, when the immediate danger of the GFC passed, the Fed should have cranked up rates somewhere north of 3%.

Had the US cash rate been set at an appropriate level (one that balanced the needs of savers and borrowers), we would not find ourselves in the awful mess we’re in.

Corporate debt would have been more restrained.

Buy backs (goosing up earnings per share) wouldn’t have been so prevalent.

Speculative behaviour would have been a little more subdued.

Would’ve. Could’ve. Should’ve.

It’s all academic…a bit like the Fed’s theories.

We have to live and invest in the world that actually happened.

These academic numbskulls occupying senior Fed positions have delivered upon us the greatest asset bubble in history.

The lifers who were instrumental in keeping rates ‘so low, for so long’ to spark inflation, are now the ones people are counting on to have the nous to rein in inflation without tanking the economy?

Dream on.

It ain’t going to happen folks.

These people are the very embodiment of Einstein’s definition of insanity.

They keep doing the same thing over and over and over again, expecting a different result.

The Fed’s completely clueless (but Wall Street and Washington friendly) strategies are destined to make an already bad situation a whole lot worse.

With this lot piloting the world’s largest economy, investors would be well advised to brace for the crash position.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia