You could almost hear the market’s sigh of relief yesterday after the Reserve Bank of Australia decided to pause on raising rates.

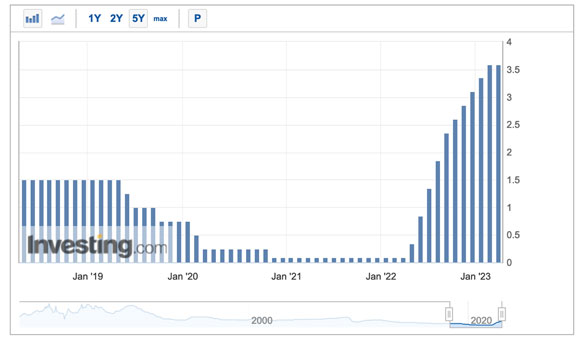

The RBA has been aggressively tightening since last year, when rates were close to 0, as you can see below:

|

|

| Source: Investing.com |

Now, the RBA said it’s taking a ‘wait-and-see’ approach to let these rate rises work through the economy before moving them again.

Markets rallied after the announcement. In fact, they’ve been rallying all week in hopes that the worst is over for rates and the banking crisis.

Confidence is still taking hits

Overnight, though, Jamie Dimon — JPMorgan’s Chairman and Chief Executive Officer — threw a bucket of cold water on that thought.

While he noted that the current crisis is nothing like the 2008 GFC and involves less issues and players, he said:

‘The current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come.

‘Any crisis that damages Americans’ trust in their banks damages all banks — a fact that was known even before this crisis. While it is true that this bank crisis “benefited” larger banks due to the inflow of deposits they received from smaller institutions, the notion that this meltdown was good for them in any way is absurd.’

It’s not just banks though, the property sector is also losing confidence as debt gets more expensive.

Here’s the Australian Financial Review:

‘Blackstone’s $US70 billion ($103 billion) real estate trust for wealthy individuals faced higher withdrawal requests last month, and restricted redemptions for a fifth straight month.

‘Shareholders asked to redeem $US4.5 billion ($6.6 billion) in March from Blackstone Real Estate Income Trust “in a month of tremendous market volatility and broad-based financial stress,” the company said on Monday in a letter. BREIT allowed about $US666 million to be withdrawn, or about 15 per cent of what was requested.

‘Investors asked to pull out more than they did in February, when they tried getting $US3.9 billion.’

But the punches seem to be coming from all sides.

A few days ago, OPEC+ surprised markets by announcing production cuts.

OPEC+ oil producers said their cuts were ‘pre-emptive and aimed at supporting market stability’. But their move sent oil prices higher, with some expecting oil to hit US$100 a barrel, which doesn’t bode well for inflation.

Add to all this the war and geopolitical tensions — as the US and China continue to notch up their competition in tech, communications, and the space race — and things are still very touch-and-go out there.

So, in a world with increasing risks, what’s the best course of action? Well, the best hedge is gold of course!

Gold has been moving higher, hitting more than US$2,000 an ounce now. All in all, gold has increased close to 10% in the last month.

We could see gold continue to do well while this volatility and uncertainty continue.

But there’s another metal that’s been doing well too…

While gold is up close to 10% in the last month, silver has climbed 19% in the same time frame.

Silver, like gold, is also a precious metal and used as a hedge.

We could see silver continue to do well if confidence in the economy continues to tank, and the fact that silver also has industrial uses means that it could do well if the economy starts to recover too.

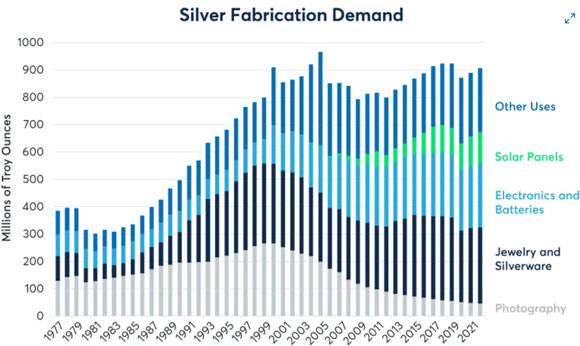

Silver is used in many industries: dentistry, medicine, semiconductors, solar panels, etc.

In fact, solar panel demand for silver was around 12% in 2021 — up from 0% in the early 2000s. Demand for silver in solar panels continues to grow, along with that of electronics and batteries:

|

|

| Source: CME Group |

China is the top solar panel manufacturer in the world…and with China restarting their economy, we could see an uptick in demand for silver.

So keep an eye out for silver…

All the best,

|

Selva Freigedo,

For Money Morning