Do you remember the once-in-a-generation commodity boom that topped out in 2012?

That was one heck of a boom.

It lasted 6–8 years (give or take) and made a fortune for some.

As a geologist in the mining industry throughout that era, I can only say the feeling was feverish on the ground.

Just like the tech boom of late, it made its fair share of millionaires AND some prominent billionaires too.

Least of which was Andrew ‘Twiggy’ Forrest, a virtually unknown businessman in the early 2000s.

But just 3–4 years later, he was a household name across Australia.

He became part of the mega-rich fraternity.

Now an iconic business magnate, he, like many uber-rich Australians before him, benefited from the vast quantity of minerals that lie below YOUR feet.

And whether you love him or hate him, his success was very much down to timing and intricate knowledge of the industry.

Twiggy had the experience to capitalise on the opportunity that sat in front of him, or more aptly, below him.

And whether it was well-planned business shrewdness or just sheer luck, his bold move into the iron ore sector, challenging the only other iron ore players at the time — BHP and RIO — was a feat of impeccable timing.

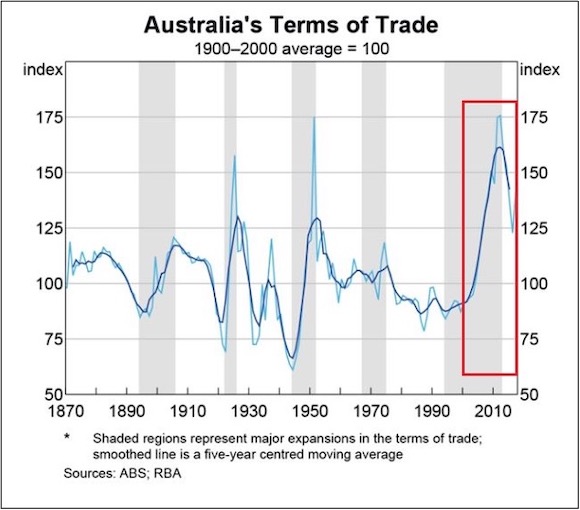

The Chinese-led boom fuelled commodity prices across the globe, and this had an enormous impact on boosting Australia’s Terms of Trade at the time, not to mention Twiggy’s back pocket.

If you’re unfamiliar, the Terms of Trade is a ratio of the prices of exports to imports. It’s a good measure of how strongly a country performs, particularly in a resource-rich nation like ours.

I’ve highlighted the boom years in the chart below:

|

|

| Source: ABS, RBA |

Aussie boom years were a bust for Aussies

For most Australians, the answer was an overwhelming no!

National wealth grew exponentially from 2004–10.

But for the average Australian, the boom years did little more than change the morning newspaper headlines.

The boom came and went.

It didn’t make an ounce of difference for the majority.

Twiggy, the billionaire, and many other ‘unnamed’ mining executives created companies, pooled investor funds, and generated the necessary cash flow to turn minerals bound up in hard rock into cold, hard cash.

They absorbed the bulk of the country’s prosperity during this ‘once-in-a-lifetime windfall’.

But you deserved it too.

Unfortunately, this is how commodity booms work.

The majority of the riches sitting below all of us fall into the golden hands of the well-connected few who have experience in the mining game and understand how to play with investor funds.

And, whether we like it or not, so much of Australia’s wealth comes from mining.

But more on that later…

A brief introduction

For those who don’t know me, I’ve recently joined the Fat Tail Investment Research team as the in-house commodity analyst.

I’m genuinely excited to be part of a like-minded group of independent thinkers and can’t wait to share with you some of the big themes that are set to take place across the commodities sector over the coming years.

By way of introduction, I’ve worked within the mining and exploration space for a tad over 10 years, primarily as an exploration geologist.

I’ve spent many years in the field, be it on the side of a dusty drill rig or mapping rock outcrops through remote Australian bush.

The career of a geologist is a wild ride of adventures, booms, and busts. And my career has been no different.

I’ve experienced mergers, takeovers, redundancies, and everything in between.

It’s an exciting career, but certainly not for the fainthearted.

On any particular day, I might have been directly involved in influencing company decisions at the top, the next, driving out in remote bush and pulling up under the stars with just a swag and a Land Cruiser or, if I was lucky, a caravan.

On top of all that, it is a career that took me around the world. From the WA outback to the African jungle, there really isn’t anywhere a geologist doesn’t go.

And this is what got me started in the field.

But my biggest adventure is just beginning, and it’s right HERE with you…

I intend to walk you through the minefield of resource investing. Avoid the traps that catch everyday investors who buy into the director hype.

As an Australian who works, pays taxes, and lives in a nation that easily provides enough wealth to abolish income taxes, it is your right to benefit from the future gains that come from unlocking the vast mineral wealth that sits under your feet.

But, as always, it will take INSIDER knowledge and TIMING to capitalise on the coming boom in commodities.

Don’t buy into the threats of rising interest rates and Chinese slowdowns.

This is simply a distraction from the enormous opportunity presenting in the mining sector.

A multiyear commodity boom awaits!

In fact, it’s already underway.

The same executives who got rich from unknowing investors in the last boom are quietly building new companies.

They understand we’re entering a new phase in this commodity cycle and are gearing up for a rinse and repeat.

There are numerous boards like this.

Ever notice the same non-executive director appearing on three, four, five, or more companies?

They’re specialists in mining the stock market.

In fact, there’s only a very select number of directors and managers who are experts when it comes to adding shareholder value.

These are the people that know how to find deposits.

It’s in their genes.

These are the people I’ll be following. The ones I know and trust.

Over the coming weeks and months, I’ll detail how this boom is likely to play out, how we can capitalise on this multiyear trend in rising commodity prices, and what it takes to invest like an insider.

And our timing couldn’t be any better.

Until then…

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia

Comments