In today’s Money Morning…gold…bitcoin… small-caps…property…a word of caution…and more…

Any future stock market historian will look back at 2020 and think it must have been a pretty great year to be alive.

Because despite the dramas of daily life — from bushfires to COVID-19 to US election lawsuits — it’s actually been a ripper of a year for most investors.

Especially those at the more speculative end.

From property to gold, to small-caps, to bitcoin… the proverbial monkey with a dartboard could’ve made bank this year!

It might not make logical sense at face value.

But the fact is, the economic response to these various dramas; namely record low interest rates and record debt, have done exactly what policy makers wanted.

They’ve kept many companies from failing and kept the economy ticking over.

At the same time, these policies have pushed investors up the risk curve and propelled asset values higher. Especially in the sectors I just mentioned.

The rational act for investors in 2020 has often been to do the seemingly irrational.

For example, we’ve the amazing situation this year where tech stocks like Apple (trading at 36 times earnings) and Amazon (trading at 91 times earnings) have become ‘safe havens’.

As Forbes reported back in June:

‘Many investors view these big names as a safe haven, and they expect steady profits and revenue from online businesses despite uncertainty over the coronavirus pandemic, which has wreaked havoc on much of the rest of the market.’

There’s no doubt, you’ve got to be ready for anything these days.

So today, I want to take a look around a few of the former ‘risk-on’ assets and see what was, and what could be in 2021…

How to Find Promising Energy Stocks, This Investment Sector Is Ripe for Massive Disruption. Download Your Free Report Now.

Gold

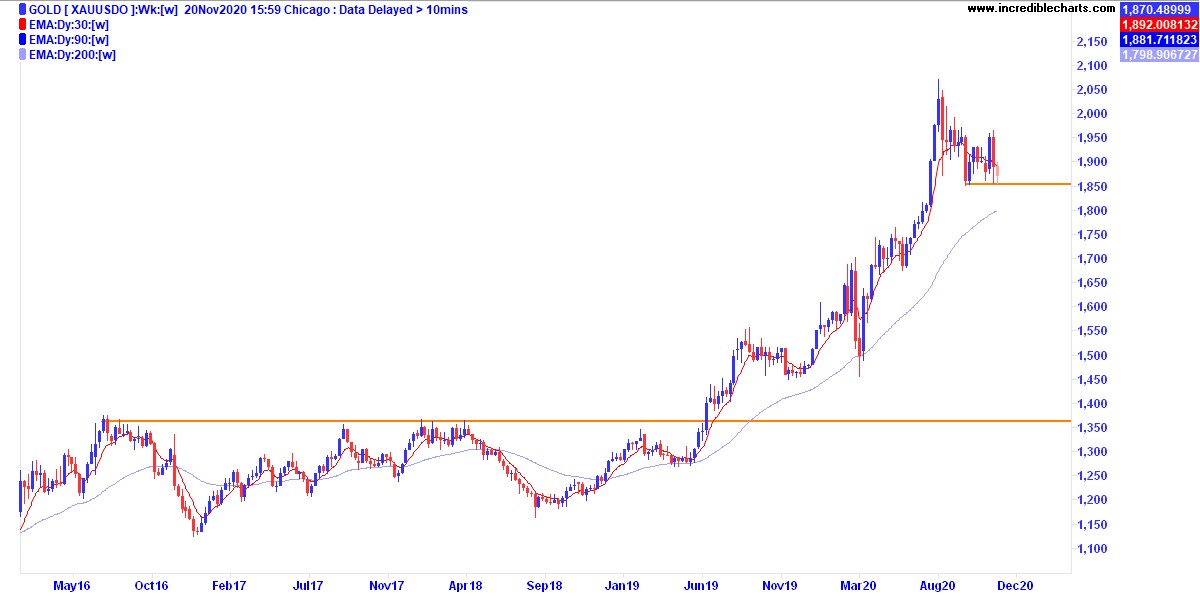

First gold.

Check out the weekly chart below:

|

|

| Source: Incredible charts |

After initially falling steeply on coronavirus news, gold resumed its uptrend back in March this year as central bankers began their cash injections.

After a rapid rise, it slowed down in August and has been trading sideways ever since.

If you presume that central bankers are addicted to printing money, then the gold price could be set for another surge higher in 2021.

My play on this would be to buy any dip down to the 50% Fibonacci level around US$1,767. Conversely if there is no dip, then I’d buy the break of US$1,965, which was a recent high.

Bitcoin

Bitcoin is playing the same narrative as gold. Albeit as ‘gold on steroids’.

Those who know me, know that I’m very bullish on bitcoin and crypto, and have been since 2013!

But to me it really feels like there’s a new wave of adoption very close.

Mainstream companies like PayPal and Square have already announced crypto plans, and I expect a wave of corporate adoption to follow.

Here’s the chart:

|

|

| Source: Coinigy |

Now bitcoin is super volatile and could easily fall 50% as much as rise 50%!

But I think it will touch new all-time highs some point in 2021 (or sooner), so any price to me is a good buy right now.

One way to think of bitcoin is as a hedge to your overall portfolio.

It’s an asset outside the current financial system in a number of ways and is free from central bank manipulation.

Whether that means you allocate 1%, 5%, or more of your portfolio to bitcoin and crypto is up to you.

But to my mind, it’s the best bet in terms of risk versus reward any of us will see in our lifetimes and should form some part of a well-rounded portfolio.

Small-caps

Now the ASX Small Ordinaries Index [XSO] is actually flat for the year.

But that flatness doesn’t take into account the steep dip and subsequent recovery from the March coronavirus lows.

Check out the daily chart:

|

|

| Source: Incredible Charts |

But within that seeming flatness has been some astounding opportunities for those playing at the smaller end of the market.

Indeed, the average return for stocks in my small-cap advisory service Exponential Stock Investor this year is a whopping 87%!

I’m particularly keen on small-cap stocks in the ‘clean’ energy and mining sectors leading into 2021 and have a number of recent picks for subscribers in this area.

You can read more about that here if you’re interested.

Property

Funny story, I was just down for a short family break last week to Phillip Island — about a two-hour drive south of Melbourne.

Anyway, we went to see the famous Penguin Parade, where you can watch the little penguins swim from the sea and run the gauntlet over the beach as they head for their burrows.

Usually there are 4,000 spectators watching this (it’s a big tourist attraction).

But last Tuesday, it was restricted to just 50 people!

So, the wife, two kids, and I got a special treat, and pretty much a one-on-one commentary with one of the park rangers on what was happening.

After I ran out of questions about penguins (the worst of which was ‘How do they know which home is theirs?’ to which she replied, ‘How do you know which home is yours’…touché!), the conversation turned — as it so often does in Australia — to property prices.

The ranger told me incredulously how a townhouse next to her house had just sold for $1.2 million in just two days.

‘And it doesn’t even have a garden!’ she exclaimed.

I read between the lines. Her house did have a garden!

The point of this anecdote is that property around Australia is surging. Not just in the major cities but in good rural locations too.

It’s another consequence of the super low interest rates we have.

My colleague and property cycles expert Catherine Cashmore expects property prices to stay strong all the way through to 2026.

If she’s right, then property prices might go higher than anyone expects.

And especially ones with gardens!

A word of caution

As you can see it could be a big 2021 ahead.

But as investors you’ve always got to look at other possibilities too.

Maybe this is the ‘everything’ melt-up year before a 2021 crash?

Maybe, coronavirus strikes again in 2021 and this time no money printing can save the economy?

Maybe Australia–China relations worsen or the domestic situation in the US takes a darker turn?

As ever there are risks for investors to be aware of. But my counter argument would be that there always has been and always will be risks to think about.

The key is to prepare for all eventualities, both good and bad.

Easy, eh!?

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Make Profitable Trades, More Often — Trading expert Murray Dawes reveals his unique trading strategy designed to help you clock up steady gains in any market, while limiting your downside risks. Click here to learn more.

Comments