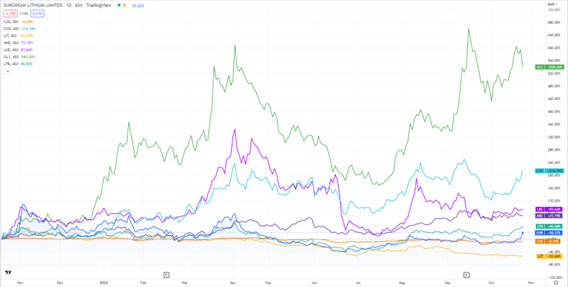

While EUR shares surged on Wednesday, European Lithium is still down 25% year to date.

Source: Trading View

European Lithium to form Critical Metals via SPAC merger

As part of the merger deal, EUR will sell down its interest in its Wolfsberg Lithium Project to create a new entity named Critical Metals Corp.

Critical Metals is expected to be listed on the Nasdaq, with an implied pro forma enterprise value of US$838 million.

If the merger is successful, EUR will receive US$750 million worth of ordinary shares in the newly formed Critical Metals, an 80% ownership stake in the combined entity.

EUR could earn an additional 10% of Critical Metals upon satisfying ‘certain price-based milestones once listed on the NASDAQ’.

The US$750 million equity value to be paid for the Wolfsberg project ‘represents a significant increase to the current market capitalisation of EUR of approximately $112 million as a whole’.

Sizzle has around US$159 million in cash that the newly formed entity will use to progress the development of the Wolfsberg Project.

In a caveat, EUR advised that Sizzle’s cash position assumes no redemptions by existing Sizzle stockholders.

Commenting on the deal, European Lithium Executive Chairman Tony Sage said:

‘We are enthusiastic to partner with the Sizzle team to form a publicly traded company on NASDAQ and are thrilled to have Carolyn Trabuco, Sizzle’s lead independent director, join the Critical Metals board. The need for additional battery-grade lithium in Europe will only continue to accelerate as demand for EVs continues to outstrip supply. Wolfsberg is poised to become the first major source of battery-grade lithium concentrate in Europe, the world’s leading EV market, capable of supporting the production of approximately 200,000 EVs per year. The funds raised though this transaction will provide us with the resources anticipated to be required to advance construction and commissioning of Wolfsberg. With the capital raised, in addition to the increased access to the public capital markets by listing on NASDAQ by means of the business combination, we believe we will be able to achieve our commercial goals at Wolfsberg by 2025.’

EUR said the definitive feasibility study for the Wolfsberg project is on track for Q1 2023.

While EUR is excited about the deal, the merger is not set in stone.

As The Wall Street Journal reported overnight:

‘The company could still face challenges funding and developing the project. Nearby Serbia revoked mining giant Rio Tinto PLC’s permits for a lithium project early this year following protests about potential environmental damage.

‘European Lithium could also struggle to complete the deal given the turmoil hitting many SPACs, also known as blank-check companies.

‘SPACs are shell companies that raise money from investors and list on a stock exchange with the sole intent of merging with another company that eventually replaces it in the stock market if the deal is approved by regulators. Such mergers have become popular alternatives to traditional initial public offerings in the past few years.

‘The Sizzle SPAC has about $160 million that European Lithium could use to grow if the deal gets completed. That number could shrink significantly because SPAC investors can pull their money out before mergers get done. Such withdrawals have skyrocketed during this year’s market volatility.

‘The lithium upstart could also raise equity before the deal closes. To finance the project, it could attempt to tap debt markets or European government funding.

‘When it raised money early last year, the Sizzle SPAC, launched by former restaurant executives and investors, said it intended to merge with a company in that industry, though such claims aren’t binding.’

Lithium and the EV revolution

In 2021, lithium stocks dominated the ASX — eight of the 10 best-performing stocks on the All Ordinaries in 2021 were lithium stocks.

But lithium stocks haven’t fared as well in 2022, with many of last year’s high-flyers trading well below their 52-week highs.

Is it too late to tap into the lithium sector, then?

You may want to read Money Morning’s latest research report on the matter (spoiler alert: we’ve found three overlooked ASX lithium stocks!).

Regards,

Kiryll Prakapenka,

For Money Morning