Exploration and mining group of minerals and lithium Essential Metals [ASX:ESS] has shared a quarterly update for the March quarter of 2023.

Among the group’s highlights, ESS says it has competed its scoping study of the Pioneer Dome Lithium Project, with potential for standalone mining and processing, and which resulted in a base case net present value (NPV) of $367 million.

Also among its updates is the upcoming Scheme Implementation Agreement (SIA) under which Chinese energy giant Tianqi proposes to acquire 100% of Essential subject to shareholder approval at a Shareholder meeting on 20 April 2023.

There was not a lot of movement in the ESS share price following the update, with ESS’ share price bumping up 1% very early in the day, only to fall half a percent a few hours later.

Year-to-date, ESS has gained 53% in share value and its in the upper end of tis sector average and the ASX 200 average:

Source: TradingView

Essential Metals outlines March quarter highlights

Minerals and metals miner with a distinct interest in lithium mining and development, Essential Metals provided an array of updates in its March, FY23 quarterly report.

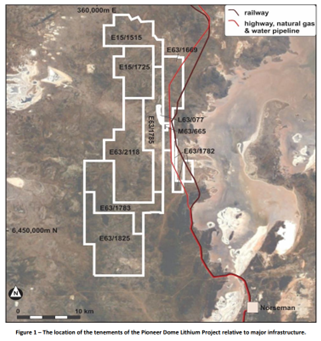

The group announced that its Pioneer Dome Lithium Project has now had its scoping study completed, with suggestions of potential viability of a standalone mining and processing operation at the site.

Primero, a leading engineering firm with significant lithium experience competed the scoping study, revealed to the group a base case NPV, real and after tax, of $367 million.

In December 2022, the group found a whopping 81% of total contained lithium matching high confidence Indicated Category, which reflected thick, high grades, and out-cropping deposits.

Assessment has also been completed for multiple exploration targets found in the December review, with several new pegmatite discoveries calling for further investigation.

Essential Metals obtained a Mining lease M15/1896 in February, which will last a term of 21 years and covers 2,408 hectares. This area includes the Dome North lithium mineral resource and surrounds, where the group plans future mining operations and infrastructure to be built.

Essential Metals closed the quarter with $8.7 million cash on hand, as at 31 March.

Source: ESS

Essential Scheme of Arrangement with Tianqi and IGO

In other news, Chinese company Tianqi Lithium Energy has said it will spend $136 million to acquire 100% of Essential by way of a Scheme of Arrangement.

Tianqi will do so via 50 cents in cash per ESS share, subject to, amongst other matters, approval by Essential shareholders at a shareholder meeting to be held on 20 April 2023.

The scheme contains various standard ‘no shop’, ‘no talk’, ‘notification’, and ‘matching rights’ provisions, with a break fee payable in certain circumstances.

Tianqi is an incorporated joint venture owned 51% by Tianqi Lithium Corporation, listed on the Shenzhen and Hong Kong Stock Exchanges, and 49% owned by IGO [ASX:IGO].

It’s an integrated lithium business, including a 51% interest in the Greenbushes Lithium Operation (Albemarle Corp, 49%) and 100% of the Kwinana Lithium Hydroxide Refinery, both located in Western Australia.

The Essential Directors have unanimously recommended that Essential shareholders vote in favour of the Scheme at the Scheme Meeting, in the absence of a superior proposal and stating that it is in the best interest of its shareholders.

Time to ‘drill baby drill’

Many in the resources industry are making raging bull market-like gains regardless of recession fears, interest rates and wider market actions.

This can be described as an alternate universe, the universe of booming drillers.

And guess what, more booms are marked to happen for many other metals.

It’s the ‘new golden age’ for junior explorers who get in early.

Aussie mining is at its best right now, but who, where?

It’s a big universe, and you may need a little help — that’s where our commodities expert James Cooper comes in.

He’s found six ASX mining stocks that are heading to top the charts for 2023.

Regards,

Mahlia Stewart,

For Money Morning